Governments are increasingly inserting themselves into the cryptocurrency space—not as distant regulators peering over the fence, but as active participants, rule-makers, and even direct owners. In the United States, the Trump administration's 2025 executive orders established a Strategic Bitcoin Reserve (initially built from seized assets, with broader ambitions discussed) and pushed forward the GENIUS Act for stablecoin oversight. Similar moves are happening globally: the EU's MiCA framework has been fully operational since late 2024, China maintains its digital yuan while suppressing private crypto, and emerging markets experiment with CBDCs to modernize payments or combat dollar dominance. The question isn't whether governments will get involved—they already are—but why they feel compelled to do so, what genuine advantages this brings, and where the deep structural downsides lie. The reasoning behind government involvement is rarely about embracing decentralization; it's almost always about preserving or extending existing power structures in a rapidly digitizing financial world.

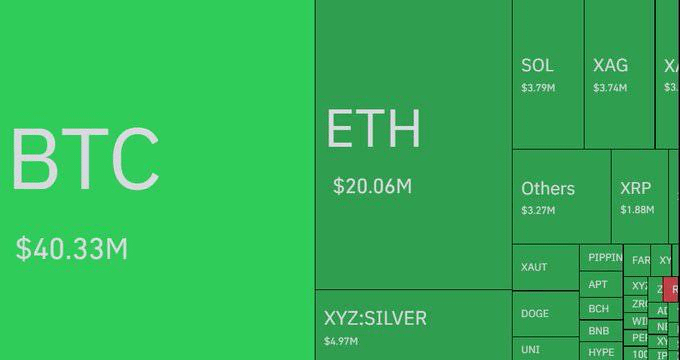

First, financial stability and systemic risk management dominate the calculus. Crypto's total market cap has swung from over $4 trillion in late 2025 peaks to roughly $2.3 trillion amid recent deleveraging. Unregulated leverage, opaque stablecoins, and interconnected failures (FTX in 2022, cascading liquidations in 2026) have repeatedly shown how crypto can spill into traditional finance. When exchanges fail or stablecoins de-peg, retail investors suffer, confidence in payment systems erodes, and in extreme cases, banks with crypto exposure face runs. Governments intervene because they bear the political and economic cost of cleanup—bailouts, lost tax revenue, or eroded public trust. The GENIUS Act's reserve and audit requirements for stablecoin issuers reflect this: by mandating 1:1 backing with high-quality assets (cash or short-term Treasuries), regulators aim to prevent runs and protect the "singleness of money"—the idea that one dollar should equal one dollar everywhere, without private issuers introducing credit or liquidity risk.

Second, monetary sovereignty and geopolitical leverage are core drivers. The U.S. dollar's global reserve status allows cheap borrowing, sanctions enforcement, and influence over international finance. Private stablecoins (especially offshore ones like Tether) and foreign CBDCs threaten this by offering dollar-denominated alternatives without U.S. oversight. A Strategic Bitcoin Reserve, even if initially modest, serves as a hedge: Bitcoin's fixed 21 million supply makes it a potential "digital gold" counterweight to fiat inflation or devaluation. More broadly, governments pursue CBDCs to retain control over money supply and payment rails in a world where private digital money could bypass central banks entirely. The Fed's repeated emphasis on a CBDC being "risk-free" (no credit or liquidity risk to users) underscores the fear that non-government digital dollars could fragment monetary policy transmission.

Third, crime prevention and revenue capture play a practical role. Crypto's pseudonymity has facilitated ransomware, laundering, and sanctions evasion. Traceable blockchains combined with KYC/AML obligations turn this weakness into a strength for enforcement. Meanwhile, massive taxable events (capital gains, trading fees) represent untapped revenue; clear rules ensure governments collect their share without driving activity fully underground. These motivations are not abstract—they reflect real trade-offs between innovation and control.

Advantages: Where Government Involvement Can Add Real Value

When executed thoughtfully, government action brings structure to a space that has repeatedly proven chaotic.

Consumer and systemic protection becomes far more robust. The GENIUS Act's requirements for 100% reserves, regular audits, and restricted issuer activities reduce the risk of stablecoin de-pegs or runs that could cascade into broader markets. This isn't trivial: stablecoins now underpin much of crypto trading and cross-border payments. Clear rules also lower entry barriers for institutions—banks can custody or partner with compliant issuers without fear of regulatory backlash, potentially increasing liquidity and reducing volatility over time.

Payment efficiency and inclusion improve. A well-designed CBDC or regulated stablecoin ecosystem enables instant, low-cost transfers—especially valuable for remittances (which cost 6–7% on average via traditional rails). For the unbanked or underbanked, government-backed digital money offers access without credit risk or predatory fees. In emerging economies, this can discipline fiscal policy and reduce reliance on dollarized systems.

Geopolitical and fiscal hedging becomes possible. A Bitcoin reserve diversifies national assets beyond Treasuries and gold. If Bitcoin appreciates long-term (as many analysts still project despite short-term crashes), it could strengthen fiscal positions without taxpayer-funded purchases. Clearer market structure laws (like the pending Clarity Act) also position the U.S. as a leader in digital finance, attracting talent, capital, and innovation that might otherwise flee to friendlier jurisdictions.

Crime deterrence strengthens without banning innovation. Traceability + compliance obligations make crypto less attractive for illicit finance compared to cash or unregulated offshore vehicles. This preserves the technology's legitimate uses while shrinking its criminal appeal.

Disadvantages: The Deeper Costs and Trade-Offs, The more profound downsides stem from the fact that crypto's core innovation was precisely the removal of trusted intermediaries—including governments.

Privacy erosion is almost inevitable. Any system requiring KYC, transaction monitoring, or central ledger visibility (CBDCs especially) creates surveillance potential far beyond traditional banking. In authoritarian contexts this enables direct financial repression; even in democracies, the chilling effect on legitimate activity (political donations, journalism funding, personal expression) is real. The Fed itself has acknowledged that a retail CBDC could allow real-time visibility into transactions—a feature incompatible with cash's anonymity.

Centralization reintroduces single points of failure. Decentralization's value lies in censorship resistance and no trusted third party. Government rules create chokepoints: licensed issuers, approved wallets, sanctioned addresses. Regulatory capture becomes likely—large players lobby for favorable treatment, squeezing smaller innovators. Offshore evasion persists (Tether's dominance despite U.S. rules), but compliant entities face higher costs, potentially stifling competition.

Innovation migration and opportunity loss. Heavy-handed or uncertain rules drive talent and capital elsewhere. The U.S. saw this during stricter SEC eras; lighter-touch hubs like Singapore and Dubai gained ground. A Bitcoin reserve favoring one asset over others distorts market signals and risks political manipulation (e.g., using holdings to prop prices during downturns). If governments crowd out private stablecoins or DeFi via CBDCs, the experimental space shrinks—exactly what made crypto dynamic.

New systemic vulnerabilities emerge. CBDCs risk bank disintermediation (deposits flee to risk-free central-bank digital cash), triggering credit crunches. Stablecoin frameworks tie issuers to Treasuries, amplifying demand but also linking crypto failures to sovereign debt markets. And politically connected involvement (Trump-family crypto ventures, lobbying ties) raises legitimate concerns about corruption and capture—undermining public trust in both government and crypto.

In the end, government involvement reflects a fundamental tension: crypto's promise was escape from centralized power, yet its scale and spillovers make total escape impossible. The current U.S. path, pro-crypto tilt with strategic reserves, stablecoin rules, and market-structure clarity, seeks to capture upsides (legitimacy, institutional inflows, geopolitical edge) while mitigating downsides (systemic risk, crime). But the deeper question remains unanswered: can you truly regulate something whose essence is non-regulation without fundamentally altering it? The answer, so far, seems to be no.

The wins are tangible and near-term; the costs are structural and long-term. Whether the trade-off is worth it depends on what society values more: safety and scale, or sovereignty and experimentation. For now, we're running the experiment in real time.