Why this market feels hostile & Why that matters

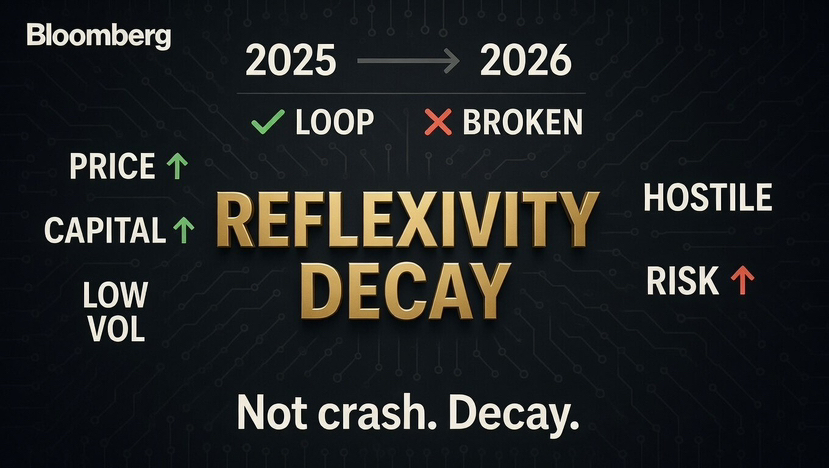

The 2025 expansion phase was not purely directional; it was reflexive.

Price appreciation strengthened narrative conviction, narrative conviction attracted incremental capital, and incremental capital compressed volatility while expanding leverage tolerance.

This feedback loop sustained itself until marginal efficiency deteriorated.

What we are witnessing in early 2026 is not a collapse of thesis ! It is Truly the decay of reflexivity.

When Reflexivity Stops Working

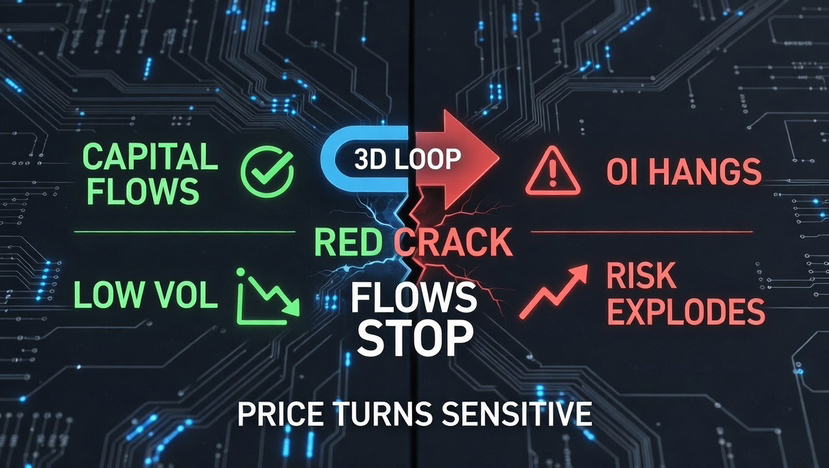

Reflexive markets function efficiently when capital inflows outpace risk recognition.

During that phase, volatility suppression reinforces positioning confidence. Leverage expands because downside realization remains statistically shallow.

Market participants mistake liquidity abundance for structural resilience.

However, reflexivity contains an embedded fragility.

Once incremental inflows plateau, positioning inertia remains while demand elasticity declines. Open interest does not immediately contract, it persists against weakening spot confirmation.

This divergence introduces convex instability.

Price sensitivity to marginal order flow increases non-linearly.

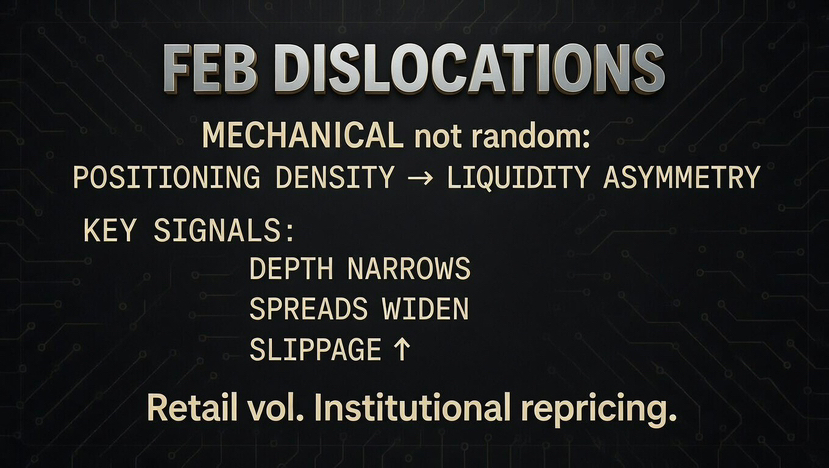

Why the February Dislocations Were Mechanical

The February dislocations were not anomalies.

They were mechanical consequences of positioning density encountering liquidity asymmetry.

In expansionary regimes, liquidity is competitive.

In transitional regimes, liquidity becomes selective.

Depth narrows near inflection points.

Market makers adjust exposure tolerance.

Spread efficiency declines.

Slippage increases.

Retail participants interpret this as volatility.

Institutional participants recognize it as structural repricing.

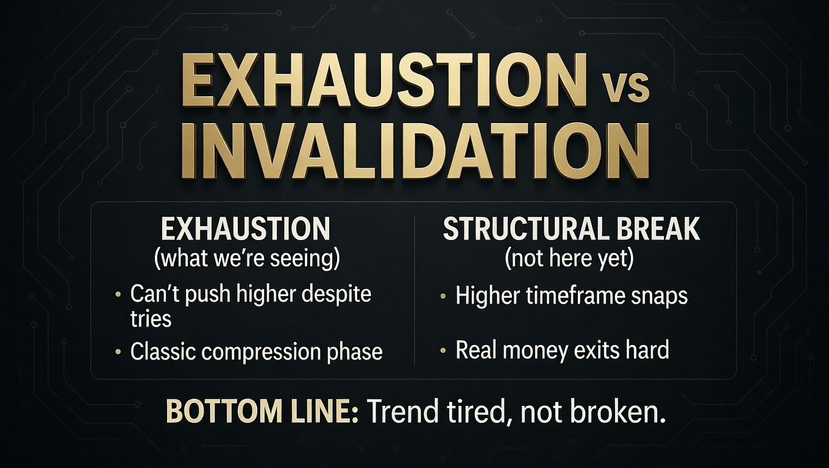

Trend Exhaustion vs Structural Invalidation

There is a critical distinction between trend exhaustion and structural invalidation.

Trend exhaustion manifests as failure to extend despite repeated attempts.

Structural invalidation requires higher-timeframe breakdown accompanied by sustained capital flight.

Current conditions reflect the former and not the latter.

This is characteristic of compression regimes.

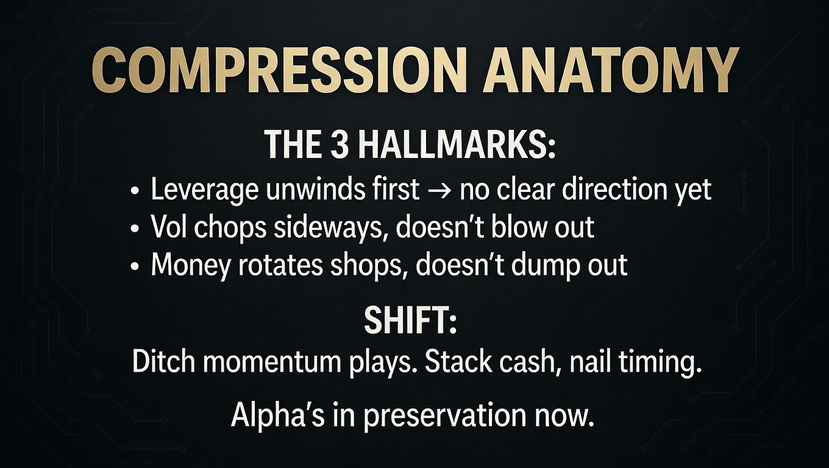

The Anatomy of a Compression Regime

Compression regimes are defined by three observable conditions:

Compression Regimes are Defined By 3 of the Observable CONDITIONS :

• Leverage normalization precedes directional clarity

• Volatility fragments rather than expands cleanly

• Capital rotates internally before exiting systemically

In these environments, alpha generation shifts away from momentum capture and toward capital preservation and timing precision

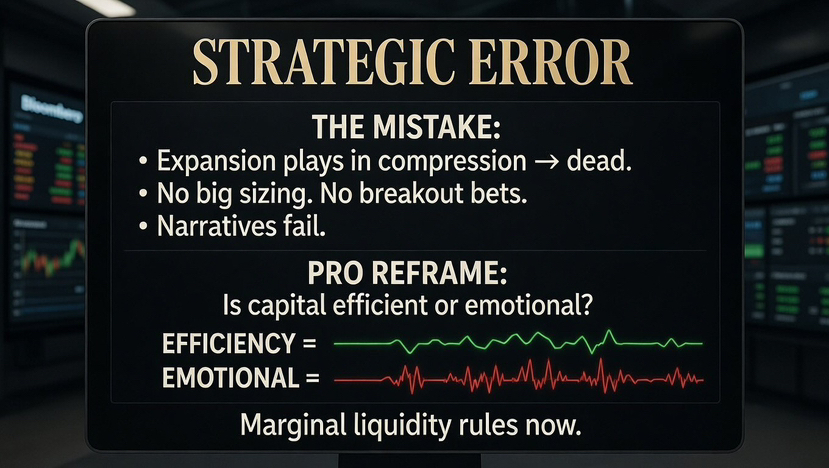

The Strategic Error Most Participants Make

The dominant error is applying expansion tactics to compression structure.

Aggressive sizing, breakout anticipation, and narrative conviction underperform when marginal liquidity becomes conditional.

The sophisticated participant reframes the question.

Not “Where is price going?”

But “Is marginal capital becoming more efficient — or more emotional?”

Efficiency implies stabilization and selective accumulation.

Emotional flow implies reactive liquidation and short-term dislocation.

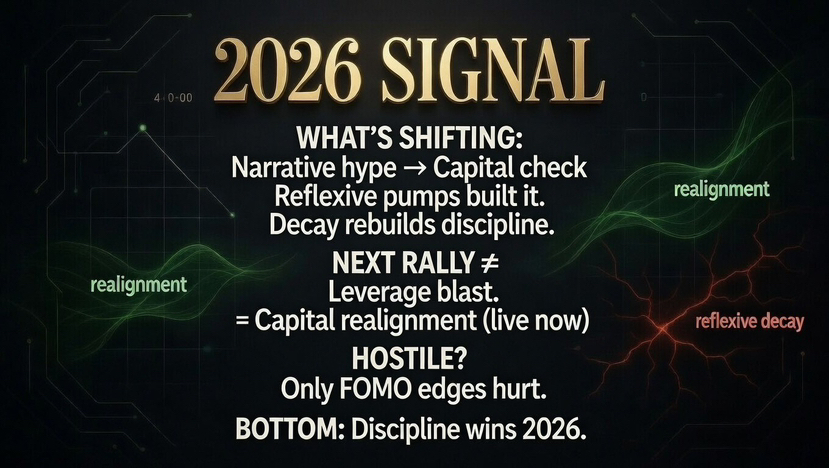

What 2026 Is Actually Signaling

2026, thus far, reflects a market transitioning from narrative dominance to capital scrutiny.

That transition feels hostile only to those whose edge depended on reflexive expansion.

Reflexivity built the rally.

Its decay is rebuilding discipline.

The next sustainable expansion will not emerge from leverage acceleration.

It will emerge from capital realignment.

And that process is already underway.

#CZAMAonBinanceSquare #USNFPBlowout #TrumpCanadaTariffsOverturned