The crypto market is currently ruled by "fear". Those who dream of $300,000 Bitcoin by tomorrow, today those who are afraid are warning of $50,000. The market always hits "hopes" and rewards those who follow "cold strategies".

1. The Standard Chartered Flip: From $300K to $50K?

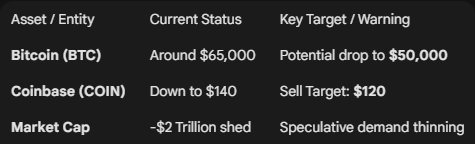

Standard Chartered Bank, which until recently had been eyeing Bitcoin at $300,000, has lowered its target to $100,000. Their new warning signal is that Bitcoin could “bleed” to $50,000 before stabilizing.

The Logic: Momentum traders have exited the market and macro conditions (inflation and rates) are not yet in crypto’s favor. Bitcoin has fallen 45% from its October high ($126,000+).

2. Novogratz: "The Buying Stopped"

Michael Novogratz, head of Galaxy Digital, made a stark statement in New York. He said that when Bitcoin crossed the psychological level of $100,000, it was ETF buyers who stopped “big sellers.”

“Once the buying stops, it doesn’t take much selling to push it back in the other direction.”

That is, the market was running out of liquidity and sellers suddenly flushed out “leverage.”

3. Coinbase: The "Sell" Signal and Technical Glitches

Coinbase Global Inc. is not doing well. Analysts have given Coinbase a “sell” rating and cut their price target by 68% to $120.

Financial setback: Coinbase had high hopes for Q4 revenue, but reports show an 80% year-over-year decline.

Technical mess: Trading and transfers on Coinbase suffered an “outage” on Thursday. The exchange said its “funds are safe,” but the exchange’s exposure to such volatility erodes investor confidence.

4. Tactical Takeaway: Strategy over Sentiment

As we discussed earlier, markets are not emotional, they are logs. What is happening now is the same “several nights” we mentioned.

Don’t catch the falling knife: When a bank like Standard Chartered is talking $50k, it is better to wait for DCA levels (support zones) than “blind buying”.

Watch the volume: Until buying volume returns, every “bounce” can be a trap.