The crypto market in 2026 feels very different from what it did just a few years ago. It’s no longer just about faster block times, cheaper transactions, or launching another smart contract platform. The real race now is about infrastructure, specifically, infrastructure that can support artificial intelligence in a decentralized way.

That’s where Vanry Coin continues to catch my attention.

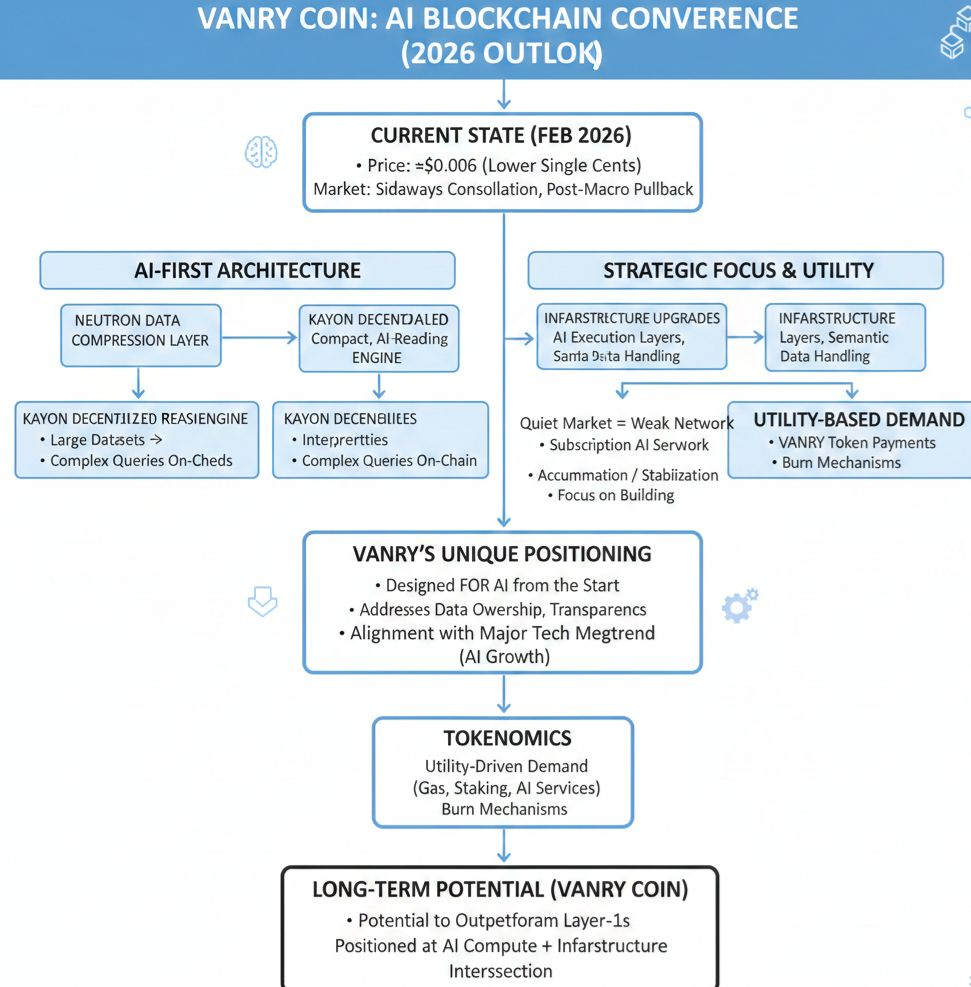

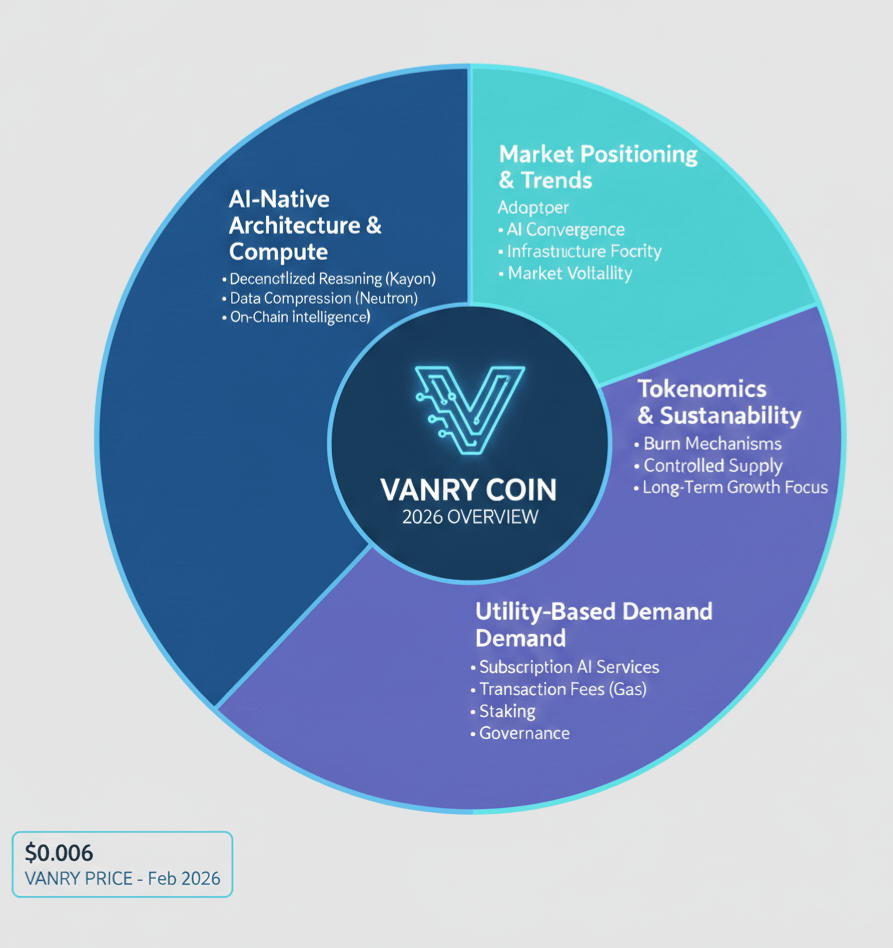

As of mid-February 2026, Vanry is trading in the lower single-cent range, hovering around $0.006. The broader altcoin market has been moving sideways after macro-driven pullbacks, and Vanry has followed that consolidation pattern. But what stands out to me is that daily volume hasn’t disappeared. Interest is still there. It’s just quieter, less hype, more building.

And honestly, I prefer it that way.

Recent updates from the community highlight ongoing improvements to the network’s AI execution layers and semantic data handling tools. These aren’t flashy announcements designed to spike the price overnight. They’re infrastructure upgrades, the kind that usually matter much more over the long term.

From my perspective, this is exactly why I believe Vanry Coin has the potential to outperform many other Layer-1 tokens. Its network wasn’t retrofitted for AI. It was designed with AI in mind from the start.

AI-First Architecture, Not Just AI Buzzwords

There’s a huge difference between saying “we integrate AI” and actually building a network that is AI-native.

Many chains today claim AI compatibility. But in reality, most of them rely heavily on off-chain computation. The blockchain acts as a settlement layer, while the actual intelligence lives somewhere else. That’s not true integration, that’s outsourcing.

Vanry approaches things differently.

The Neutron data compression layer, for example, focuses on turning large datasets into compact, AI-readable seeds. Anyone who understands blockchain knows storage is expensive and inefficient when dealing with heavy data. Instead of forcing developers to choose between intelligence and scalability, Vanry attempts to balance both by compressing semantic meaning into manageable on-chain structures.

To me, that’s practical engineering, not marketing.

Then there’s Kayon, the decentralized reasoning engine. Traditional smart contracts are deterministic: input A produces output B. That works for many use cases, but AI doesn’t operate in rigid binaries. AI systems classify, interpret, adapt and infer.

Kayon introduces interpretive capabilities into decentralized environments. That’s a subtle but powerful shift. It opens the door to applications that can process complex queries and decision trees directly within blockchain systems.

In a world increasingly driven by AI agents, automating trading strategies, content moderation, data analysis, and even governance, anchoring intelligent decision-making on-chain could become extremely valuable.

A Quiet Market Doesn’t Mean a Weak Network

Right now, the broader market feels cautious. Bitcoin dominance remains relatively high, and capital rotation into smaller altcoins has been selective. Vanry’s price consolidation reflects that environment.

But consolidation isn’t necessarily weakness.

Sometimes it’s accumulation. Sometimes it’s structural stabilization. And sometimes it’s simply the market catching its breath.

What I appreciate about Vanry’s approach is that the team seems focused on strengthening the core AI infrastructure stack instead of chasing short-term hype cycles. There’s a maturity in that strategy. When markets mature, reliability matters more than noise.

Another detail I find important is the move toward utility-based demand. Subscription-style AI services paid in VANRY tokens create recurring usage. That’s very different from a token that only moves because of speculation.

If usage grows steadily, token demand becomes tied to functionality, not just sentiment.

That’s a much healthier long-term dynamic.

Why AI Infrastructure Matters More Than Ever

Artificial intelligence isn’t a niche conversation anymore. It’s embedded in enterprise systems, creative workflows, financial tools and automation platforms across the globe.

But most AI platforms today are centralized.

That raises real concerns about data ownership, transparency and control. Developers building AI applications may eventually prefer decentralized infrastructure that supports reasoning and semantic interaction natively, rather than constantly relying on centralized APIs.

This is where I see Vanry’s potential edge.

If AI adoption continues accelerating and all signs point in that direction, demand for decentralized AI execution layers could expand significantly. Layer-1 chains competing purely on transaction speed may struggle to stand out in that environment.

Vanry’s positioning aligns with one of the strongest technological megatrends of this decade. And alignment with major trends often matters more than short-term price performance.

Tokenomics That Make Practical Sense

I’ve seen too many Layer-1 tokens struggle because their supply inflation overwhelms actual usage. When emissions outpace demand, price pressure becomes inevitable.

Vanry’s model attempts to tie token utility directly to network activity. VANRY is used for gas, staking, governance and AI service payments. The more AI tools are used, the more organic transaction demand exists.

There are also burn mechanisms connected to usage, introducing a gradual supply reduction element. It’s not aggressively deflationary and that’s probably a good thing. Extreme tokenomics often create instability.

Instead, Vanry seems to aim for sustainability.

In my opinion, that balance reinforces the idea that this project is building for endurance, not for short-lived hype cycles.

The Competitive Reality

The Layer-1 landscape remains extremely competitive. Some chains focus on gaming. Others lean into DeFi or enterprise adoption. Many are now exploring AI partnerships.

But depth of integration matters.

There’s a meaningful difference between “we support AI projects” and “our network is structured around AI logic.”

Vanry’s core narrative is not just compatibility, it’s architectural alignment with AI systems. If decentralized AI agents become more autonomous in the coming years, networks capable of handling complex reasoning natively could have a structural advantage.

Of course, risks exist. Developer adoption will determine long-term success. Regulatory clarity around AI and blockchain convergence could impact growth. And market volatility can temporarily overshadow strong fundamentals.

I don’t ignore those risks.

But when evaluating infrastructure projects, I focus more on alignment with long-term technological shifts than on short-term candles.

Final Thoughts

At around $0.006, Vanry’s current price doesn’t fully capture the ambition behind its roadmap. The emphasis on semantic compression, decentralized reasoning, and AI-native architecture sets it apart from many Layer-1 competitors.

Short-term volatility is part of crypto. That won’t change.

But the broader thesis, the convergence of AI compute and decentralized infrastructure remains powerful. And Vanry sits directly at that intersection.

Personally, I continue to believe Vanry Coin has the potential to outperform similar Layer-1 tokens because it was built for AI applications from the ground up, not adjusted later to fit the trend.

If AI continues reshaping digital infrastructure and it almost certainly will networks like Vanry may find themselves positioned exactly where innovation meets decentralization.