There’s a strange pressure in crypto that nobody talks about openly.

The moment a project proves it can build, the market demands that it builds everything.

More verticals. More integrations. More narratives. More announcements.

And I’m starting to think Vanar’s biggest test isn’t technology — it’s restraint.

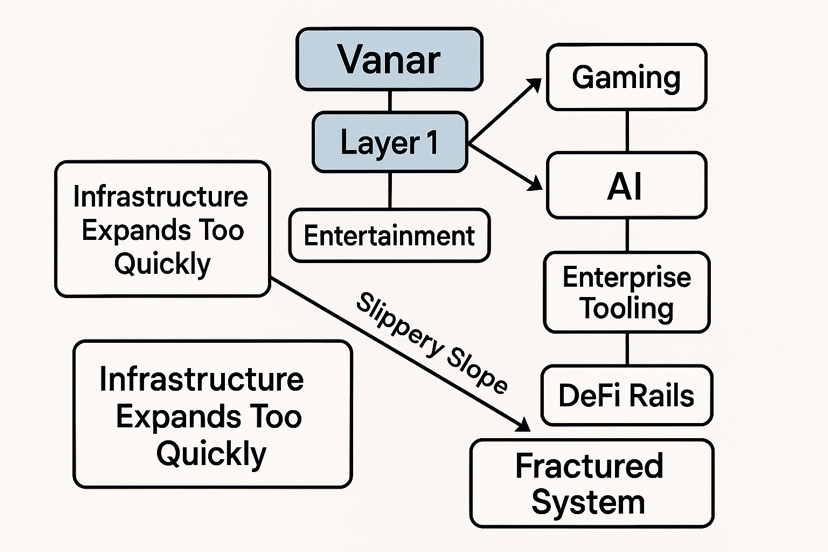

Because once you have an operational Layer 1, live products like Virtua, an ecosystem forming around VANRY, and infrastructure pieces like Neutron in place, expansion becomes dangerously tempting. Gaming? Expand into AI. AI? Expand into enterprise tooling. Enterprise? Expand into DeFi rails. The slope is slippery.

But infrastructure that expands too quickly usually fractures under its own ambition.

Vanar positions itself around entertainment and digital culture. That sounds broad, but it’s actually a constraint. Entertainment has very specific requirements: low latency, cost predictability, seamless onboarding, consistent UX. If you compromise any of those while chasing adjacent markets, the core promise weakens.

Most chains don’t fail because they lack capability.

They fail because they dilute focus.

When I look at Vanar, I don’t see a chain trying to be everything. I see one trying to optimize for a narrow experience: consumer-facing digital environments that don’t feel like crypto.

That optimization requires trade-offs.

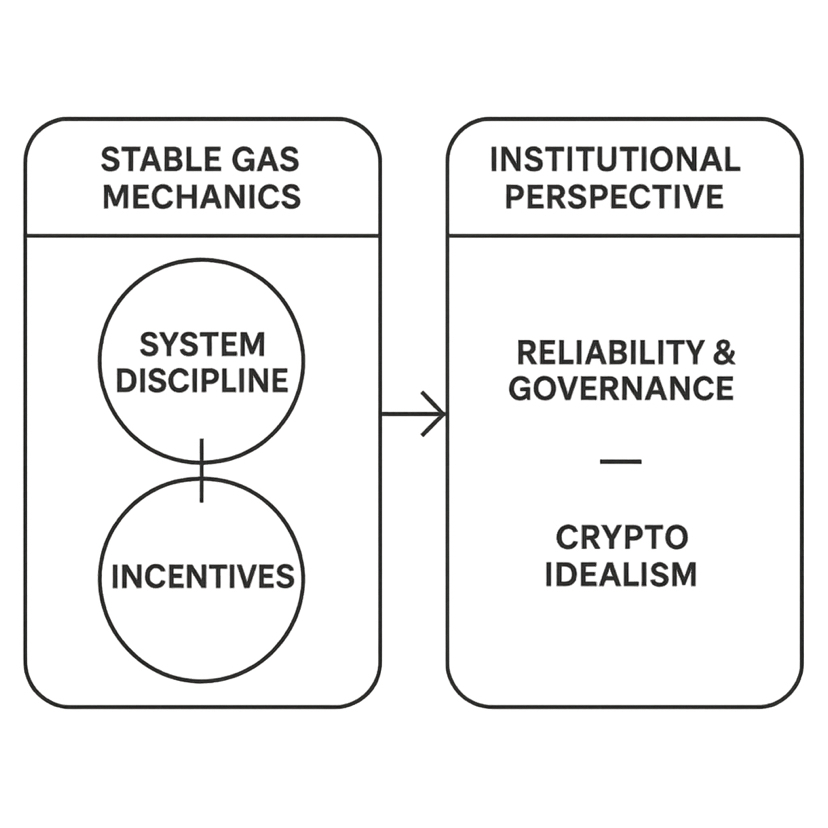

For example, stable gas mechanics sound simple. They aren’t. You’re effectively choosing system discipline over reactive market pricing. That means saying no to certain high-frequency behaviors that could inflate activity metrics short term. It also means designing validator incentives carefully so economic alignment doesn’t drift.

That’s not flashy. It’s structural.

The institutional angle makes this even clearer. Brands, gaming studios, and large digital platforms don’t care about ideological decentralization debates. They care about reliability and governance clarity. They want to know who to call when something breaks. They want escalation paths.

That’s uncomfortable territory for pure crypto idealists. But it’s realistic territory for mainstream adoption.

If Vanar leans fully into that lane, it can’t afford chaotic expansion. Every new vertical adds operational complexity. Every added narrative shifts focus from the core problem: making blockchain invisible inside entertainment systems.

Neutron compression? Useful — but only if it serves that core thesis.

AI integration? Relevant — but only if it enhances user-owned digital environments, not distracts from them.

VANRY incentives? Powerful — but only if they reinforce long-term ecosystem alignment rather than short-term speculation loops.

The real tension ahead isn’t technical scaling.

It’s narrative scaling.

The crypto market constantly tries to pull projects into trend cycles. Today it’s AI infrastructure. Tomorrow it’s RWAs. Then something else. If Vanar jumps at every wave, it risks becoming indistinguishable from chains it’s quietly trying not to resemble.

But if it stays focused — almost stubbornly — it could carve out something rarer: a specialized Layer 1 that doesn’t apologize for being opinionated about its domain.

That’s harder than expanding.

Because growth metrics reward breadth.

Longevity rewards depth.

Right now, Vanar sits at that fork.

Expand aggressively and chase attention — or deepen the entertainment stack until it becomes difficult to replace.

Most projects choose the first path.

The second one requires patience the market rarely celebrates.

And that’s probably the real bet unfolding here.