Market participants often look for the next trend by watching what developers build, but a more subtle signal lies in how those developers manage their data over time. In current liquidity conditions, the most resilient assets are those shifting from purely speculative trading toward utility driven consumption models. We are seeing a pattern where networks that provide a "service" rather than just "space" tend to retain value more effectively during volatility. When a protocol integrates memory and intelligence directly into its foundation, it changes the way liquidity moves; capital isn't just parked in a vault, it is actively used to power computation and store knowledge.

The Shift to Intellectual Infrastructure

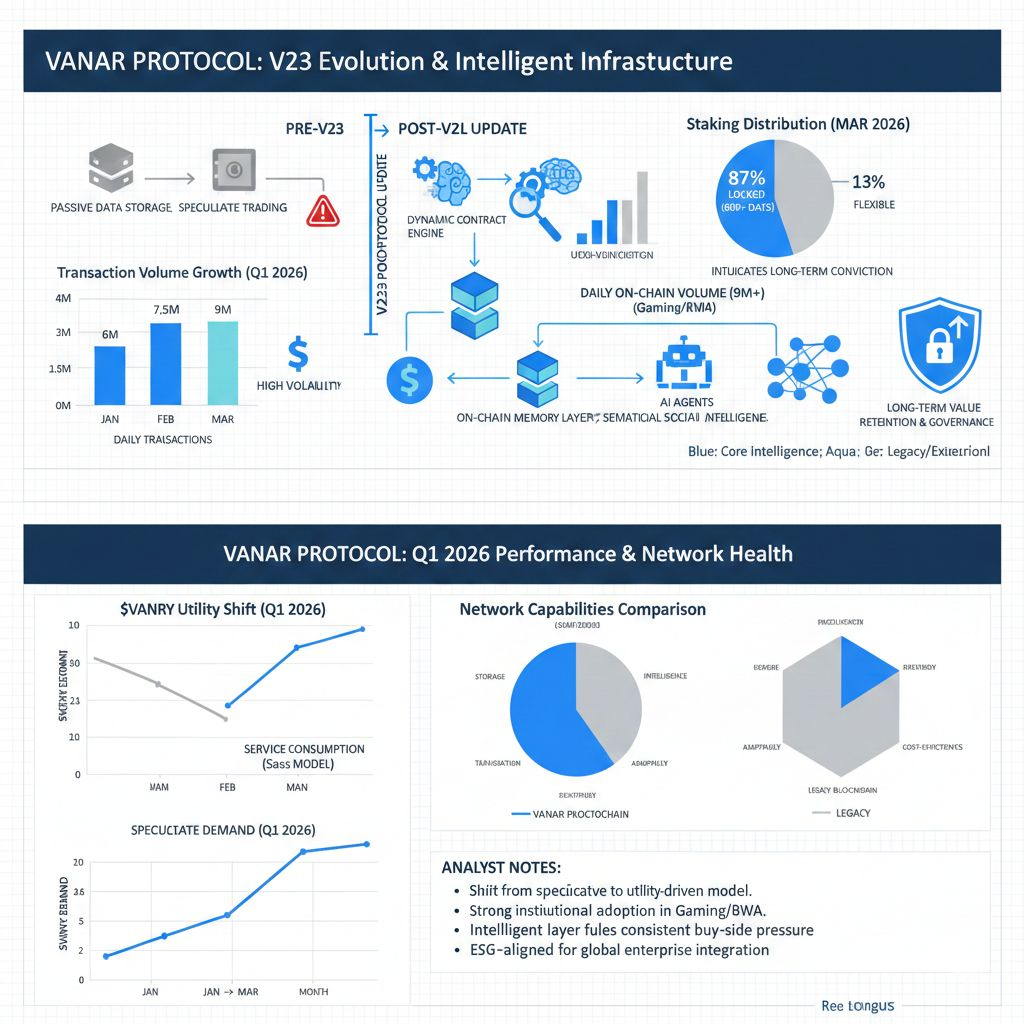

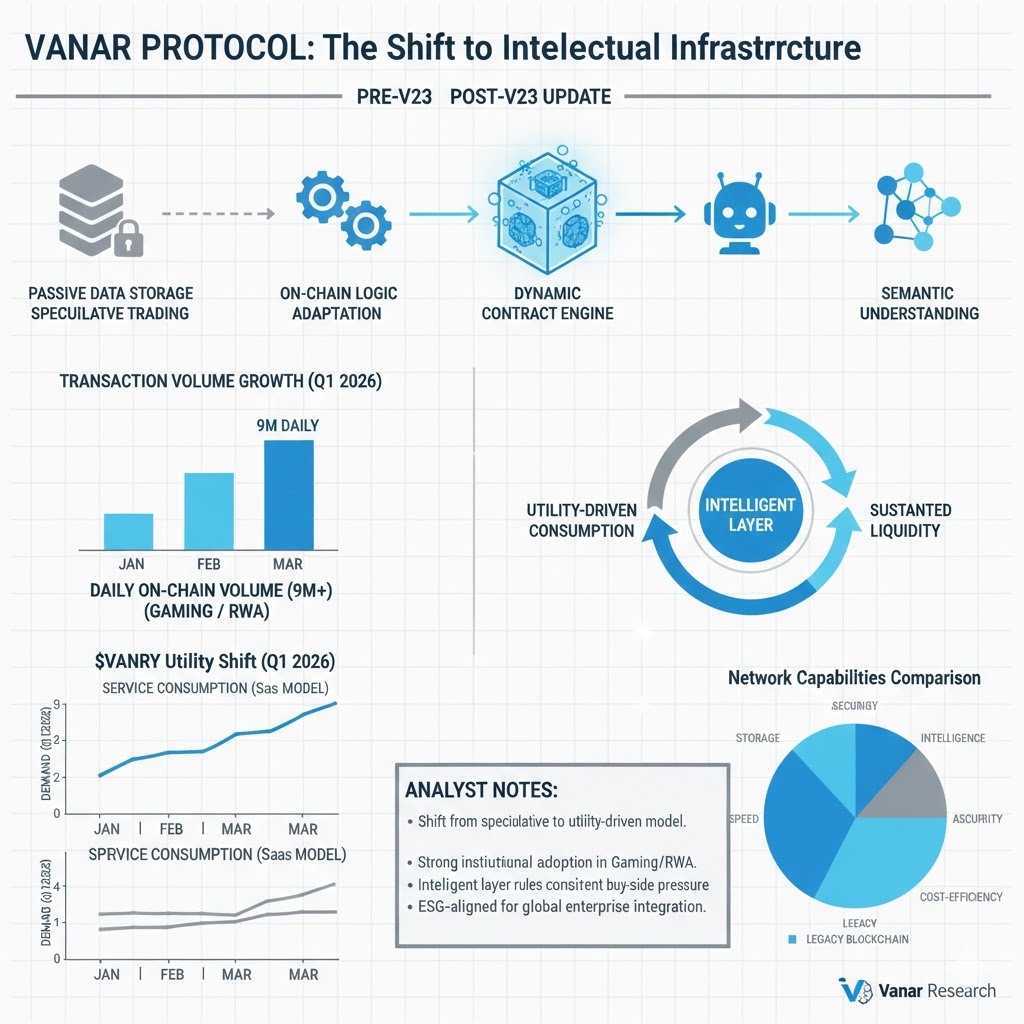

The move from passive storage to active reasoning is visible in the recent implementation of the V23 protocol. This update introduced a dynamic contract engine that allows for on-chain logic to adapt without the friction of redeploying entire systems. According to data from early 2026, the average on-chain transaction volume has climbed to over 9 million daily interactions, driven largely by automated processes in the gaming and RWA sectors. This isn't just noise; it represents a structural shift toward @Vanarchain being an "intelligent layer" where transactions are governed by semantic understanding. If a network can understand the context of a payment before it executes, does the concept of a "dumb" transaction become obsolete?

"The true value of a network isn't measured in how fast it moves, but in how much of the world's complexity it can reliably remember."

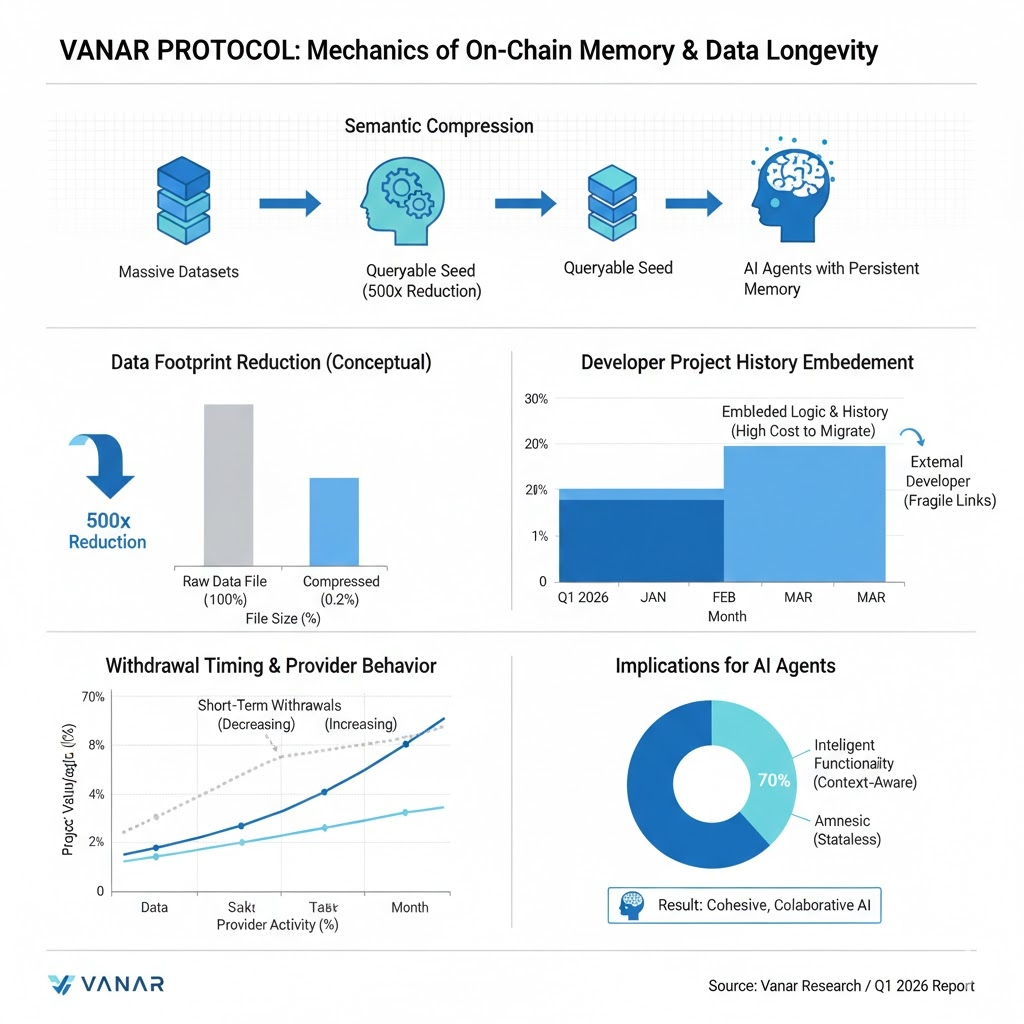

Mechanics of On-Chain Memory

In this environment, the way we handle data density determines the longevity of a project. Instead of relying on fragile external links, tools like #Vanar use semantic compression to turn massive datasets into queryable seeds. By reducing the footprint of a file sometimes by up to 500 times while keeping its meaning intact, the chain ensures that AI agents can function without "amnesia." This mechanism directly affects withdrawal timing and provider behavior; when a developer’s project history and logic are deeply embedded in the state of the chain, the cost of moving to a different ecosystem becomes significantly higher.

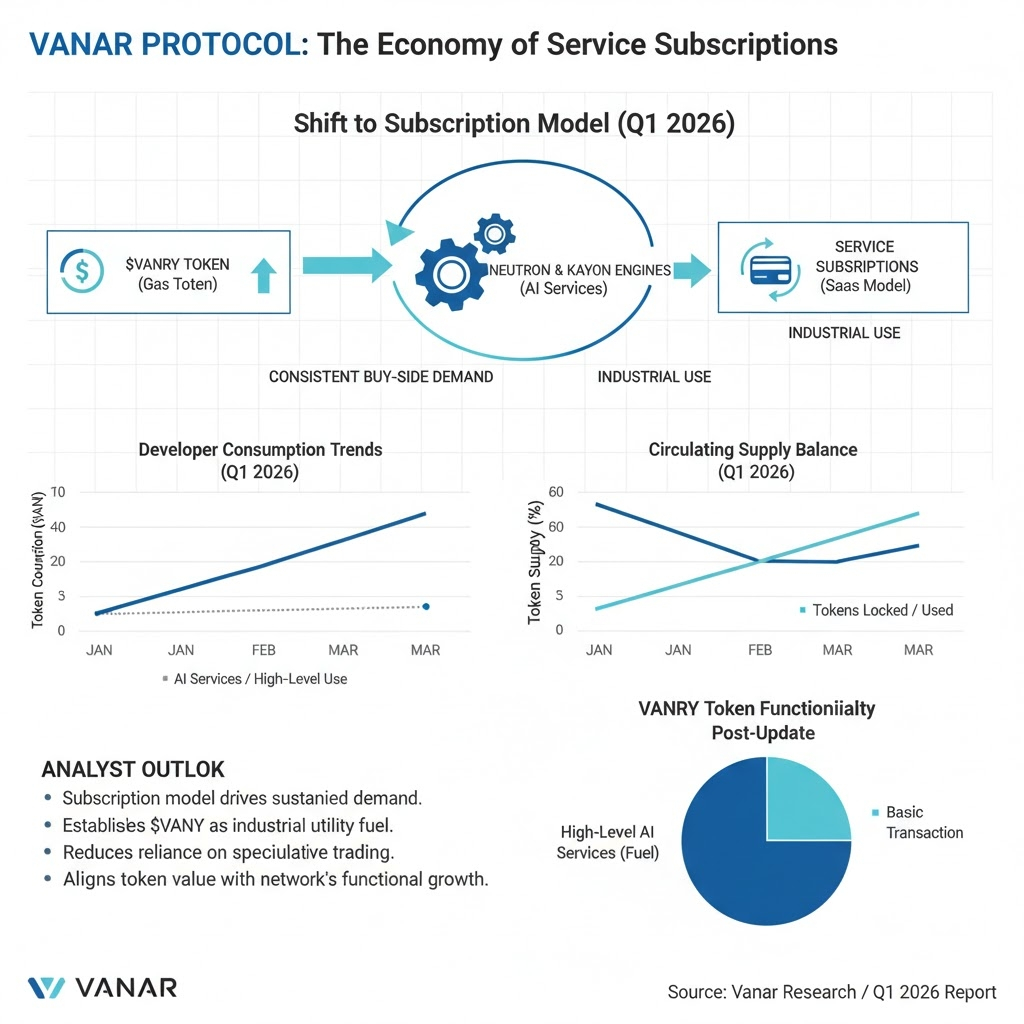

The Economy of Service Subscriptions

Beginning in the first quarter of 2026, the transition to a subscription based model has started to redefine $VANRY from a simple gas token into a requisite fuel for high-level AI services. Developers now consume the token to access the Neutron and Kayon engines, creating a consistent buy-side demand that mirrors traditional software-as-a-service (SaaS) structures. This shift ensures that the token's circulating supply is constantly being balanced by actual industrial use. It moves the focus away from the "impossible triangle" of blockchain and toward a feasible reality where storage, intelligence, and speed coexist.

"When your infrastructure begins to think, the tokens that power it stop being just currency and start being the electricity for global intelligence."

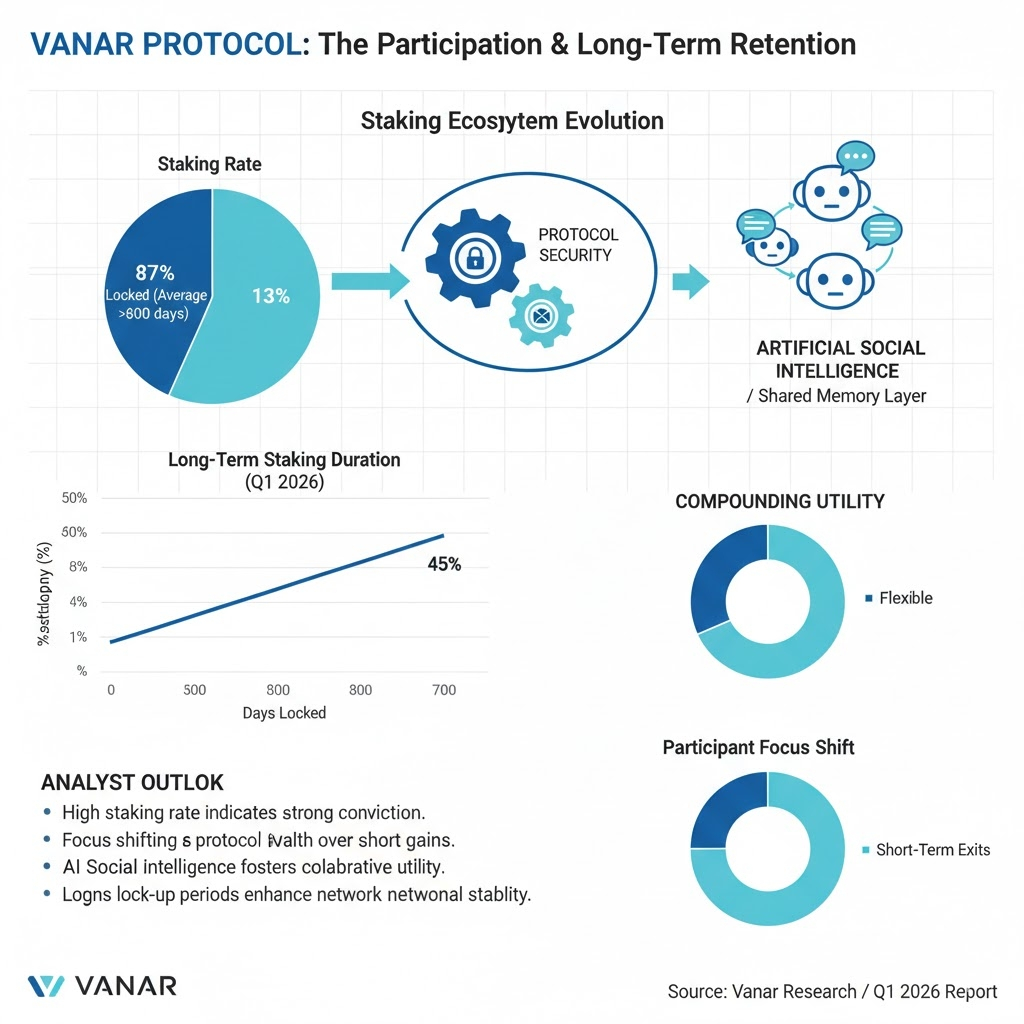

Participation and Long-Term Retention

Practical implications for contributors are becoming clearer as the staking ecosystem matures. Recent reports show a staking rate near 87%, with a significant portion of participants locking their positions for over 600 days. This indicates a preference for protocol security and governance over short-term exits. For the person contributing to the network, the focus has moved to how these AI agents interact with each other a concept often called "Artificial Social Intelligence." It allows different agents to plan and collaborate using the same shared memory layer, creating a compounding effect of utility.

Bridging the Gap to Reality

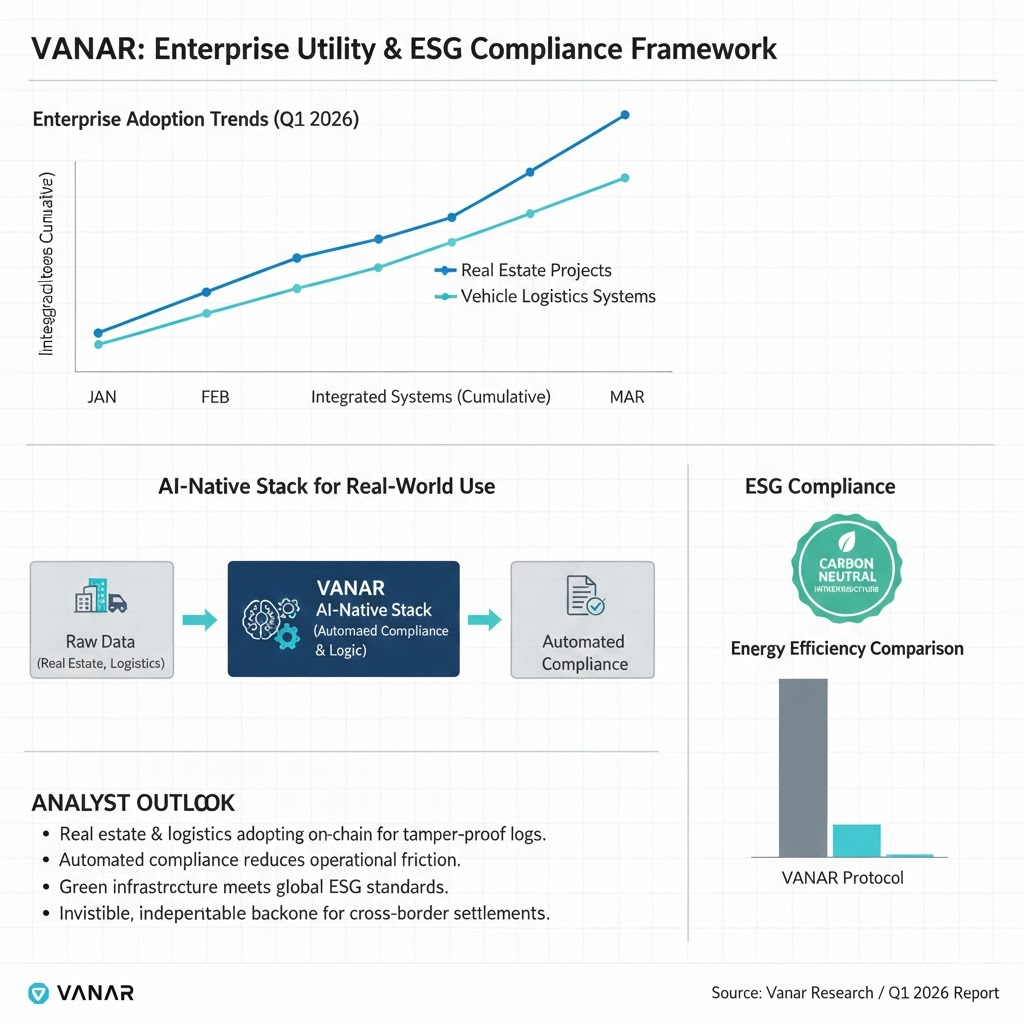

The convergence of AI and blockchain is no longer a theoretical exercise but a requirement for modern enterprise adoption. We are seeing real estate projects and vehicle logistics systems move on-chain because they need the tamper-proof logs and automated compliance that only an AI-native stack can provide. This isn't about making the chain flashy; it is about making it invisible and indispensable. As these systems become the backbone of cross-border settlements, the importance of a green, carbon-neutral infrastructure becomes the deciding factor for global brands looking to meet ESG standards.

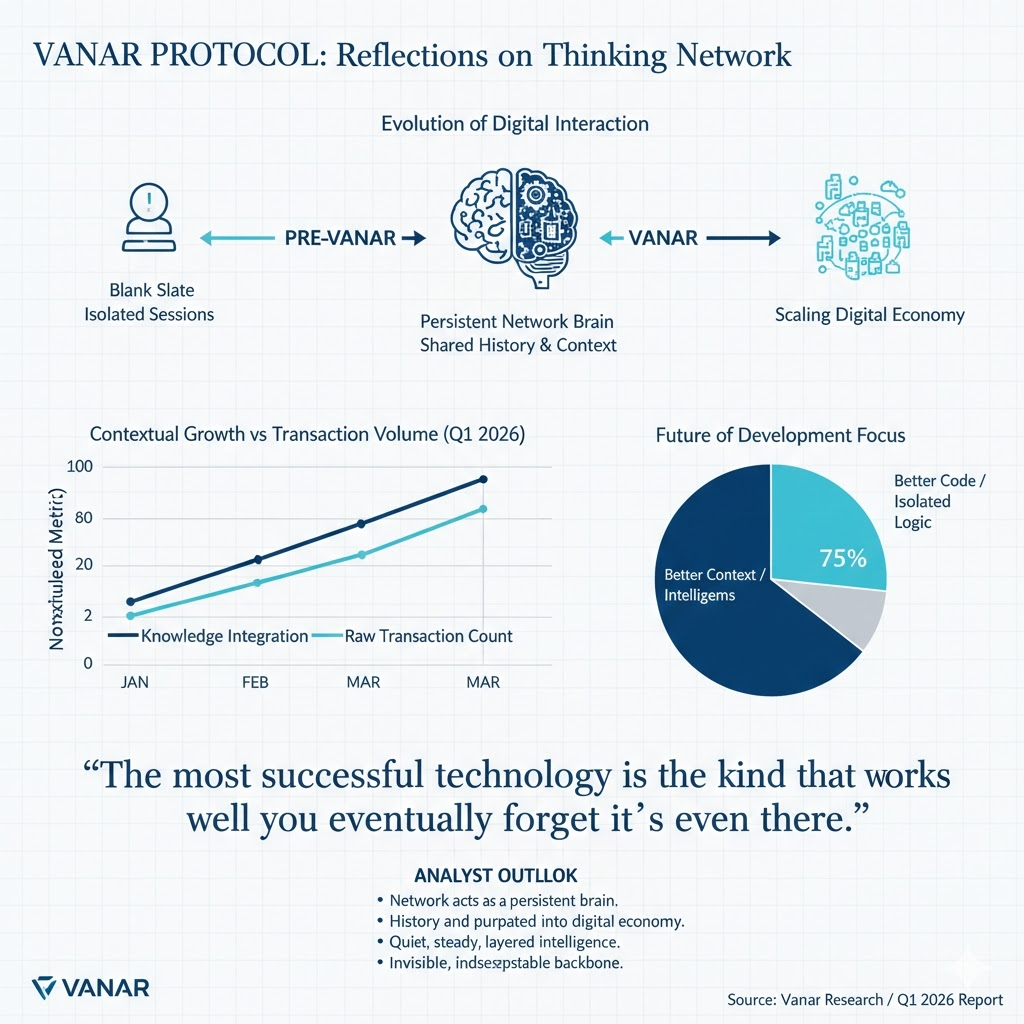

"The most successful technology is the kind that works so well you eventually forget it's even there."

Reflections on a Thinking Network

The evolution of these tools suggests that the future of development isn't just about better code, but about better context. We have moved past the era of isolated sessions where every interaction started from a blank slate. Now, the network itself acts as a persistent brain, holding the blueprints of our previous successes and failures. This level of integration ensures that as the digital economy scales, it does so with a sense of history and purpose. It remains a quiet, steady process of building layer upon layer of intelligence.