The CLARITY Act seeks to establish a comprehensive regulatory framework for digital assets in the United States. Its objective is to clarify legal classifications, delineate oversight between the SEC and CFTC, define registration standards for exchanges and custodians, and set issuance and reserve requirements for stablecoins. In effect, it attempts to provide a constitutional foundation for the crypto industry.

Yet legislative progress has slowed. The central conflict revolves around yield-bearing stablecoins. Banking groups argue that offering interest or rewards transforms stablecoins into deposit substitutes, potentially increasing liquidity risks for regional banks. They advocate strict limits on compensation structures. Exchanges, however, depend on yield programs as key revenue streams and user acquisition tools, making this issue structurally significant.

If enacted, CLARITY could evolve in two directions. A restrictive framework may limit stablecoins primarily to payment functions and subject yield products to securities or bank-level regulation. Alternatively, a conditional model may permit limited yield structures under enhanced capital, disclosure, and segregation requirements.

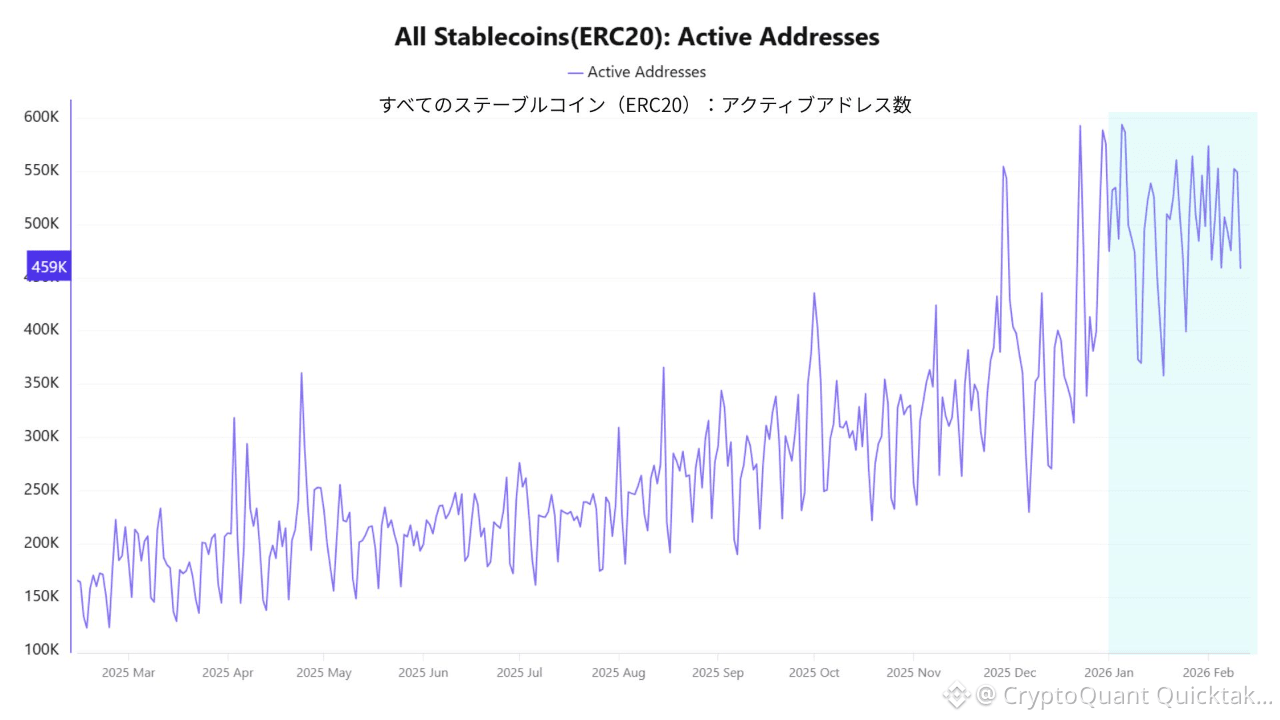

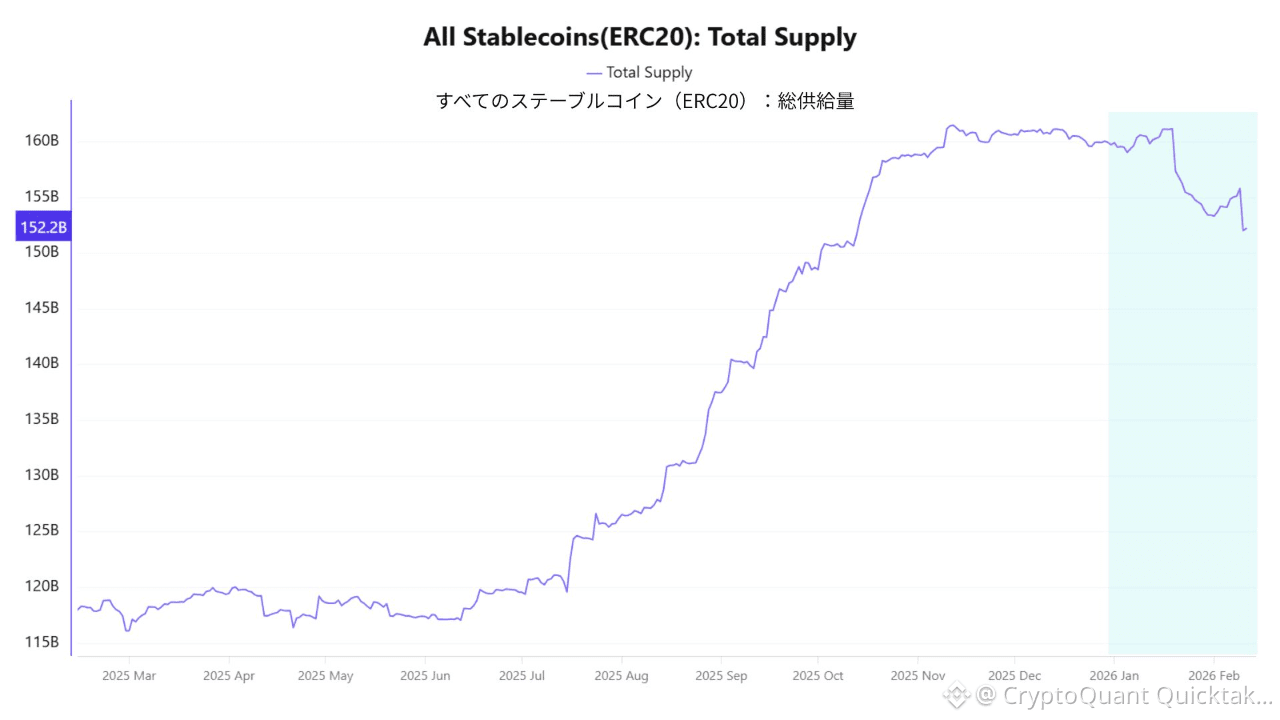

Despite regulatory uncertainty, on-chain indicators suggest resilience. ERC20 stablecoin supply remains elevated, and active addresses continue at stable levels, indicating preserved liquidity rather than structural capital flight.

CLARITY’s impact is therefore more likely to reshape participant composition and institutional accessibility over time than to trigger immediate price reactions.

Written by XWIN Research Japan