Bitcoin prices have been falling and are on track for a four-day losing streak. The drop comes as investors react to strong U.S. economic data, which suggests interest rates may stay high for longer. Higher interest rates often reduce demand for risky assets like cryptocurrencies.

Why Interest Rates Matter

A strong U.S. jobs report showed the economy remains resilient. This reduces the chances of the Federal Reserve cutting rates soon. When borrowing costs stay high, investors tend to move money away from crypto and into safer assets, putting pressure on Bitcoin’s price.

Market Signals Show Caution

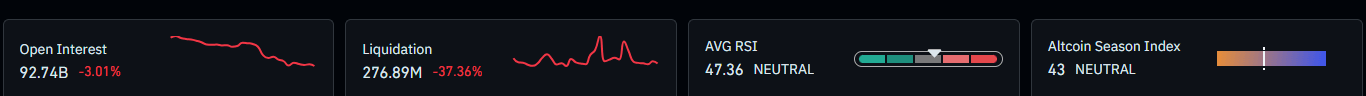

Analysts say the overall crypto market is moving sideways with limited momentum. Bitcoin ETFs have also seen large outflows, and trading activity in derivatives markets has slowed. These signs suggest investors are uncertain about short-term price direction.

Could Bitcoin Fall Further?

Some analysts warn Bitcoin could drop toward $50,000 in the coming months if selling pressure continues. Many ETF investors are currently holding unrealized losses, which may increase the chance of more selling instead of buying dips.

Mixed Performance Across Crypto

While Bitcoin and Ethereum declined, some altcoins moved differently. This shows the market is still range-bound, with no clear trend.

What Traders Should Know

Crypto prices don’t move in isolation, global economic news matters. Interest rates, inflation data, and investor sentiment all influence Bitcoin’s direction. Understanding these factors helps explain why prices rise or fall.