There’s a moment most stablecoin users don’t talk about.

You’re helping someone send USDT for the first time. Maybe it’s a freelancer. Maybe a friend. Maybe someone in a region where stablecoins are already everyday money. They open the wallet, enter the address, hit send — and the transaction fails.

“Insufficient gas.”

You then have to explain that even though they’re holding digital dollars, they also need a different token just to move those dollars. That explanation is where the embarrassment creeps in. It sounds irrational because, outside crypto, it is.

Plasma feels like it’s built around removing that explanation.

Money Shouldn’t Require a Footnote

In mature financial systems, payments don’t come with disclaimers. You don’t need to preload a separate asset to make your bank transfer function. You don’t check a congestion meter before sending rent. The system absorbs that complexity so users don’t have to.

Stablecoins solved volatility. They didn’t solve awkwardness.

Plasma’s stablecoin-first design suggests that if stablecoins are already behaving like digital dollars, then the infrastructure beneath them should behave like payment rails — not like experimental networks where users manage internal economics.

Letting fees be paid in stablecoins, and removing them entirely for basic transfers, isn’t about being cheaper. It’s about removing the moment where someone has to ask, “Wait, why do I need that?”

That question is small. But it breaks confidence.

Finality as Relief, Not a Metric

Another quiet friction point in crypto is the pause after pressing send. You watch confirmations. You refresh. You wait for enough blocks to feel safe. For traders, this is normal. For businesses, it’s inefficiency disguised as caution.

Plasma’s emphasis on fast, deterministic finality reframes this entirely. The value isn’t sub-second settlement for its own sake. It’s the ability to stop thinking about the transaction immediately after it’s initiated.

In payments, closure matters more than speed.

When a transaction is final in a way that doesn’t invite second-guessing, workflows tighten. Reconciliation becomes procedural. Internal policies simplify. It’s not dramatic, but it compounds.

Infrastructure That Stays Out of the Way

One of the more interesting aspects of Plasma is what it doesn’t try to do. It doesn’t attempt to reinvent developer tooling. By staying EVM-compatible, it inherits habits developers already have. That choice signals something subtle: the goal isn’t to build a new culture. It’s to support an existing one.

Infrastructure that demands cultural change struggles to scale. Infrastructure that fits into existing workflows spreads quietly.

Plasma seems comfortable being the latter.

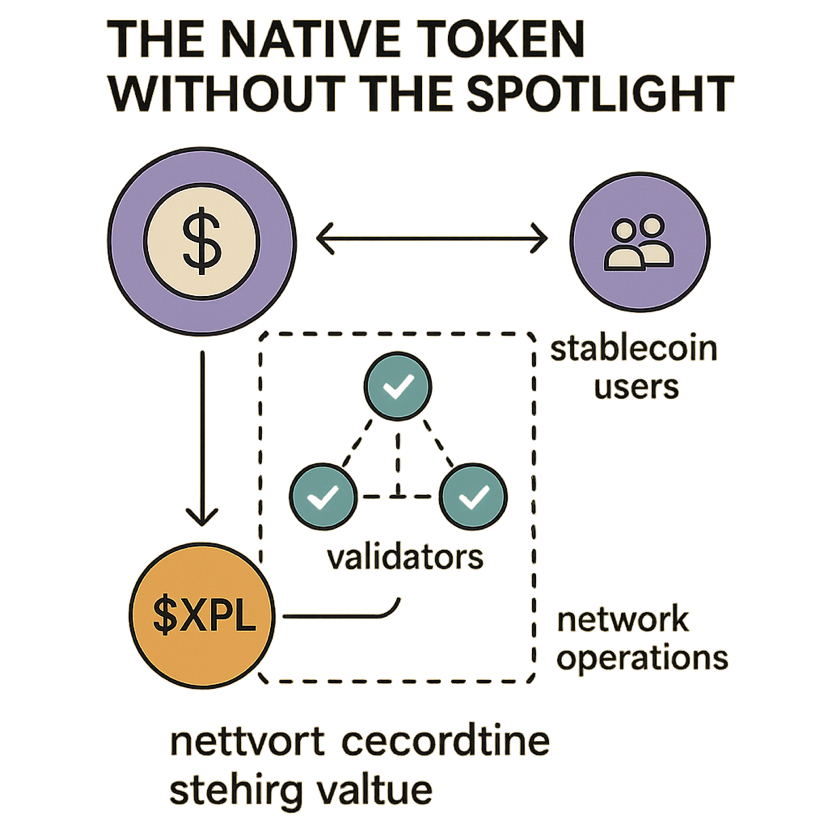

The Native Token Without the Spotlight

In a network centered on stablecoins, the native token naturally recedes from daily user behavior. $XPL coordinates validators and secures the chain, but it isn’t forced into every interaction. Users move stable value. The network handles its internal economics in the background.

That separation mirrors traditional systems more than most crypto ecosystems do. Settlement layers aren’t supposed to be the star of the show. They’re supposed to function.

Restraint shows up again here.

The Kind of Growth That Doesn’t Trend

Plasma doesn’t look optimized for hype cycles. Its usage patterns lean heavily toward stablecoin transfers rather than speculative bursts. That might appear quiet from the outside, but quiet is often what payment infrastructure looks like before it becomes normal.

If adoption comes, it likely won’t feel explosive. It will feel gradual. Integrations compound. Workflows settle. Users stop noticing the chain itself.

And that might be the point.

The Real Test

None of this removes the real questions. Gas sponsorship must remain sustainable. Governance decisions must stay transparent. Claims of neutrality only matter under pressure. Payment systems are tested in stress, not in calm periods.

Plasma’s design suggests it understands those stakes. Whether it can maintain discipline as usage grows will determine if this quiet approach holds.

What makes Plasma interesting isn’t that it promises to revolutionize money. It’s that it seems intent on removing the small embarrassments and hesitations that still cling to stablecoins.

If sending digital dollars ever feels completely uneventful, we probably won’t celebrate the chain that made it happen.

We’ll just stop needing explanations.