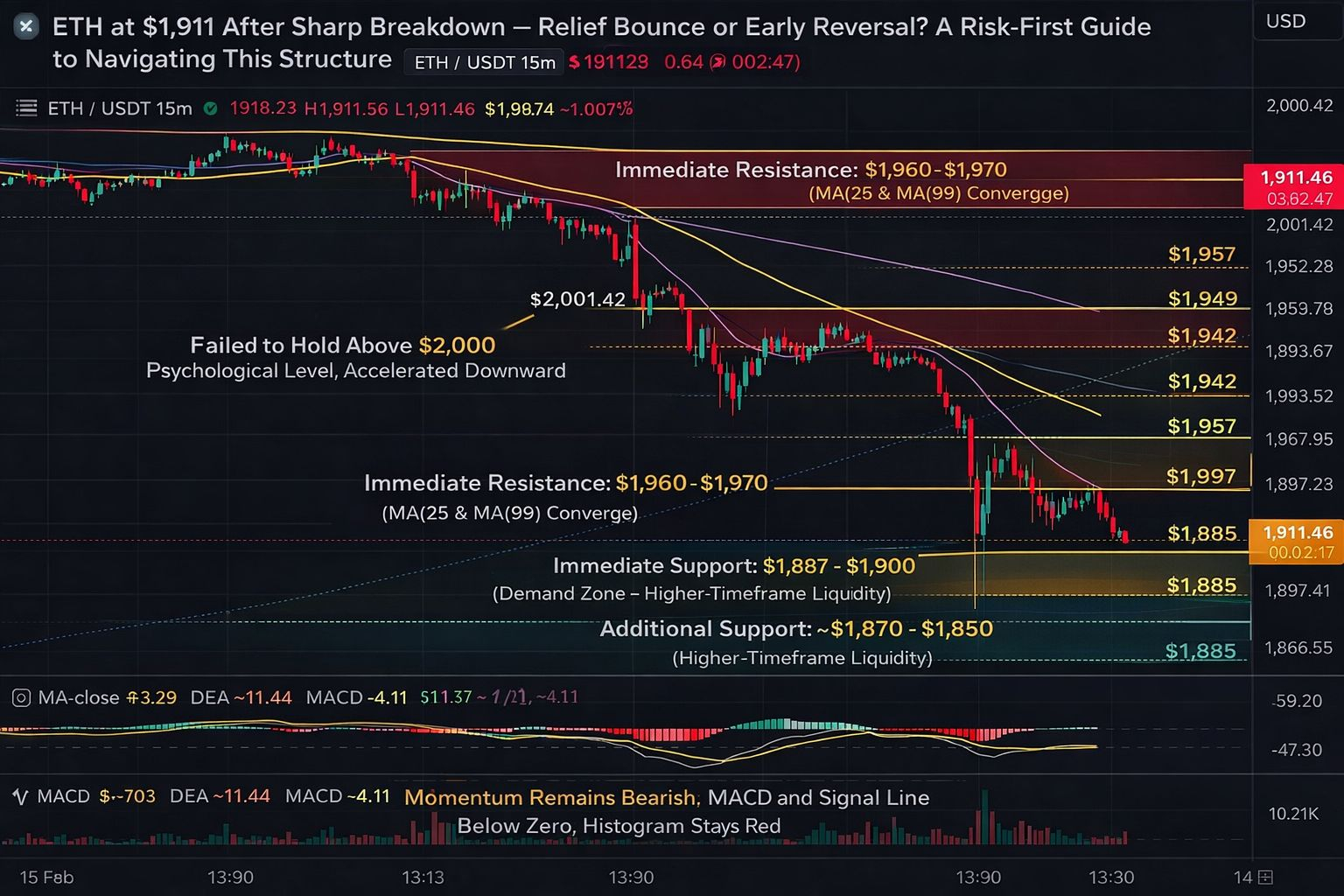

Right now, Ethereum ( $ETH /USDT) is trading around $1,911, down from a recent intraday high near $2,001.42, after printing a session low at $1,897.24. On the chart, the move isn’t subtle it’s a decisive breakdown followed by a small stabilization attempt.

Let’s read what the structure is actually saying and more importantly, what you should do if this turns into deeper downside.

First, price action. ETH pushed toward the $2,000 psychological level and failed to hold above it. From there, we saw a sharp sequence of strong red candles that sliced through short-term support and accelerated into the $1,897–$1,900 demand zone. That type of impulsive move usually signals forced selling not gradual distribution.

Now look at the moving averages.

MA(7) is around $1,917.76, MA(25) around $1,964.63, and MA(99) around $1,961.52. Price is currently trading below all three, and the shorter MAs are sloping downward. That’s textbook short-term bearish structure.

When price trades below the 25 and 99 moving averages with widening separation, it often signals momentum control by sellers. Until ETH reclaims at least the MA(7) and holds above $1,920–$1,930 with conviction, the bounce remains fragile.

Now the momentum indicators.

MACD is negative, with histogram bars still red. DIF and DEA are both below zero, indicating bearish momentum remains active. Yes, the histogram may begin to contract if buyers step in — but contraction is not reversal. It’s just deceleration.

Volume is also telling a story. The selloff came with expanded volume — that confirms participation. The current small green candles near $1,910 are happening on relatively lighter volume, which means buyers are cautious.

Here’s the first educational lesson:

Not every bounce is a reversal. Some are relief moves inside a broader corrective leg.

Now let’s map key levels clearly.

Immediate support: $1,897–$1,900.

If that level fails decisively, the next liquidity pocket could sit closer to $1,870–$1,850, depending on higher-timeframe structure.

Immediate resistance: $1,920–$1,930 (short-term reclaim zone).

Stronger resistance: $1,960–$1,970, where MA(25) and MA(99) converge.

For bulls to regain control, ETH needs to reclaim $1,930 with volume and build higher lows. For bears to extend dominance, a breakdown below $1,897 with momentum expansion would confirm continuation.

Now let’s shift from analysis to education.

What should you do in this environment?

First: reduce leverage.

When volatility expands and structure turns bearish, leverage becomes dangerous. If you cannot survive a 5–8% move against your position on a lower timeframe, your sizing is too aggressive.

Second: define invalidation before entry.

If you long near $1,910, ask yourself: where are you wrong? If support at $1,897 breaks, are you exiting — or hoping?

Hope is not risk management.

Third: respect timeframes.

The 15-minute chart shows short-term weakness. The 4-hour and daily charts determine broader direction. Don’t treat a small bounce as a macro reversal.

Fourth: avoid emotional averaging down.

Buying aggressively just because price dropped from $2,000 to $1,910 is not a strategy. A valid entry requires confirmation — higher low, reclaimed structure, increasing volume.

Fifth: protect mental capital.

Sharp intraday selloffs create urgency. Urgency leads to overtrading. Overtrading increases losses. Sometimes the best decision is to step back and wait for clarity.

Another key educational point is understanding liquidity events.

Moves like the drop from $2,000 to $1,897 often liquidate overleveraged longs. That’s a reset. After liquidation clusters clear, markets sometimes stabilize. But stabilization is different from bullish continuation.

Ask yourself rational questions instead of reacting emotionally:

Is this a healthy pullback inside a larger uptrend?

Or is it the beginning of a broader lower-high sequence?

Is volume expanding on bounces or only on selloffs?

Price tells the truth — narratives follow.

If the market deteriorates further:

Lower correlated exposure across your portfolio.

Increase cash or stable allocations temporarily.

Avoid revenge trading to “win back” losses.

Stick to predefined risk per trade — 1–2% capital exposure is common disciplined practice.

In downturn phases, survival becomes the priority.

In bull markets, traders focus on maximizing gains. In corrective phases, professionals focus on minimizing damage.

Capital preservation is not weakness. It’s strategy.

Here’s my balanced take:

ETH at $1,911 is attempting a short-term stabilization after an impulsive breakdown. The market is testing whether buyers are willing to defend the $1,900 region. So far, the response is cautious — not aggressive.

Until ETH reclaims $1,930 and builds structure above it, the path of least resistance on this timeframe remains fragile.

The goal isn’t to predict the next candle.

The goal is to position in a way where:

If you’re wrong, the loss is small.

If you’re right, the reward compounds.

Markets will always move. Volatility will always test discipline.

What determines long-term success isn’t whether $ETH bounces from $1,900.

It’s whether you manage risk properly when it doesn’t.