$BTC is trading around 66,996 and still stuck inside a short-term corrective structure.

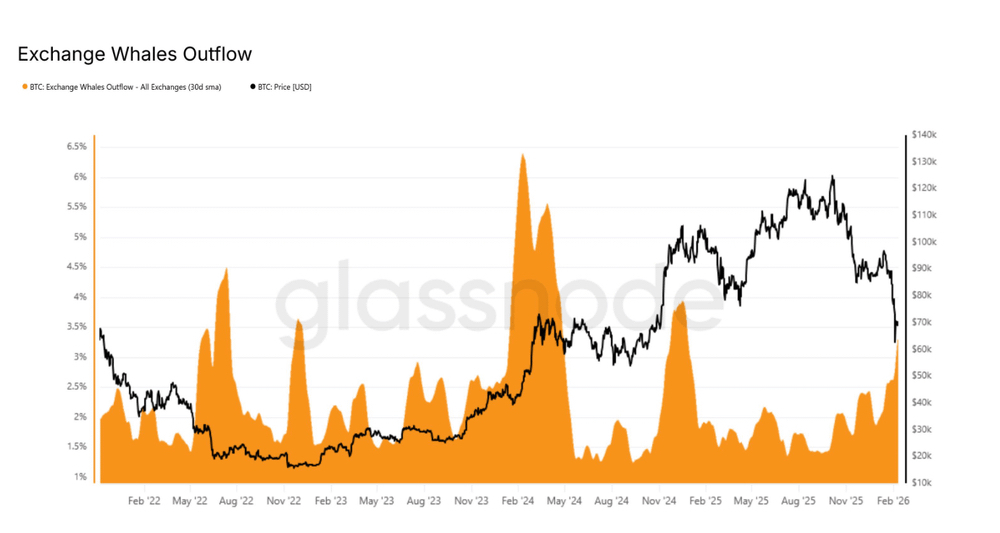

No clean reversal on the chart yet, but on-chain tells a slightly different story. Whales have been quietly adding while price drifts. That combination usually makes the market feel uneasy — sentiment weak, positioning cautious, structure undecided.

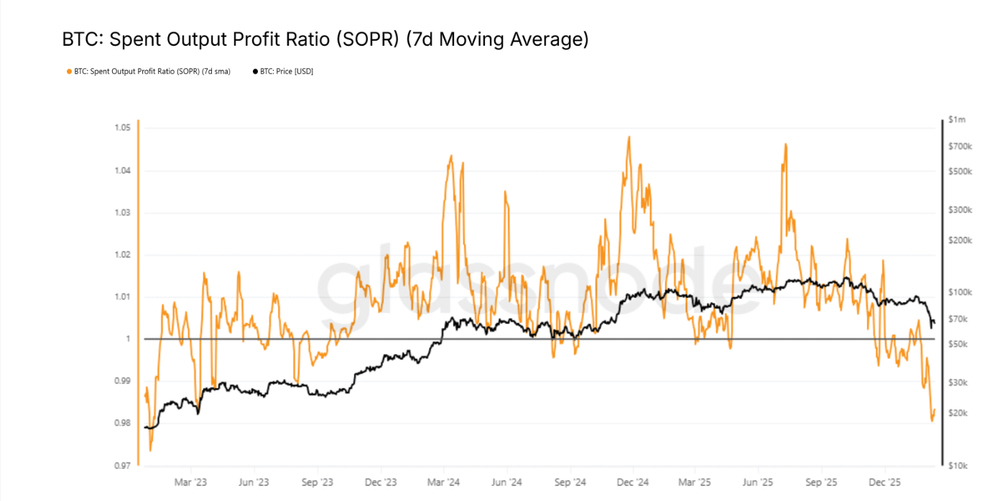

SOPR hovering around 1, even dipping below, shows a lot of holders selling at breakeven or at a loss. That’s typical of a cleansing phase. Weak hands rotate out. But cleansing is not the same as reversal. Exhaustion can last longer than people expect.

Meanwhile wallets holding 10,000–100,000 BTC have added roughly 70,000 BTC this month. Supply is moving off exchanges into larger hands. We’ve seen this before. Early 2022 had similar accumulation patterns — whales building size while price chopped sideways for months.

Important detail: back then, price didn’t explode right after accumulation. It compressed. Time did more work than price.

Right now $BTC is holding above the 65,000–66,000 pocket, but keeps getting rejected near 70,600. That tells me supply is still active overhead. If 65,000 holds, this can continue as a broad range, absorption underneath, rotation above. Lose that level and 63,000 or even 60,000 becomes natural liquidity targets.

For a real structural shift, reclaiming 78,000 and holding it would change the tone. Until that happens, upside moves feel more like technical relief than confirmed expansion.

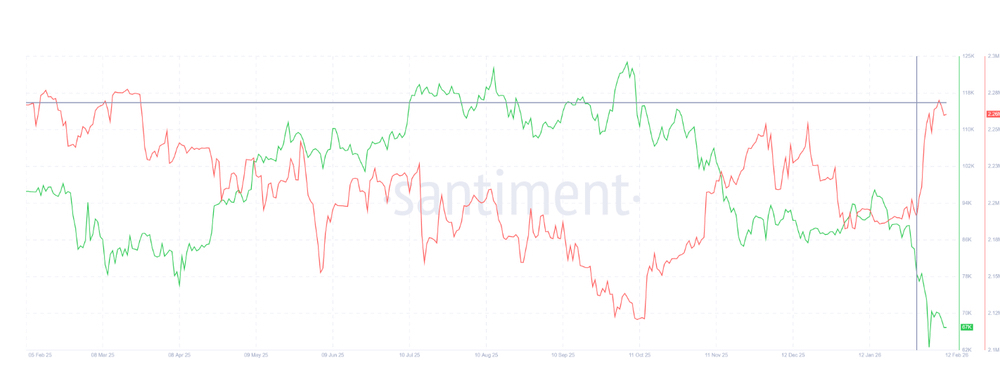

There’s a divergence forming — retail cautious, whales accumulating. Long term that tends to matter. Short term, structure still needs to prove itself.

Maybe this is base-building. Maybe it’s just another rotation inside a larger correction.

Market hasn’t decided yet.