The crypto world just took a meaningful step forward: Plasma’s on-chain USDT yield product is now available through Binance Earn. That pairing — a purpose-built stablecoin blockchain meeting one of the largest distribution platforms in crypto — isn’t just a product launch. It’s a real test of whether on-chain stablecoin finance can scale for normal users.

Why stablecoin rails still matter

Stablecoins are the plumbing of crypto: they move value, stabilize portfolios, back lending and trading, and power cross-border flows. Despite that central role, the rails that carry stablecoins are uneven. High fees, slow finality, awkward wallet and bridge workflows — these are everyday frictions that keep stablecoins from being truly useful for mainstream money movement.

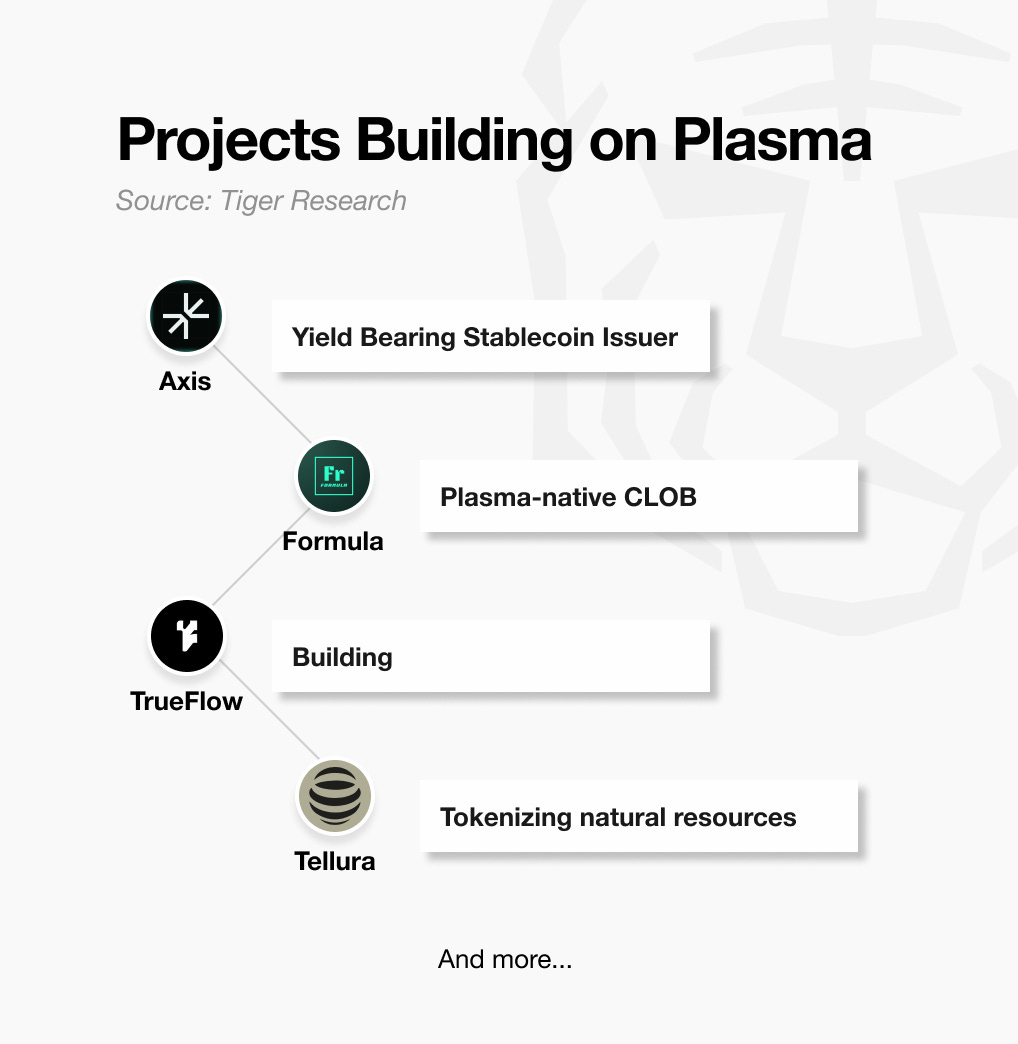

Plasma is designed to remove those frictions. Instead of being a general playground for speculative tokens, it’s a Layer-1 built around moving dollar-pegged value quickly, cheaply, and transparently.

What Plasma brings to the table

Plasma’s fundamentals are simple and focused: zero-fee USDT transfers, fast settlement, and full compatibility with Ethereum tooling (EVM). That means developers and users can reuse familiar wallets and smart contracts while benefiting from a network tuned specifically for stablecoins rather than broad, often noisy, general-purpose activity.

Practically, Plasma aims to let people send, receive, and earn yield on USDT without wrestling with multiple chains, complex bridges, or opaque off-chain processes. Everything is meant to be visible and auditable on-chain, reducing guesswork about where funds are and how yields are generated.

Why Binance Earn matters for distribution

Infrastructure is one half of the problem; distribution is the other. Binance Earn sits on a platform with hundreds of millions of users and deep USDT liquidity — a distribution footprint that most on-chain projects lack. Embedding Plasma’s USDT yield product inside Binance Earn removes the biggest onboarding barrier: users don’t need to set up new wallets or learn DeFi tooling. Deposits made through Binance Earn can flow directly into Plasma’s audited lending stacks, where yield is generated on-chain and recorded transparently.

That both simplifies user experience and exposes Plasma’s model to a much larger, less crypto-native audience.

Token economics and user incentives

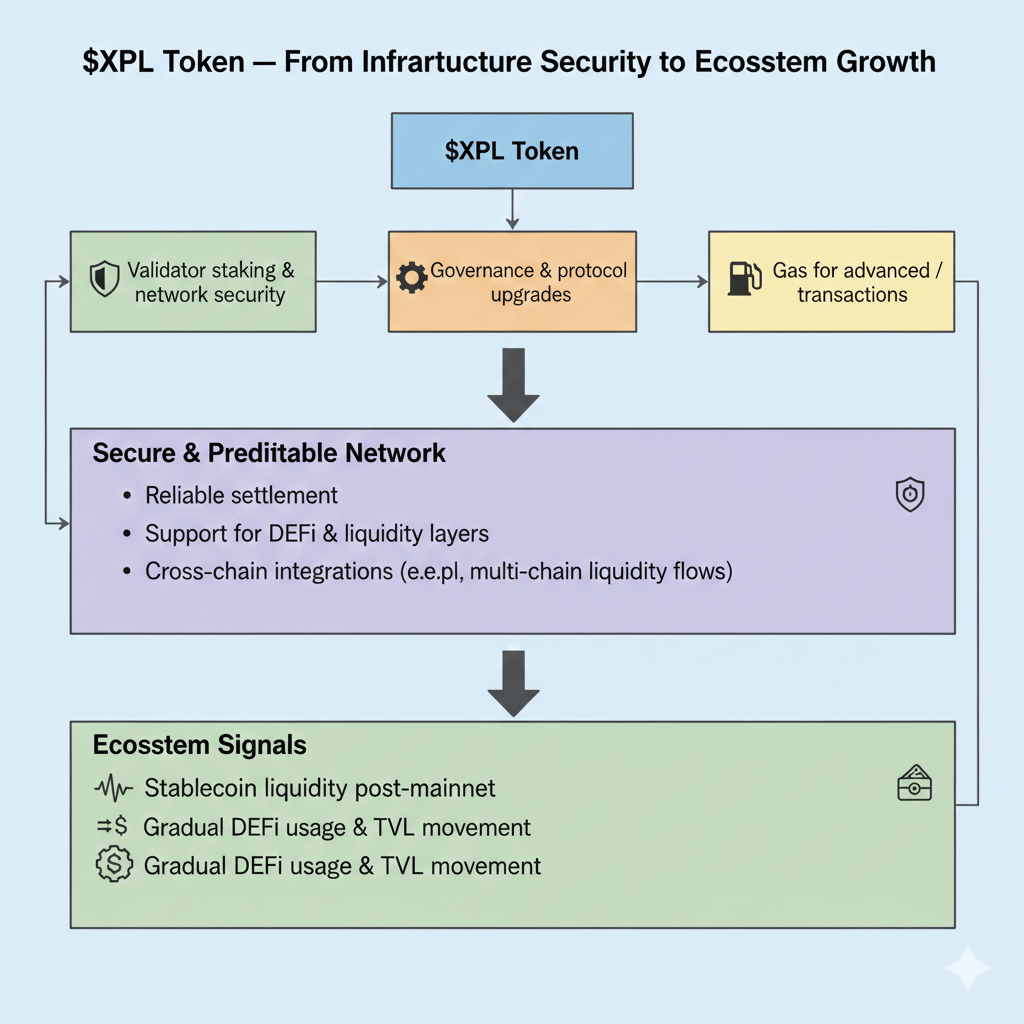

As part of the campaign, Plasma is allocating incentives equal to 1% of the total XPL token supply post-TGE. The aim is clear: link token distribution to actual product usage instead of speculative trading. XPL also functions across the ecosystem — securing the network, supporting staking and governance, and helping bootstrap liquidity — so the token isn’t just a reward, it’s an operational piece of the stack.

What could change if this works

If Plasma’s tech scales and the integration behaves as advertised, the payoff could be tangible:

• Easier global access to yield on dollar-pegged holdings.

• Faster, cheaper cross-border transfers that settle on-chain.

• Transparent, auditable yields instead of opaque off-chain accounting.

• Lower friction for everyday users to try DeFi primitives.

That said, success hinges on execution. Competing L1s and L2s, regulatory shifts, and the perennial risk of smart contract vulnerabilities are real constraints. On-chain experiments look great in whitepapers; they’re judged in production by uptime, security incidents, and real capital flows.

Bottom line

The Plasma — Binance Earn collaboration is more than a marketing announcement. It’s a pragmatic experiment: marry rails optimized for stablecoins with a distribution channel that reaches mainstream crypto users. If the model proves secure and reliable under real usage, this could be a clear blueprint for bringing simple, on-chain dollar yield to a far broader audience. If it doesn’t, the experiment will still teach which parts of the stack need tighter operational guardrails or regulatory clarity.

Either way, this is one to watch — not for hype, but for whether on-chain stablecoin finance can move from niche DeFi playgrounds to everyday financial utility.