Introduction

Public blockchain infrastructure has reached an inflection point. Early networks prioritized security, decentralization, and general-purpose programmability. While these properties remain foundational, they introduced structural trade-offs: limited throughput, fee volatility under congestion, and execution environments that struggle with parallel workloads. As institutional capital, high-frequency trading systems, and consumer-scale applications enter the ecosystem, performance constraints are no longer theoretical—they are operational bottlenecks.

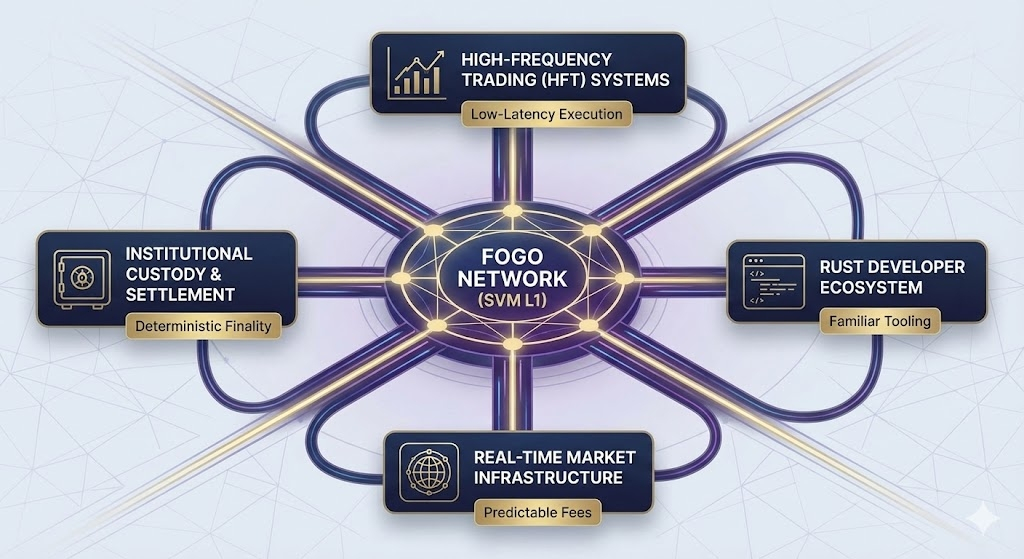

High-performance Layer 1 (L1) networks have emerged to address these constraints. Architectures such as monolithic high-throughput chains, modular execution layers, and rollup-centric ecosystems each attempt to reconcile scalability with composability. Within this context, Fogo positions itself as a purpose-built high-performance L1 leveraging the Solana Virtual Machine (SVM) as its execution environment.

The strategic decision to adopt SVM rather than the Ethereum Virtual Machine (EVM) is not merely a tooling preference. It represents alignment with a parallel execution model optimized for throughput, deterministic scheduling, and efficient state access. For institutional participants and developers, this architectural choice directly influences latency profiles, capital efficiency, and system reliability.

Fogo’s thesis is straightforward: high-performance execution should not be confined to a single dominant chain. By building a standalone L1 powered by SVM, Fogo seeks to extend the execution paradigm while tailoring network design, economic incentives, and scaling strategies to its own ecosystem priorities.

Technical Architecture

SVM and Parallel Execution

The Solana Virtual Machine, originally designed for the Solana network, introduces a transaction execution model based on explicit state access declarations. Each transaction specifies the accounts it intends to read or write. This allows the runtime to schedule non-overlapping transactions in parallel without risking state conflicts.

This differs fundamentally from EVM-based systems, where transactions are typically processed sequentially within a block. While optimistic concurrency and rollup-based scaling improve throughput in EVM ecosystems, the core execution environment remains largely single-threaded at the transaction level.

SVM’s architecture enables:

Parallel transaction processing

Reduced block-level contention

Deterministic execution scheduling

Efficient resource allocation

For Fogo, adopting SVM means inheriting a battle-tested execution engine optimized for high-frequency workloads such as order books, derivatives trading, and real-time on-chain coordination.

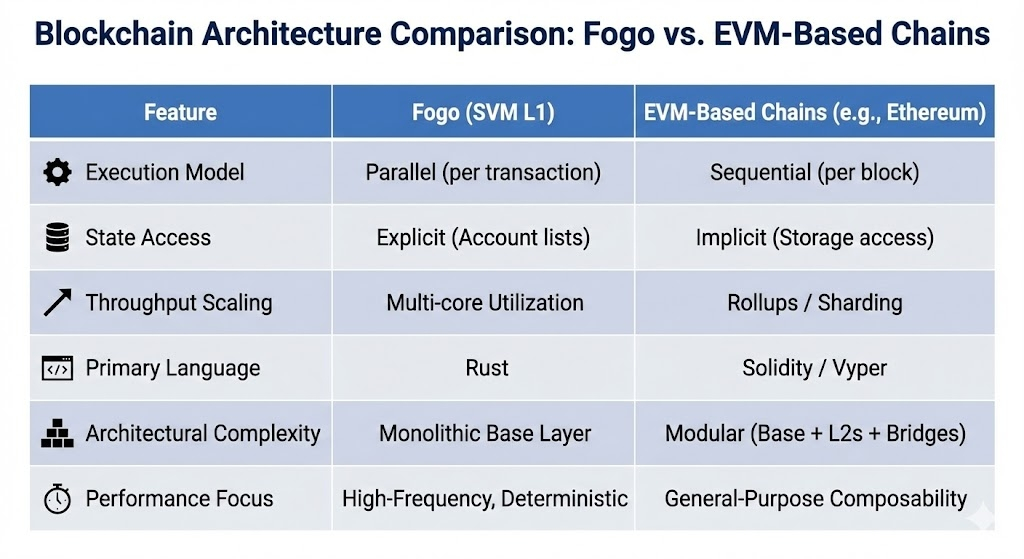

Comparison with EVM-Based Chains

The Ethereum ecosystem and its Layer 2 networks rely on the EVM, which emphasizes general-purpose programmability and composability. However, the EVM’s stack-based architecture and sequential execution limit throughput at the base layer.

Key contrasts include:

FeatureSVM (Fogo)EVM-Based ChainsExecution ModelParallelSequential (per block)State AccessExplicit account listsImplicit storage accessThroughput ScalingMulti-core utilizationRollups / shardingLanguageRust (primary)Solidity / Vyper

EVM-based chains compensate through rollups and modular designs. While effective, these introduce additional layers—bridges, proof systems, sequencers—that increase architectural complexity. Fogo’s approach remains monolithic at the base layer but optimized for high concurrency.

Execution Efficiency and State Management

SVM’s account-based data model minimizes global state mutation. Because transactions must declare their account dependencies upfront, the runtime can avoid speculative execution and reduce unnecessary locking. This improves block production efficiency and reduces the probability of failed transactions due to dynamic state conflicts.

State growth remains a challenge for any high-throughput L1. Fogo’s differentiation lies in how it manages state compression strategies, pruning policies, and validator hardware expectations. While inheriting SVM’s efficiency, Fogo can calibrate validator requirements independently of Solana, potentially balancing decentralization and performance differently.

Differentiation from Other SVM Chains

Although SVM originated on Solana, Fogo is not merely a fork. Its differentiation may include:

Independent validator set and governance model

Tailored fee markets and priority mechanisms

Custom economic design

Modified consensus parameters

By decoupling from Solana’s network-level constraints, Fogo can iterate on throughput optimization, block times, and resource pricing without affecting the primary chain.

Performance & Scalability

Throughput and Latency

High-performance L1s compete primarily on:

Transactions per second (TPS)

Block time

Finality guarantees

Network reliability under load

SVM’s parallel runtime enables significantly higher theoretical throughput than sequential virtual machines. In practice, realized performance depends on workload characteristics—high account overlap reduces concurrency benefits.

Fogo’s performance advantage stems from:

Multi-core CPU utilization

Optimized scheduler design

Reduced transaction serialization

Low-latency execution is particularly important for market infrastructure applications, where deterministic settlement and predictable inclusion times influence capital deployment strategies.

Congestion and State Bloat

Congestion on high-throughput chains often arises from compute-heavy transactions or high account contention. Fogo can mitigate this via:

Localized fee markets

Account-based prioritization

Compute budgeting mechanisms

State bloat remains a systemic issue for all L1s. Without disciplined pruning and rent mechanisms, storage growth increases validator hardware requirements, indirectly centralizing the network. Fogo’s long-term viability depends on balancing state persistence with economic incentives that discourage excessive storage usage.

Horizontal vs Vertical Scaling

Vertical scaling (increasing validator hardware capacity) provides short-term throughput gains but risks centralization. Horizontal scaling—via sharding or modular components—introduces complexity.

Fogo’s SVM-based architecture favors vertical scaling through parallelism but must address decentralization trade-offs. Institutional-grade performance may require higher hardware baselines; the question is whether validator participation remains sufficiently distributed.

Developer Ecosystem

Compatibility with Solana Tooling

One of Fogo’s strongest strategic advantages is compatibility with the Solana developer stack:

Rust-based smart contracts

Existing SVM tooling

Established development frameworks

Auditing familiarity

For developers already building in the Solana ecosystem, migrating to Fogo could involve minimal refactoring. This lowers ecosystem bootstrapping friction.

Migration Incentives

Developers consider:

User liquidity

Tooling maturity

Infrastructure reliability

Incentive programs

Fogo’s challenge is not technical feasibility but economic gravity. Solana’s existing ecosystem effects are substantial. Fogo must provide differentiated incentives—lower fees, specialized infrastructure support, or targeted vertical focus—to justify migration.

Composability and Interoperability

SVM-based composability enables synchronous program calls within a single transaction, preserving atomic execution. Cross-chain interoperability, however, requires bridging frameworks or messaging layers.

If SVM becomes a broader execution standard across multiple chains, interoperability between SVM-native networks could become more seamless than between heterogeneous virtual machines.

Economic & Network Design

Validator Incentives and Security

As an independent L1, Fogo must establish its own validator incentive model. Key considerations include:

Staking rewards

Slashing conditions

Hardware requirements

Governance structure

Security assumptions depend on economic stake distribution and validator participation diversity. High-performance chains sometimes risk centralization due to infrastructure costs. Long-term credibility with institutional participants requires transparent validator economics and robust fault tolerance.

Token Utility

If Fogo employs a native token, its primary utilities typically include:

Transaction fee payment

Staking collateral

Governance participation

Sustainable token economics require alignment between network usage and reward emissions. Over-subsidization may attract short-term activity but undermine long-term economic equilibrium.

Sustainability and Decentralization Tradeoffs

Performance-centric chains often confront the “scalability trilemma” trade-off. While SVM improves execution efficiency, decentralization is shaped by validator accessibility. Fogo’s governance decisions around hardware standards, minimum stake requirements, and protocol upgrades will materially affect its decentralization trajectory.

Market Positioning

Relative to Solana

Fogo operates within the conceptual orbit of Solana but as a sovereign network. The key distinction lies in strategic autonomy: Fogo can specialize, experiment with economic parameters, and target specific verticals without being constrained by Solana’s ecosystem-wide governance considerations.

However, it competes indirectly with Solana for developers and liquidity. Its value proposition must extend beyond performance parity.

Relative to Ethereum L2s

Rollup-based scaling on Ethereum offers strong security guarantees derived from Ethereum’s base layer. Fogo, as an independent L1, does not inherit that shared security. Instead, it offers native execution speed without layered complexity.

The trade-off is clear: Ethereum L2s emphasize security composability; Fogo emphasizes execution performance and simplicity.

SVM as a Dominant Execution Paradigm

If SVM-based execution proves superior for high-throughput applications, it may evolve into a standardized execution environment beyond Solana. Multiple independent SVM chains would create an ecosystem where tooling, developer expertise, and runtime optimization compound across networks.

Whether this becomes dominant depends on:

Developer migration patterns

Infrastructure provider support

Institutional comfort with non-EVM environments

The EVM retains strong network effects. However, parallel execution architectures present tangible performance advantages for certain verticals.

Institutional Adoption Potential

Institutions prioritize:

Deterministic performance

Predictable fee environments

Network uptime

Transparent governance

Fogo’s SVM-based architecture aligns well with latency-sensitive financial use cases. The remaining variables are operational maturity, validator distribution, and ecosystem liquidity depth.

Conclusion

Fogo represents a strategic bet on execution-layer optimization as the primary vector of blockchain differentiation. By adopting the Solana Virtual Machine within an independent Layer 1 framework, it combines a proven high-performance runtime with governance and economic autonomy.

Its structural advantages include:

Parallel transaction processing

High throughput potential

Rust-native developer tooling

Reduced execution bottlenecks

Its structural risks include:

Competition with Solana’s established ecosystem

Validator centralization pressures

Network bootstrapping challenges

The broader question is whether SVM-based architectures will evolve into a multi-chain execution standard or remain concentrated within a limited set of networks. Fogo’s success depends not only on raw performance metrics but on ecosystem depth, validator resilience, and economic sustainability.

For institutional and technically sophisticated participants, Fogo is less a speculative asset and more an infrastructure experiment: a test of whether execution efficiency, when decoupled from legacy constraints, can redefine the performance ceiling of Layer 1 blockchain systems.