Speed benchmarks dominate most blockchain launches. Vanar Chain doesn't publish them. VANRY trades at $0.006126, up 0.21% with RSI at 38 and volume at $460,515 USDT. The token looks weak, RSI stuck below 40 for weeks now. What's unusual about Vanar isn't the price action. It's the absence of performance marketing while products keep shipping anyway.

No TPS wars. No "fastest blockchain" claims. Just infrastructure that exists.

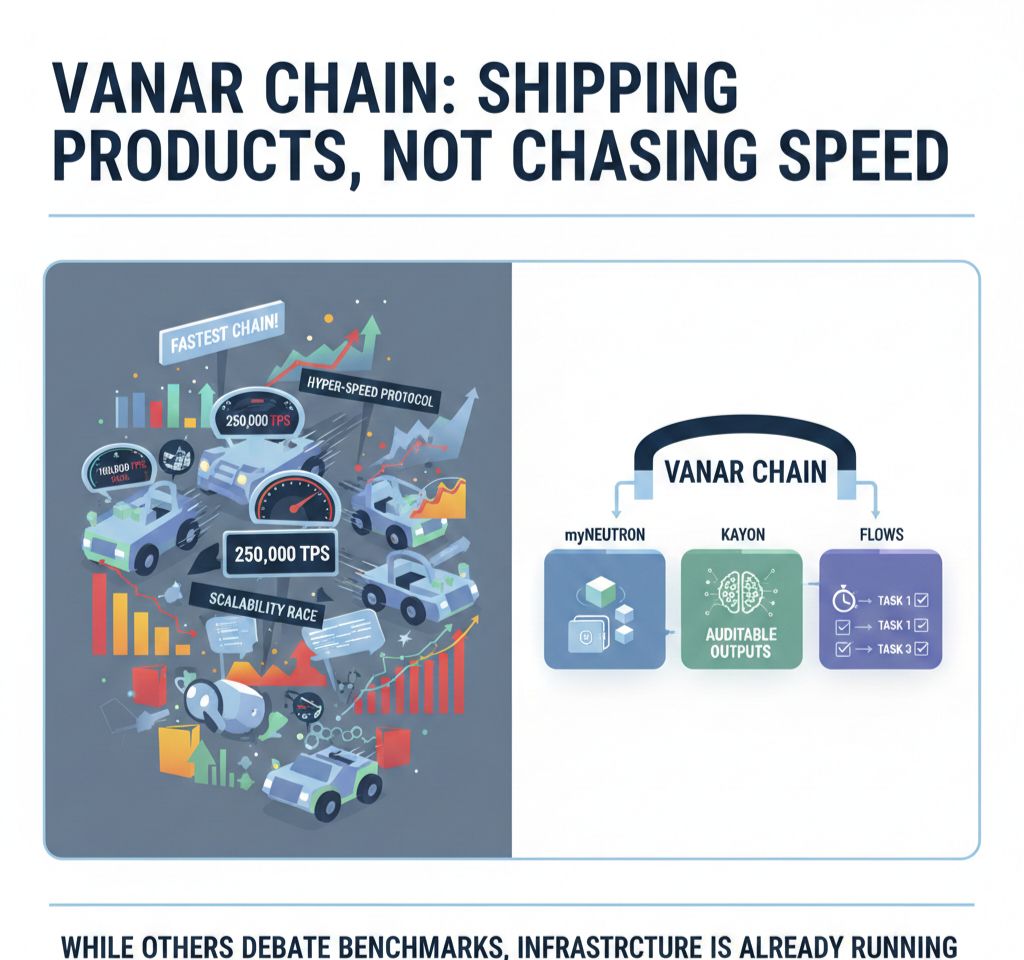

Most new layer ones follow a script. They'll be faster than Ethereum, cheaper than competitors, more scalable than everything before. The pitch centers on infrastructure specs like they're selling sports cars. Transactions per second becomes the horsepower number everyone argues about even though it rarely matters for actual use cases.

Vanar skipped that conversation entirely.

I started noticing this while reading developer discussions. People were talking about myNeutron storage compression ratios, debugging Kayon reasoning query latency, testing Flows automation trigger reliability. Technical problems with deployed systems, not theoretical capacity debates or benchmark competitions.

The difference is subtle but meaningful.

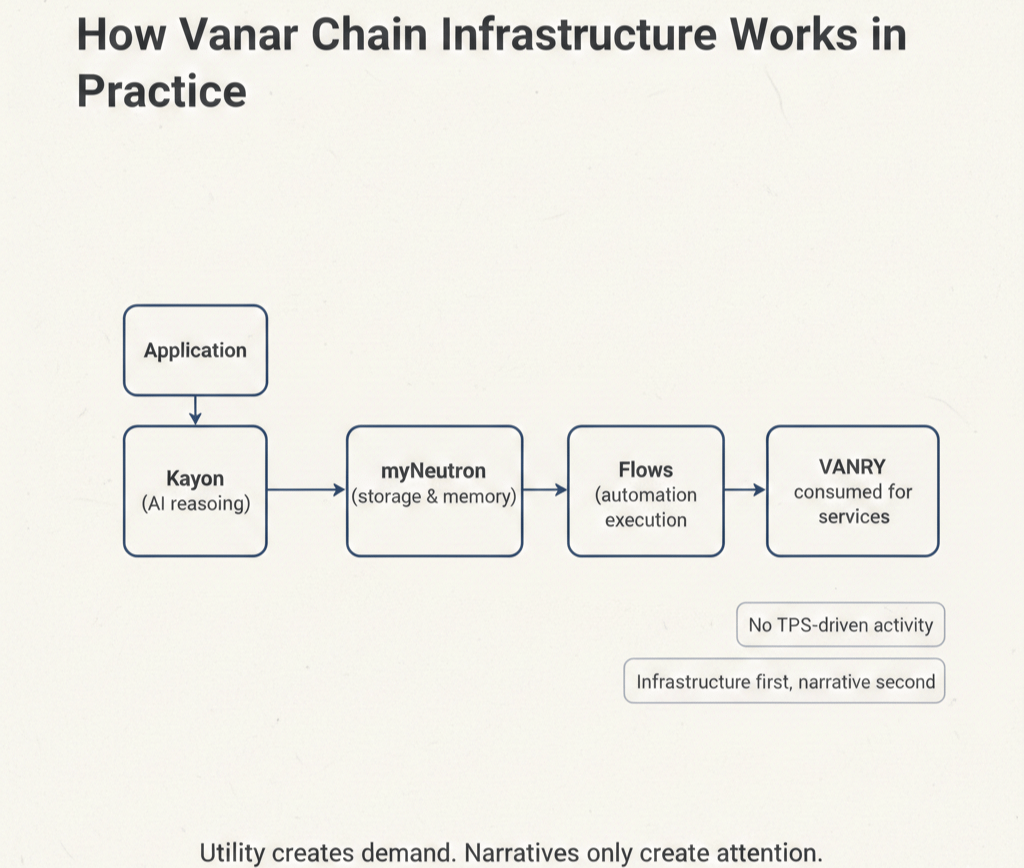

When infrastructure is theoretical, you argue about specs because that's all you have. When products exist, conversations shift to whether they work, how they break, what needs fixing. Vanar Chain bypassed the speculation phase and landed directly in operational debugging.

myNeutron isn't announced as coming soon. It compresses data and stores it on-chain now. You can test whether the compression holds under different file types or fails with certain data structures. That's not a roadmap promise. That's something developers either use or don't based on whether it solves their problem.

Same with Kayon. On-chain reasoning sounds abstract until you're building an application that needs AI decisions to be auditable. Then it becomes concrete. Either reasoning queries return results fast enough for your use case or they don't. Either explanations satisfy compliance requirements or they're not clear enough.

Flows follows the same pattern. Automated execution that's safe and bounded. Either it triggers reliably when conditions are met or it fails and you debug why. You're not arguing about whether automated execution is theoretically possible. You're dealing with whether this implementation works for your workflow.

What's missing from Vanar is the narrative layer most projects wrap around their technology. The grand vision about revolutionizing everything. The promises about capturing massive market share. The roadmaps showing dominance three years out.

Instead there's just infrastructure doing particular things. Applications either find those things useful or they don't.

Hard to generate excitement when you're talking about semantic memory compression instead of being the fastest chain in crypto. But it changes who pays attention and why.

Developers building AI applications that need persistent memory care whether myNeutron works reliably. They don't care whether Vanar processes 100,000 TPS if their use case involves storing context across sessions and retrieving it accurately. The speed debate is irrelevant to their actual problem.

VANRY reflects this philosophy in an understated way. The token isn't positioned as exposure to infrastructure that might someday be important. It underpins usage of systems that exist now. When applications store data through Neutron, query reasoning through Kayon, execute automation through Flows, they consume VANRY for actual infrastructure services rather than speculating on future potential.

That creates different dynamics than narrative-driven tokens.

Projects built on speed narratives pump when benchmarks get announced and dump when reality disappoints. Projects built on working products move based on whether usage grows, regardless of whether the narrative stays fresh. One depends on sustained attention. The other depends on sustained utility.

At $0.006126 with weak RSI and declining volume, VANRY isn't getting sustained attention. Markets moved on to whatever narrative is fresh this week. But infrastructure keeps processing transactions because applications don't pause when tokens look weak. They keep running as long as the services they need keep working.

There's something quietly different about infrastructure that exists without claiming to be revolutionary. Most chains position themselves as the solution to everything. Vanar seems content being the solution to specific problems for applications that have those problems.

Maybe that's too narrow. Maybe the market for AI-native blockchain infrastructure stays small and never justifies the development effort. Maybe most applications decide centralized solutions work fine and decentralized infrastructure remains niche forever.

But watching Vanar ship products while other launches argue about speed makes me think about positioning. Sometimes what you claim matters less than what you deliver when someone needs it.

The products exist. They either solve problems or they don't. And for now, that seems enough for Vanar Chain to keep building regardless of whether markets validate the approach or VANRY price reflects the work.