“Vanar Chain’s Predictive Blockchain Economy — A New Category Where the Chain Itself Forecasts Market & User Behavior to Pay Reward Tokens”

Last month I stood in line at my local bank to update a simple KYC detail. There was a digital token display blinking red numbers. A security guard was directing people toward counters that were clearly understaffed. On the wall behind the cashier was a framed poster that said, “We value your time.” I watched a woman ahead of me try to explain to the clerk that she had already submitted the same document through the bank’s mobile app three days ago. The clerk nodded politely and asked for a physical copy anyway. The system had no memory of her behavior, no anticipation of her visit, no awareness that she had already done what was required.

When my turn came, I realized something that bothered me more than the waiting itself. The system wasn’t just slow. It was blind. It reacted only after I showed up. It didn’t learn from the fact that thousands of people had done the same update that week. It didn’t prepare. It didn’t forecast demand. It didn’t reward proactive behavior. It waited for friction, then processed it.

That’s when the absurdity hit me. Our financial systems — even the digital ones — operate like clerks behind counters. They process. They confirm. They settle. They react. But they do not anticipate. They do not model behavior. They do not think in probabilities.

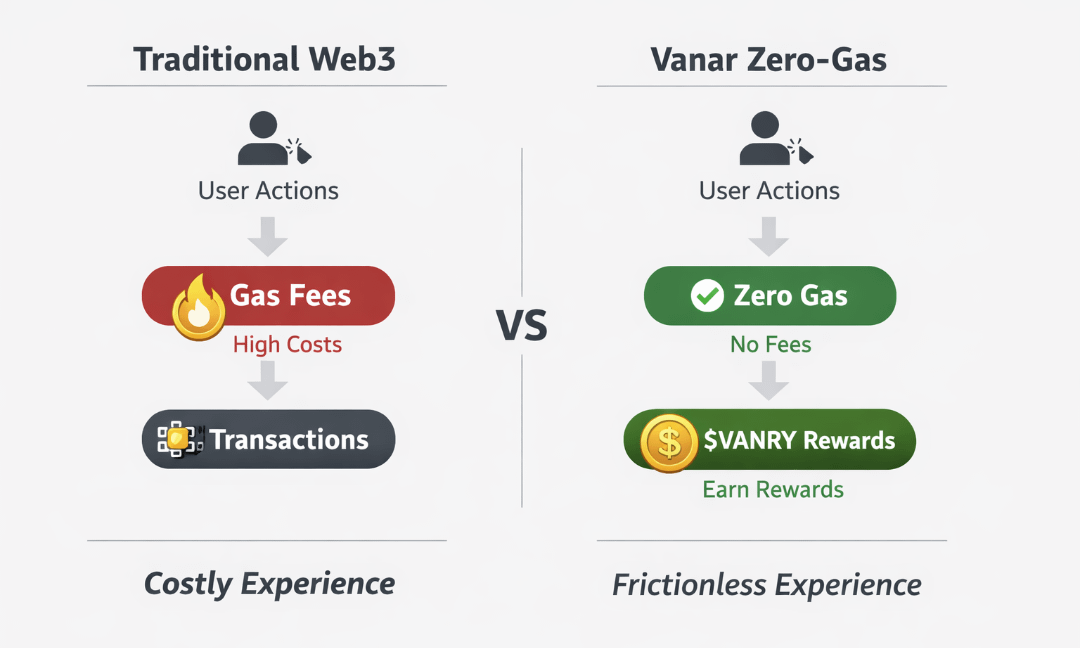

We’ve digitized paperwork. We’ve automated transactions. But we haven’t upgraded the logic of the infrastructure itself. Most blockchains, for all their decentralization rhetoric, still behave like that bank counter. You submit. The chain validates. The state updates. End of story.

No chain asks: What is likely to happen next?

No chain adjusts incentives before congestion hits.

No chain redistributes value based on predicted participation rather than historical activity.

That absence feels increasingly outdated.

I’ve started thinking about it this way: today’s chains are ledgers. But ledgers are historical objects. They are record keepers. They are mirrors pointed backward.

What if a chain functioned less like a mirror and more like a weather system?

Not a system that reports what just happened — but one that models what is about to happen.

This is where Vanar Chain becomes interesting to me — not because of throughput claims or ecosystem expansion, but because of a deeper category shift it hints at: a predictive blockchain economy.

Not predictive in the sense of oracle feeds or price speculation. Predictive in the structural sense — where the chain itself models behavioral patterns and uses those forecasts to adjust reward flows in real time.

The difference is subtle but profound.

Most token economies pay for actions that have already occurred. You stake. You provide liquidity. You transact. Then you receive rewards. The reward logic is backward-facing.

But a predictive economy would attempt something else. It would ask: based on current wallet patterns, game participation, NFT engagement, and liquidity flows, what is the probability distribution of user behavior over the next time window? And can we price incentives dynamically before the behavior manifests?

This is not marketing language. It’s architectural.

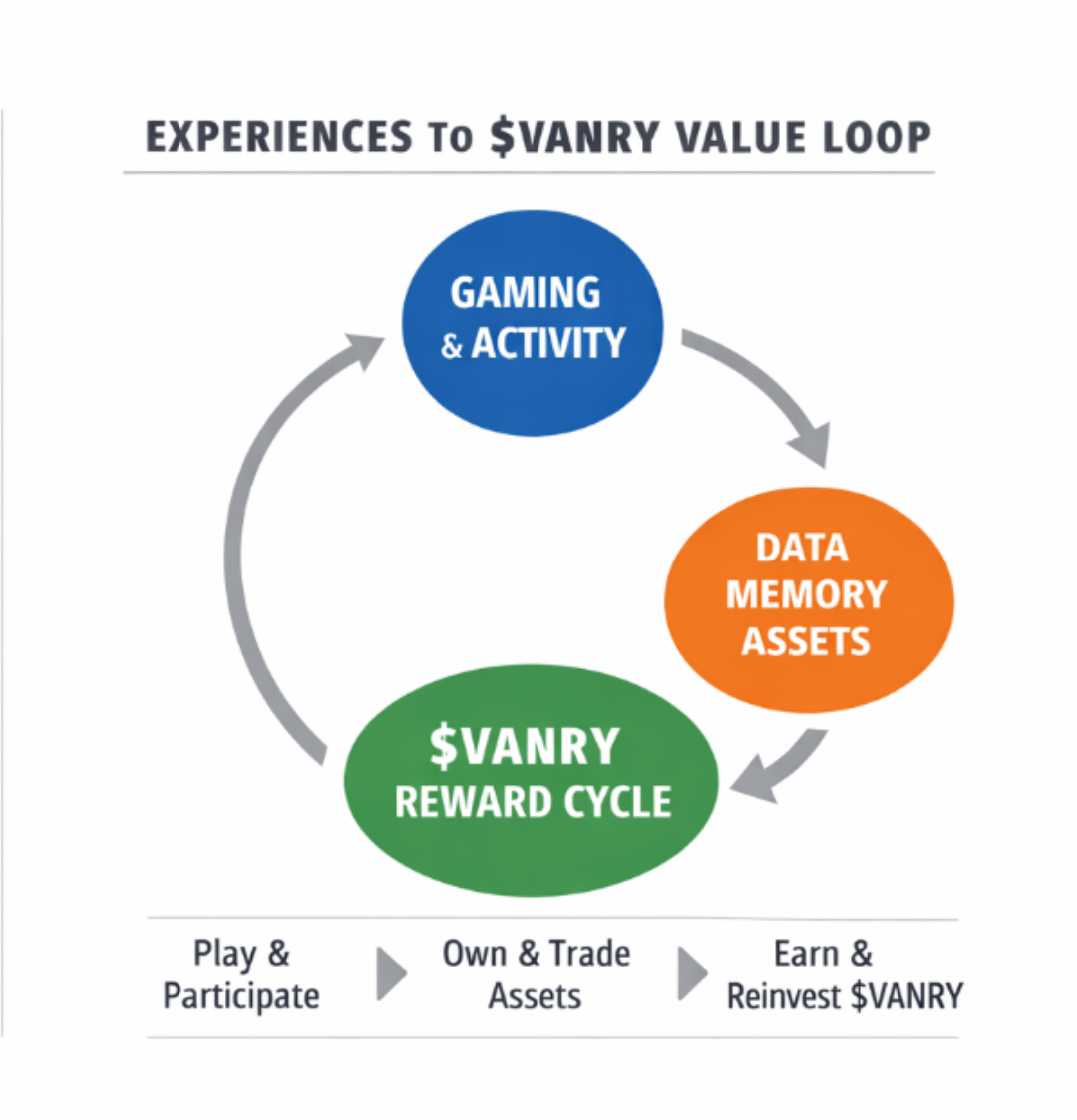

Vanar’s design orientation toward gaming ecosystems, asset ownership loops, and on-chain activity creates dense behavioral datasets. Games are not passive DeFi dashboards. They are repetitive, patterned, probabilistic systems. User behavior inside games is measurable at high resolution — session frequency, asset transfers, upgrade cycles, spending habits.

That density matters.

Because prediction requires data granularity. A chain that only processes swaps cannot meaningfully forecast much beyond liquidity trends. But a chain embedded in interactive environments can.

Here’s the mental model I keep circling: Most chains are toll roads. You pay when you drive through. The system collects fees. That’s it.

A predictive chain is closer to dynamic traffic management. It anticipates congestion and changes toll pricing before the jam forms. It incentivizes alternate routes before gridlock emerges.

In that sense, $VANRY is not just a utility token. It becomes a behavioral derivative. Its emission logic can theoretically be tied not only to past usage but to expected near-term network activity.

If that sounds abstract, consider this.

Imagine a scenario where Vanar’s on-chain data shows a sharp increase in pre-game asset transfers every Friday evening. Instead of passively observing this pattern week after week, the protocol could dynamically increase reward multipliers for liquidity pools or transaction validators in the hours leading up to that surge. Not because congestion has occurred — but because the probability of congestion is statistically rising.

In traditional finance, predictive systems exist at the edge — in hedge funds, risk desks, algorithmic trading systems. Infrastructure itself does not predict; participants do.

Vanar’s category shift implies infrastructure-level prediction.

And that reframes incentives.

Today, reward tokens are distributed based on fixed emission schedules or governance votes. In a predictive model, emissions become adaptive — almost meteorological.

To make this less theoretical, I sketched a visual concept I would include in this article.

The chart would be titled: “Reactive Emission vs Predictive Emission Curve.”

On the X-axis: Time.

On the Y-axis: Network Activity & Reward Emission.

There would be two overlapping curves.

The first curve — representing a typical blockchain — would show activity spikes first, followed by reward adjustments lagging behind.

The second curve — representing Vanar’s predictive model — would show reward emissions increasing slightly before activity spikes, smoothing volatility and stabilizing throughput.

The gap between the curves represents wasted friction in reactive systems.

The visual wouldn’t be about hype. It would illustrate timing asymmetry.

Because timing is value.

If the chain forecasts that NFT mint demand will increase by 18% over the next 12 hours based on wallet clustering patterns, it can preemptively incentivize validator participation, rebalance liquidity, or adjust token rewards accordingly.

That transforms Vanar from a static medium of exchange into a dynamic signal instrument.

And that’s where this becomes uncomfortable.

Predictive infrastructure raises questions about agency.

If the chain forecasts my behavior and adjusts rewards before I act, am I responding to incentives — or am I being subtly guided?

This is why I don’t see this as purely bullish innovation. It introduces a new category of economic architecture: anticipatory incentive systems.

Traditional finance reacts to crises. DeFi reacts to volatility. A predictive chain attempts to dampen volatility before it forms.

But prediction is probabilistic. It is not certainty. And when a chain distributes value based on expected behavior, it is effectively pricing human intent.

That is new territory.

Vanar’s focus on immersive ecosystems — especially gaming environments — makes this feasible because gaming economies are already behavioral laboratories. Player engagement loops are measurable and cyclical. Asset demand correlates with in-game events. Seasonal patterns are predictable.

If the chain models those patterns internally and links Vanar emissions to forecasted participation rather than static schedules, we’re looking at a shift from “reward for action” to “reward for predicted contribution.”

That’s not a feature update. That’s a different economic species.

And species classification matters.

Bitcoin is digital scarcity.

Ethereum is programmable settlement.

Most gaming chains are asset rails.

Vanar could be something else: probabilistic infrastructure.

The category name I keep returning to is Forecast-Led Economics.

Not incentive-led. Not governance-led. Forecast-led.

Where the chain’s primary innovation is not speed or cost — but anticipation.

If that sounds ambitious, it should. Because the failure mode is obvious. Overfitting predictions. Reward misallocation. Behavioral distortion. Gaming the forecast itself.

In predictive financial markets, models degrade. Participants arbitrage the prediction mechanism. Feedback loops form.

A predictive chain must account for adversarial adaptation.

Which makes $VANRY even more interesting. Its utility would need to balance three roles simultaneously: transactional medium, reward instrument, and behavioral signal amplifier.

Too much emission based on flawed forecasts? Inflation.

Too little? Congestion.

Over-accurate prediction? Potential centralization of reward flows toward dominant user clusters.

This is not an easy equilibrium.

But the alternative — purely reactive systems — feels increasingly primitive.

Standing in that bank queue, watching humans compensate for infrastructure blindness, I kept thinking: prediction exists everywhere except where it’s most needed.

Streaming apps predict what I’ll watch.

E-commerce predicts what I’ll buy.

Ad networks predict what I’ll click.

But financial infrastructure still waits for me to show up.

If Vanar’s architecture genuinely internalizes predictive modeling at the protocol level — not as a third-party analytic layer but as a reward logic foundation — it represents a quiet structural mutation.