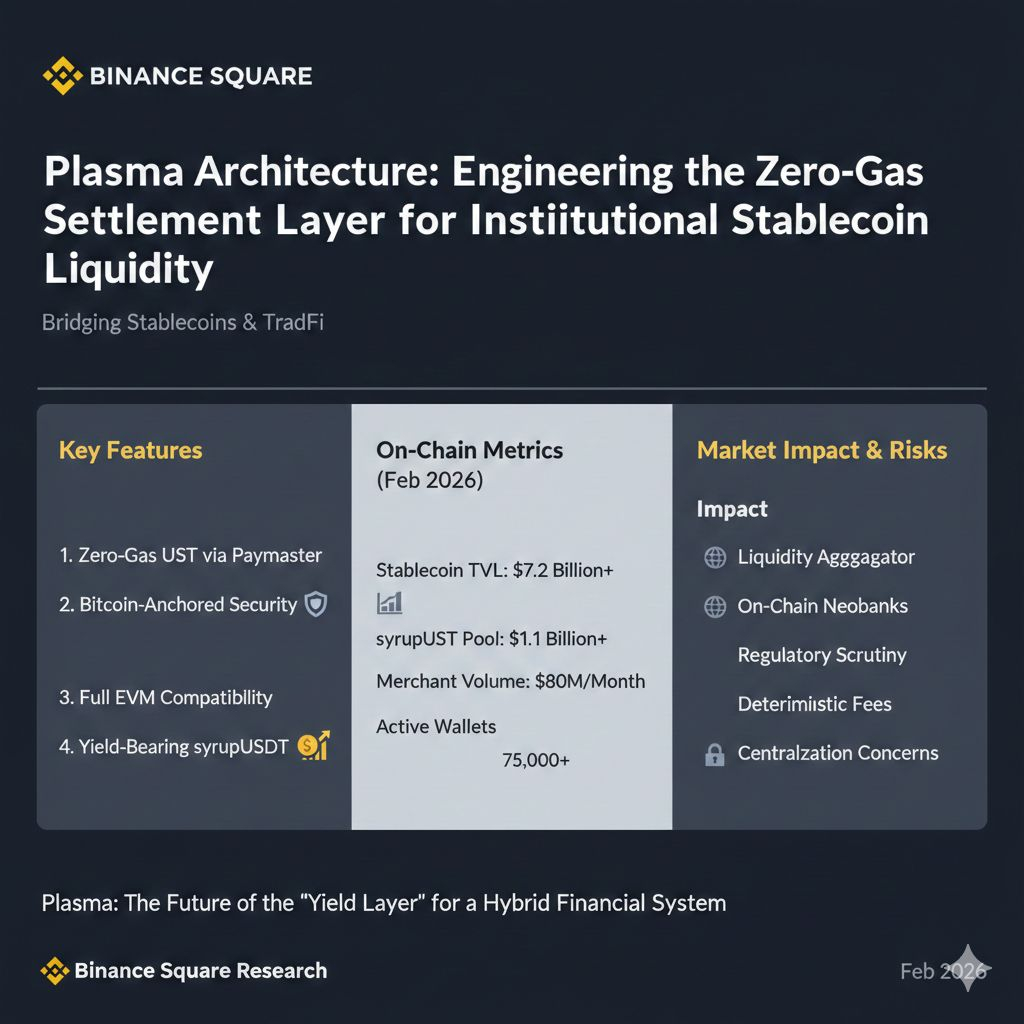

The shift toward institutional stablecoin adoption is no longer a theoretical debate but a structural reality driven by the need for instant settlement. @Plasma has positioned itself as the essential bridge in this transition by solving the two biggest headaches for traditional finance: unpredictable transaction costs and the lack of native yield. In the current market, moving millions of dollars in USDT can still be expensive or slow on congested networks, but Plasma’s architecture treats stablecoins as first-class citizens. By using a clever system called a Paymaster, the network allows users to send stablecoins without ever needing to hold a separate gas token. This "zero-gas" experience mimics the seamless feel of a traditional bank app while keeping the transparency and security of a blockchain.

At its core, @Plasma secures itself by leaning on the massive computing power of Bitcoin while remaining fully compatible with Ethereum’s smart contracts. This hybrid approach gives big banks the "best of both worlds"—the unshakeable safety of the oldest network and the flexible tools needed to build complex lending products. On-chain data shows this isn't just for hobbyists; billions in liquidity are flowing into yield-bearing assets like syrupUSDT, which earns interest from real-world credit markets rather than risky crypto bets. This creates a "Yield Layer" where money doesn't just sit idle but actively grows at rates that often outperform traditional savings accounts.

However, the path forward isn't without its hurdles. Plasma must prove it can stay decentralized as it scales, and it faces stiff competition from other networks trying to attract the same institutional capital. There is also the constant pressure of global regulation, as the line between a digital wallet and a bank account continues to blur. Despite these risks, Plasma’s focus on removing friction makes it a formidable player. It is effectively turning stablecoins from speculative digital chips into a global, high-speed payment rail.