Vanar keeps getting priced like a generic L1 because people are still grading it on the wrong axis. The real question is not whether Vanar can out feature other chains. The real question is whether Virtua Metaverse and the VGN Games Network can keep pulling mainstream users through curated surfaces, then quietly turn that attention into sustained on-chain demand that routes through the VANRY token. If that sounds like a small framing change, it is not. It flips the entire direction of causality. Most chains hope developers discover demand. Vanar is trying to manufacture demand first, then use the chain as the settlement layer that makes the consumer loop repeatable.

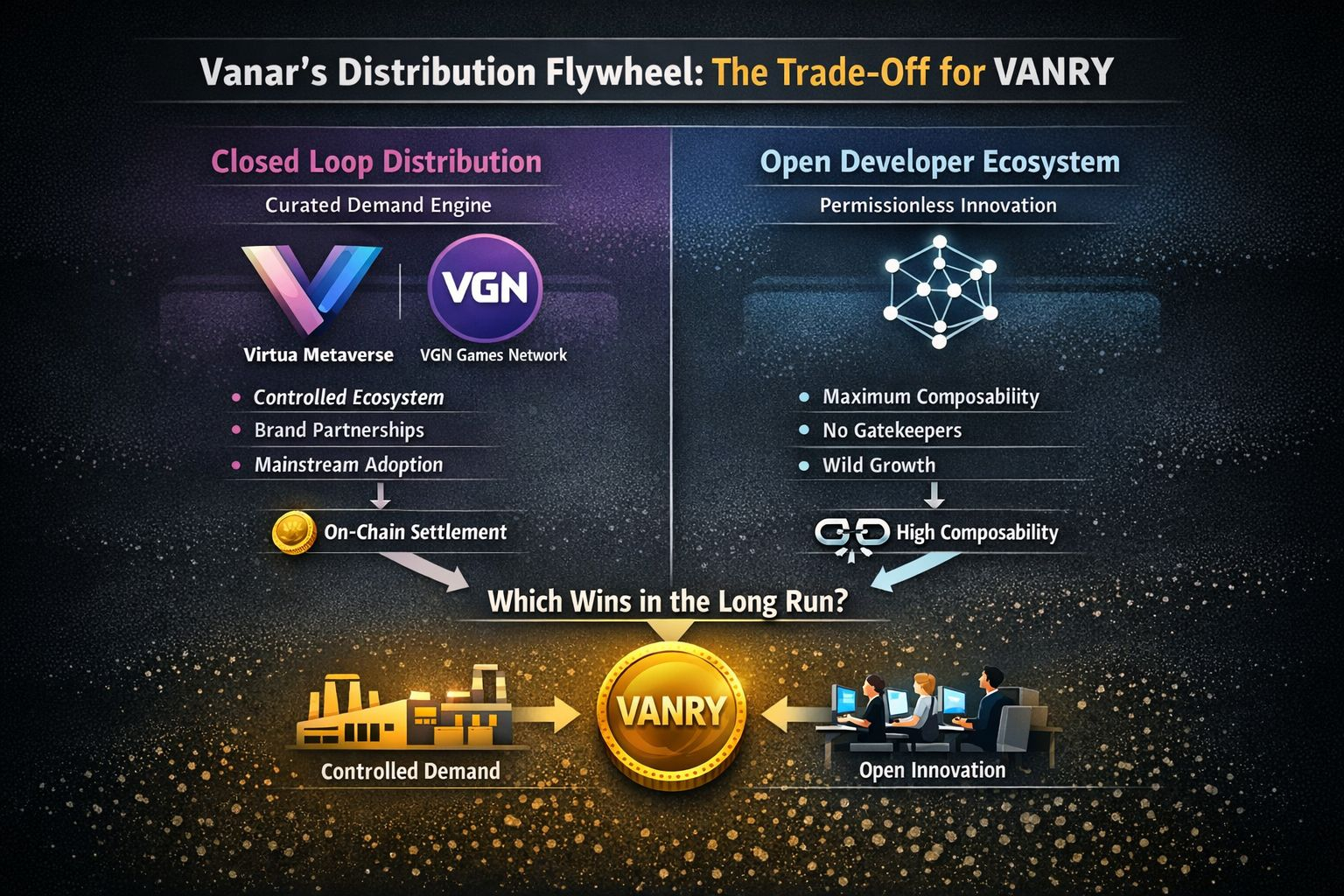

The moment you treat Virtua and VGN as distribution surfaces rather than just ecosystem apps, the usual L1 playbook stops explaining what matters. A chain-first ecosystem wants open composability because it is the fastest path to unpredictable innovation. A distribution-first ecosystem wants predictability because it is the fastest path to shipping something a brand will not regret. Those are not compatible defaults. Vanar sits inside that conflict by design, because its public identity is a blockchain, but its practical route to scale runs through entertainment, gaming, and brand relationships that typically require guardrails.

This is why the common summary of Vanar, the one that reads like a menu of verticals, misses the mechanism. Gaming, metaverse, AI, eco, brand solutions. That list does not explain why this chain exists. The mechanism is that Virtua and VGN can function like a captive demand loop. Users arrive for a product, not for a chain. Digital items and participation are packaged so the user experience stays coherent. The on-chain layer becomes the backstage system that makes ownership, transfer, and persistence possible without asking the user to become a crypto native. In that world, Vanar does not need to win the broad developer mindshare contest to generate activity. It needs its distribution surfaces to keep shipping consumer moments that create reasons for transactions to exist.

The part that makes this interesting is also the part that can break it. Brand grade curation and compliance are not optional add-ons in entertainment. They are the cost of admission. If Virtua and VGN succeed at onboarding mainstream partners, the pipeline will naturally pull Vanar toward controlled standards. That can show up as tighter integration requirements, more opinionated marketplace behavior, and fewer sharp edges that would be normal in a purely permissionless environment. I am not stating that as a moral judgment or a marketing positive. It is just what happens when rights holders and consumer expectations set the rules. The chain can still be fast and cheap and technically elegant, but the more it optimizes for brand comfort, the more it risks flattening the permissionless composability that open ecosystems use to grow.

That is the trade most people are not pricing. If Vanar leans hard into the closed loop, it can build a defensible consumer economy that does not depend on mercenary incentives. Activity becomes attached to products people already want, and those products can keep iterating because they are not trying to satisfy every edge case of the broader crypto world. The downside is that the ecosystem may never feel like a wild garden where anyone can graft anything onto anything. It may feel more like a curated mall with a very clean back office. That is not automatically worse, but it changes what kind of network effect you can expect. Open developer network effects expand through permissionless remixing. Closed loop consumer network effects expand through distribution, partnerships, and repeatable user behavior.

VANRY sits right in the middle of this. In an open composable world, the token often gets framed as neutral infrastructure gas, a commodity that rides on general activity. In a closed loop distribution world, the token’s role can become closer to a settlement unit inside a designed economy. That can be more durable than pure speculative throughput if the consumer loop is real, because the value flow is attached to repeated behavior rather than episodic hype. But it also raises a hard question about value capture. If the system is optimized to make the experience feel frictionless for users and acceptable for enterprises, the design pressure tends to compress visible costs. That is good for adoption and potentially bad for simplistic token narratives. The token has to earn its place as the bridge between consumer actions and on-chain finality, not as a story told around generic network usage.

This is where my own judgment sharpens. I think Vanar’s biggest risk is not competition. It is indecision. If Vanar tries to signal full permissionless ambition while simultaneously building for brand grade constraints, it will end up with mixed defaults that slow both sides. Brands do not want ambiguity, because ambiguity becomes headline risk. Open crypto builders do not want ambiguity either, because ambiguity becomes integration risk. A chain that wants to be a neutral base layer has to tolerate chaos. A chain that wants to be a brand safe rail has to reduce it. Vanar has to pick which friction it is willing to absorb and which friction it will push onto others. If it does not, the market will keep treating it like a generic L1, because the only visible identity will be the least distinctive one.

The most misunderstood part of this whole strategy is that closed loop does not mean small. Closed loop means controlled. A distribution surface can reach very large numbers if it keeps shipping culturally legible products and keeps the user experience stable. The scaling problem is different. It is not about attracting every developer. It is about repeatedly converting attention into on-chain actions without breaking the expectations of mainstream users and partners. Virtua and VGN are the reason this path is even plausible for Vanar. Without those surfaces, the thesis collapses into a normal chain narrative. With them, Vanar can pursue a form of scale that looks boring from a crypto angle and powerful from a consumer angle.

So what would falsify the thesis in a way that matters. Not price action. Not a temporary spike in transactions. The failure mode is a flywheel that spins only inside its own walls. Virtua and VGN keep producing activity, but third parties do not build around it because the constraints are too heavy or the standards are too specific. The on-chain economy becomes internally busy and externally thin. In that world, Vanar functions like an application chain for its own surfaces, whether or not it calls itself that. The market will eventually price it that way. The success mode is different. The success mode is that external teams accept the constraints because the distribution is worth it. They would rather integrate into a curated environment with real users than deploy into a permissionless void with no reliable demand. That is the moment where closed loop starts to behave like an ecosystem rather than a set of products.

If you want a practical way to read Vanar going forward, stop tracking the usual L1 vanity metrics in isolation. Watch whether Virtua Metaverse and VGN Games Network keep generating repeatable consumer actions that look like normal digital behavior rather than crypto behavior. Watch whether those actions create on-chain patterns that persist when incentives are absent. Watch whether third party integrations appear that are clearly motivated by access to that distribution rather than by short term grants. If those things happen, then the composability ceiling is not a fatal flaw. It becomes the price Vanar pays to keep the loop clean enough for brands and smooth enough for users. If those things do not happen, then the ceiling becomes the whole story.

Vanar is not trying to win the argument that every chain fights about who has the best architecture. It is trying to win a different argument. It is trying to prove that controlled distribution can outscale open developer ideology, and that a curated consumer pipeline can produce on-chain demand that does not evaporate the moment the market gets quiet. If that proof shows up, it will not arrive as a dramatic breakthrough. It will arrive as a pattern that repeats, product after product, partner after partner, where the chain does its job and stays out of the way. That is the only version of Vanar that deserves to be priced as something other than a generic L1