For thousands of years, gold was money.

Silver followed closely — transactional, divisible, practical.

Empires rose on metal-backed systems.

Wars were financed by it.

Currencies were anchored to it.

Then came fiat.

And now — Bitcoin.

The real question isn’t which asset is better.

It’s what role each one plays in a world that no longer trusts stability.

Gold: The Original Reserve Asset

Gold doesn’t promise yield.

It doesn’t innovate.

It doesn’t upgrade.

It simply exists.

Scarce. Durable. Globally recognized.

Central banks still accumulate it.

Institutions hold it during uncertainty.

It thrives when confidence in governments weakens.

Gold is not growth.

Gold is protection.

It performs best when:

Real yields fall

Inflation rises

Geopolitical stress increases

Currency debasement accelerates

It is slow, but it is steady.

Gold doesn’t 10x.

It survives centuries.

Silver: The Volatile Cousin

Silver is different.

It’s part monetary metal, part industrial commodity.

Used in:

Solar panels

Electronics

EV components

Medical technology

That dual nature makes silver more volatile.

In bull cycles, it often outperforms gold.

In recessions, industrial demand can weaken it.

Silver behaves like gold with leverage.

It’s not as stable —

but it moves harder.

Bitcoin: Digital Gold or Something Else?

Bitcoin entered the conversation in 2009.

Fixed supply.

Decentralized issuance.

No central authority.

Sound familiar?

Scarcity narrative.

Hedge against debasement.

Sovereign-resistant asset.

Bitcoin mirrors gold philosophically.

But behaviorally?

It trades like a high-beta macro asset.

When liquidity expands → Bitcoin surges.

When liquidity contracts → Bitcoin bleeds.

Gold moves on fear.

Bitcoin moves on liquidity.

That distinction matters.

Ethereum: Not a Store of Value — A Productive Asset

Ethereum doesn’t try to be gold.

It’s infrastructure.

Smart contracts.

DeFi.

Tokenization.

On-chain finance.

ETH behaves more like:

A tech growth asset

A network equity proxy

A risk-on macro instrument

If Bitcoin is digital gold,

Ethereum is digital oil.

Its value comes from usage, not just scarcity.

Scarcity Comparison

Let’s break it down structurally:

Gold

Annual supply inflation ~1–2%

Total supply grows slowly

Physical extraction required

Silver

Higher supply growth

Industrial demand affects availability

Less scarcity premium

Bitcoin

Hard cap: 21 million

Halving every 4 years

Transparent issuance schedule

Ethereum

Dynamic supply

Burn mechanism via EIP-1559

Supply linked to network activity

Bitcoin has absolute scarcity.

Gold has historical scarcity.

ETH has functional scarcity.

Different mechanics. Different narratives.

Volatility vs Stability

Gold:

Low volatility

Defensive

Silver:

Medium to high volatility

Cyclical

Bitcoin:

Extremely volatile

Liquidity-driven

Ethereum:

High beta

Correlated with innovation cycles

If gold is preservation,

Bitcoin is acceleration.

Correlation: Hedge or Risk Asset?

In theory:

Bitcoin should act like gold.

In practice:

It trades more like Nasdaq.

During inflation fears:

Gold often rises steadily.

Bitcoin may surge — or crash — depending on liquidity.

Bitcoin is not yet a pure safe haven.

It is a transitional asset —

between speculative technology and monetary hedge.

That evolution is still ongoing.

The Generational Divide

Older capital trusts gold.

Younger capital trusts code.

Central banks buy gold.

Individuals buy Bitcoin.

Institutions are slowly buying both.

The shift isn’t replacement.

It’s expansion.

Gold doesn’t disappear because Bitcoin exists.

Bitcoin doesn’t fail because gold remains.

They serve different psychological functions.

Gold = trust in history.

Bitcoin = trust in math.

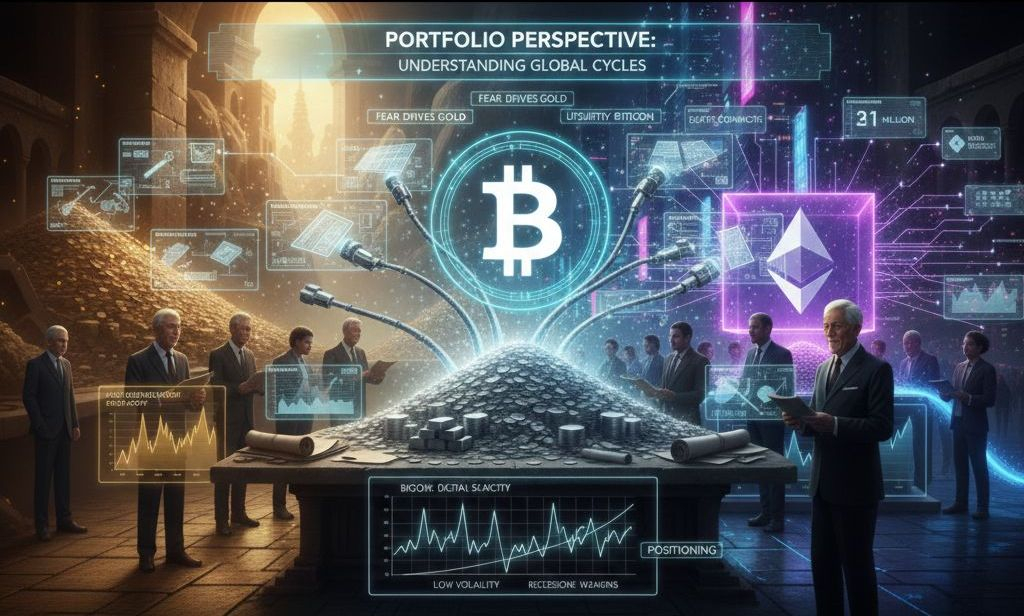

Portfolio Perspective

In macro uncertainty:

Gold stabilizes portfolios.

In expansion cycles:

Bitcoin and Ethereum outperform

Silver becomes a hybrid play —monetary hedge + industrial growth.

The real edge isn’t choosing one.

It’s understanding cycles.

Liquidity drives crypto.

Fear drives gold.

Industrial demand drives silver.

Innovation drives ETH.

The Bigger Picture

We are not witnessing the death of gold.

We are witnessing the digitization of value.

Hard assets are no longer just physical.

Scarcity is no longer just geological.

It can be algorithmic.

But credibility takes time.

Gold earned it over millennia.

Bitcoin is earning it in real time.

Final Thought

Gold protects wealth.

Silver amplifies cycles.

Bitcoin challenges the monetary system.

Ethereum builds the next one.

The future likely doesn’t belong to one asset.

It belongs to those who understand how each one behaves when the global cycle shifts.

Because markets don’t reward ideology.

They reward positioning.

Disclaimer ⚠️

This content is for educational purposes only and does not constitute financial advice. Cryptocurrency trading involves substantial risk. Always do your own research and manage risk responsibly.