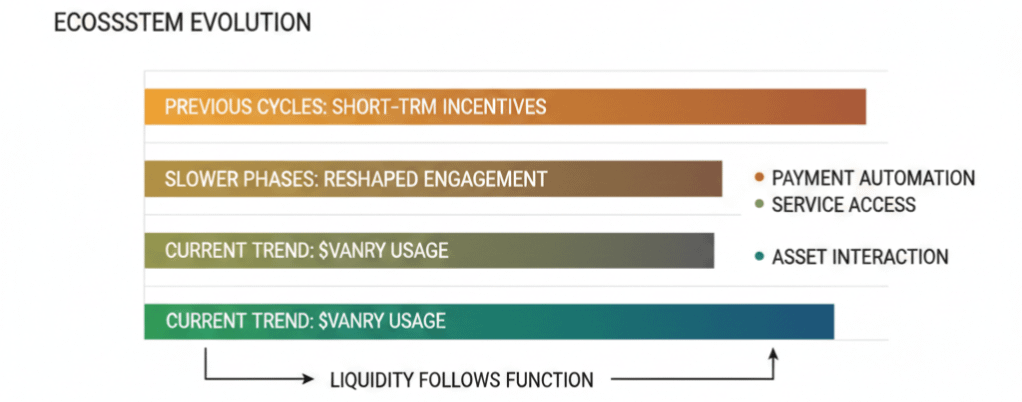

One thing I have learned from watching crypto cycles when liquidity stops moving fast and starts sitting quietly, something practical is usually being tested. That detail matters right now because steady capital often supports real infrastructure, not short-term incentives. Lately, flows around @Vanar feel less reactive, almost like builders are taking time to explore how things actually work.

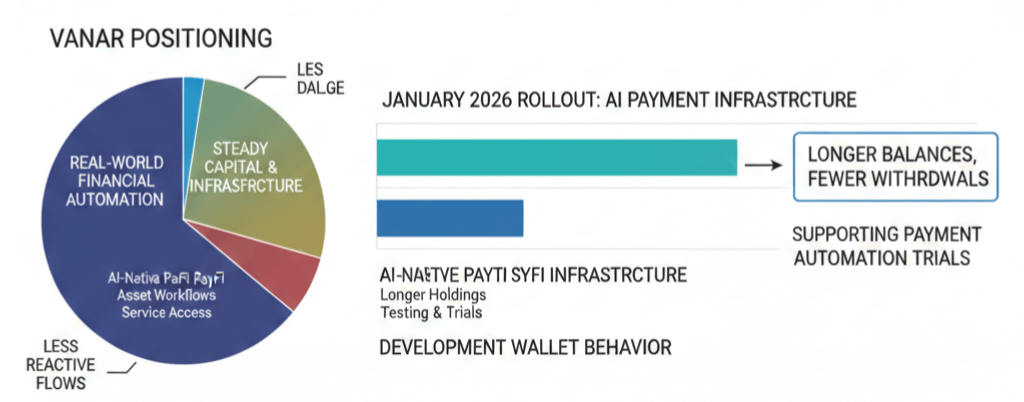

A useful reference point was the January 2026 rollout of AI-focused payment infrastructure linked to real-world asset workflows. After that update, some development wallets appeared to hold balances longer with fewer sudden withdrawals. That pattern suggests liquidity may be supporting payment automation trials rather than campaign-driven activity. With Vanar leaning toward AI-powered PayFi infrastructure, could this quieter behavior reflect preparation for more practical financial use cases?

From what I have seen before, these slower phases often reshape engagement. Some builders now connect $VANRY usage with payment automation, service access, and asset interaction instead of simple transfers. When liquidity begins to follow function instead of attention, ecosystems tend to evolve steadily, and those subtle habit changes usually tell a deeper story than market noise.