Imagine trying to catch a moving train.

If you’re one second late, it’s gone.

Markets move the same way.

Most people underestimate how much time matters in markets.

A few milliseconds can determine whether an order fills at the expected price or slips into something worse. In traditional finance, entire industries were built around shaving microseconds off execution time. Fiber routes were optimized. Servers were moved physically closer to exchanges. Infrastructure became a competitive weapon.

Yet in much of DeFi, we’ve accepted latency as normal. We click “swap,” wait for confirmation, watch the price move, and hope nothing changes before finality. That gap between intention and execution is where inefficiency lives.

@Fogo Official is interesting because it treats latency not as a secondary metric, but as the foundation of the entire design.

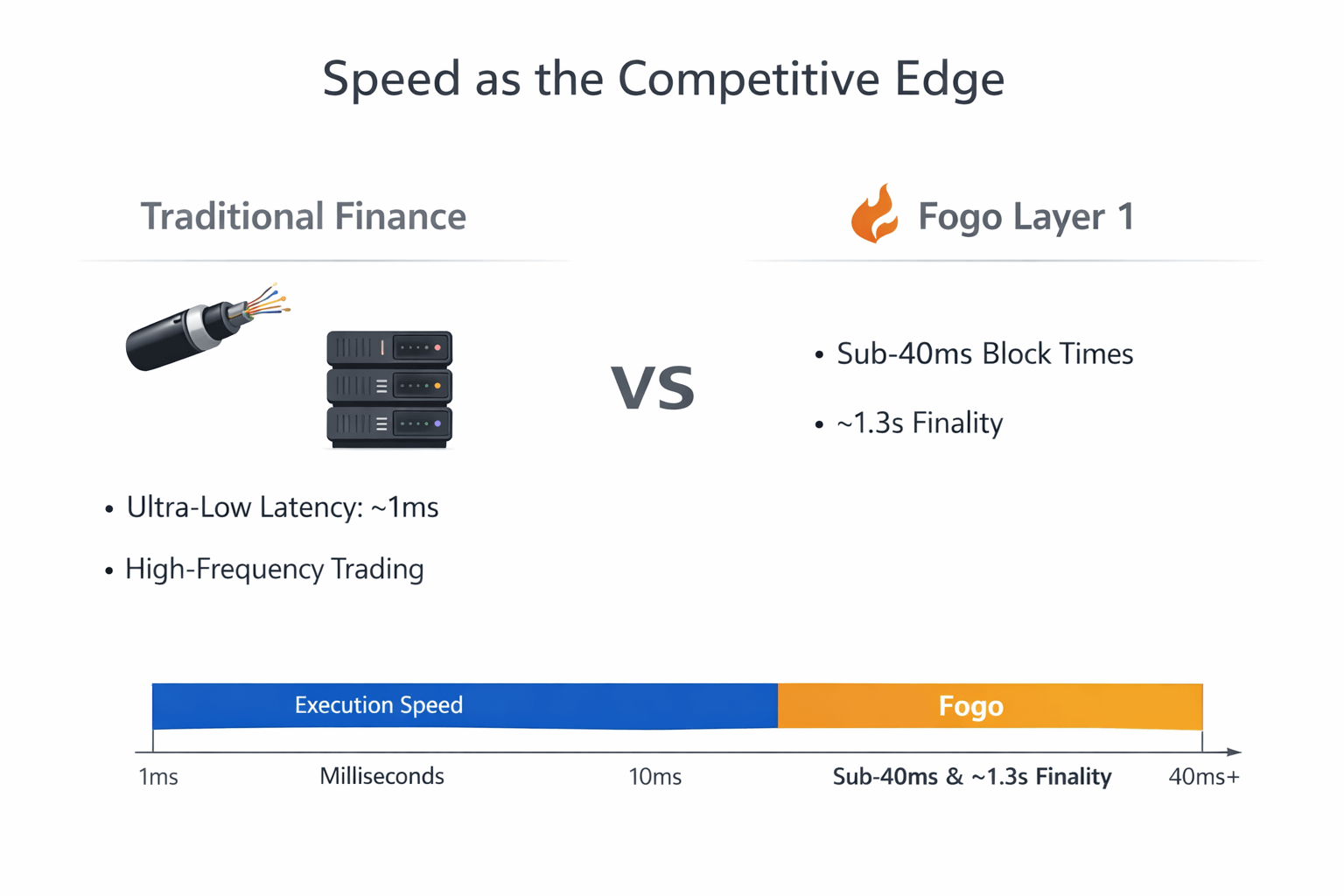

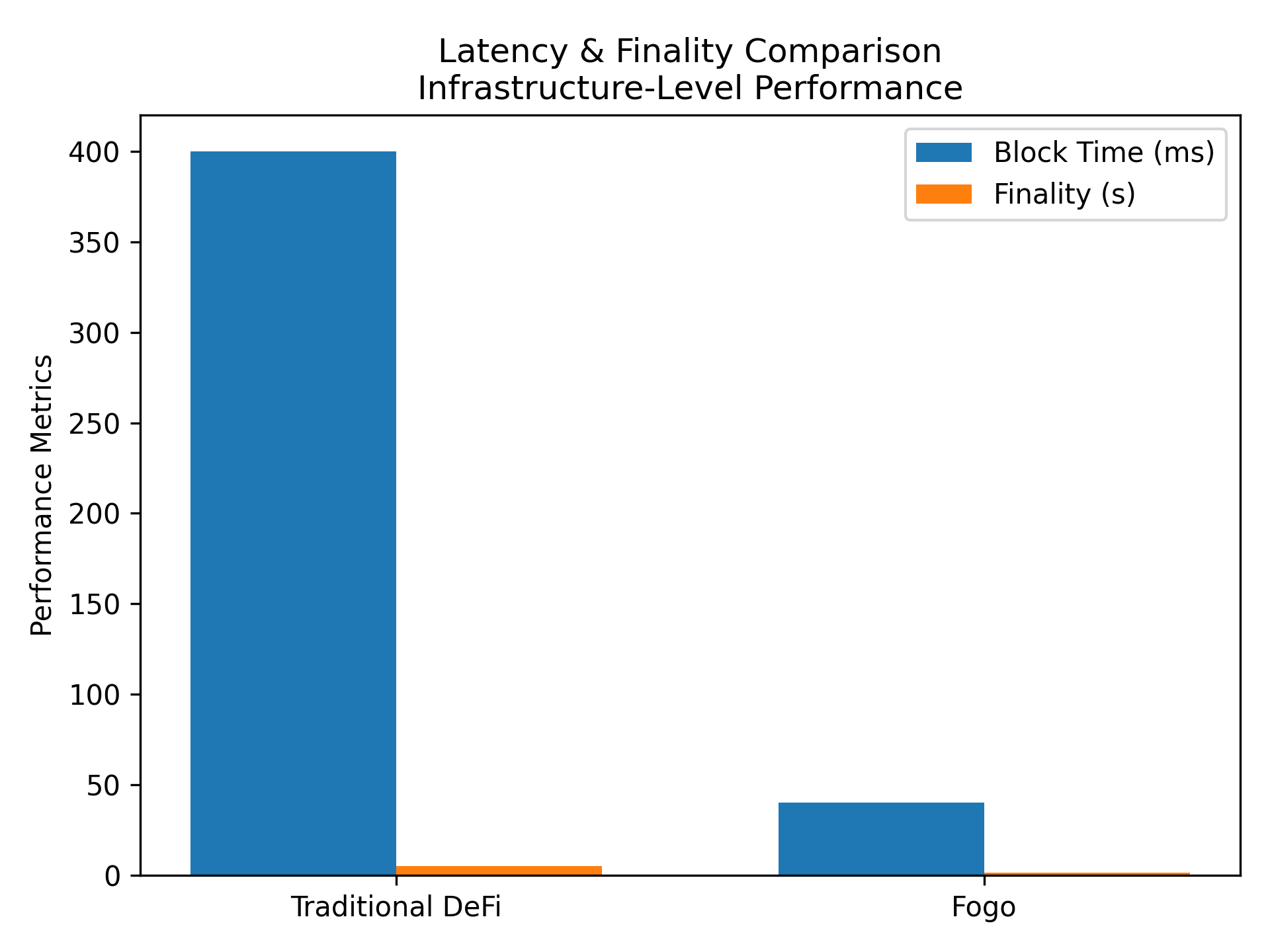

Built on the Solana Virtual Machine (SVM), Fogo positions itself as a high-performance Layer 1 optimized for real-time on-chain trading. Sub-40ms block times and ~1.3 second finality are not just numbers for marketing slides. They redefine what traders and developers can expect from decentralized infrastructure.

And that shift matters more than it first appears.

The difference between “fast enough” and “real-time” is structural.

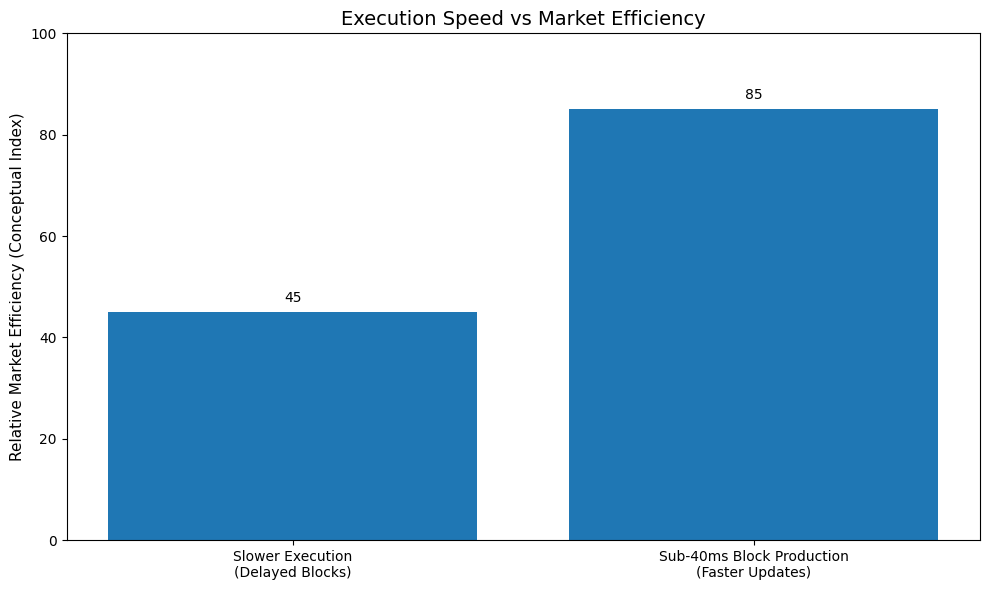

In slower environments, market participants compensate for delay. They widen spreads. They reduce order size. They price in uncertainty. Liquidity becomes cautious.

When execution is consistent and fast, spreads tighten. Liquidity providers take less defensive posture. Traders trust that the system behaves predictably. Markets deepen.

@Fogo Official sub-40ms block production moves the system closer to the rhythm of centralized exchanges. While finality still matters and 1.3 seconds is where certainty arrives the speed of block updates reduces visible lag in price discovery. Orders can be processed rapidly, and state updates propagate in a timeframe that feels responsive rather than delayed.

This is not about chasing headline TPS numbers. It’s about reducing the psychological and economic friction between a trader’s action and the network confirmation.

That friction is where many DeFi systems lose credibility.

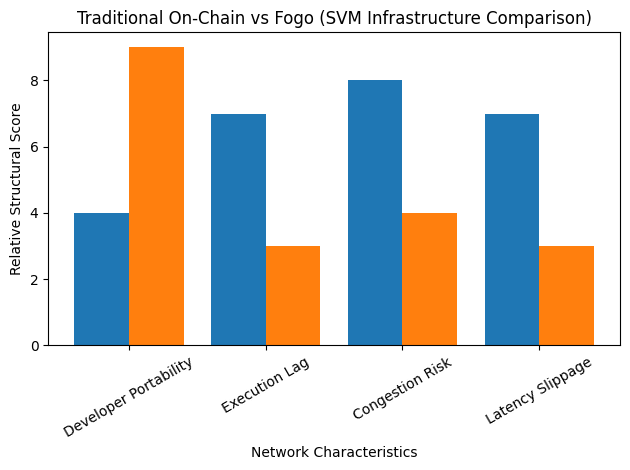

Another major dimension is developer portability.

Because Fogo runs on the Solana Virtual Machine, developers already familiar with Solana tooling can migrate applications without rewriting everything from scratch. That lowers ecosystem friction dramatically. Infrastructure compatibility is one of the most underrated growth drivers in blockchain.

When a network allows existing Solana dApps to port efficiently, it inherits a mature developer base, proven architecture patterns, and established user expectations. That’s far more powerful than asking teams to learn entirely new execution environments.

The result is not just speed for its own sake, but speed layered on top of familiarity.

And familiarity reduces adoption resistance.

From a market structure perspective, the implications are even more interesting.

On-chain trading historically struggles with three visible weaknesses compared to traditional exchanges:

Execution lag

Unpredictable congestion

Latency-driven slippage

By tightening block intervals and maintaining consistent finality, Fogo attempts to address these structural weaknesses directly. If execution becomes reliably near-instant, DeFi can begin competing on fairness rather than novelty.

Fairness here means something precise.

In slower systems, sophisticated actors can exploit timing asymmetries. When state updates lag, opportunities for manipulation widen. Consistency compresses that window. The more predictable and rapid the execution cycle, the smaller the edge that depends purely on network delay.

That moves DeFi toward a more level playing field.

Speed alone does not guarantee institutional adoption. But predictable speed is a prerequisite.

Traditional finance participants care deeply about deterministic performance. They need to know not just that the system is fast, but that it remains fast under load. Real infrastructure is defined not by peak performance, but by stable performance.

This is where Fogo’s positioning becomes strategic rather than technical.

If block times remain sub-40ms consistently, and finality remains ~1.3 seconds without degrading during periods of high demand, the chain transitions from being “fast crypto” to being “reliable infrastructure.”

And that is a different category entirely.

The psychological shift is subtle but powerful.

When traders no longer think about the network while trading, the network has succeeded.

Most DeFi users today remain hyper-aware of the chain. They monitor gas, block times, mempool behavior. In high-performance environments, that awareness fades. The product becomes the market, not the blockchain.

That invisibility is the hallmark of mature infrastructure.

Fogo’s alignment with the Solana ecosystem also suggests a strategic bet on composability. By maintaining SVM compatibility, cross-application liquidity and shared tooling ecosystems become easier to maintain. That reduces fragmentation and accelerates liquidity concentration—another key factor in building deep markets.

Liquidity depth is the ultimate test.

Fast execution without liquidity simply accelerates empty order books. But when speed and liquidity converge, markets behave more like their traditional counterparts: continuous, responsive, efficient.

Over time, that convergence changes perception.

Instead of asking whether DeFi can match centralized exchanges, participants begin asking what additional advantages decentralized markets can offer on top of comparable speed.

Transparency. Self-custody. Composability.

Once latency stops being the bottleneck, innovation shifts to higher-order improvements.

From my perspective, that is where Fogo’s relevance lies.

It is not merely a “faster chain.” It is an attempt to remove one of DeFi’s core structural disadvantages. If latency becomes negligible relative to human reaction time, the debate shifts from performance limitations to product design.

And product design is where long-term differentiation happens.

The long arc of financial infrastructure always bends toward efficiency and reliability.

Systems that minimize friction survive. Systems that reduce uncertainty compound trust. Systems that behave consistently under stress become foundational.

If Fogo continues delivering sub-40ms block times and stable 1.3s finality at scale, it positions itself as a serious candidate for next-generation on-chain trading infrastructure not because it is loud, but because it addresses a real bottleneck.

In markets, milliseconds matter.

In infrastructure, consistency matters more.

If those two converge, DeFi stops feeling experimental and starts feeling inevitable.