Most traders only watch the price chart. But if you study Bitcoin cycles closely, you’ll notice something important. Time matters just as much as price.

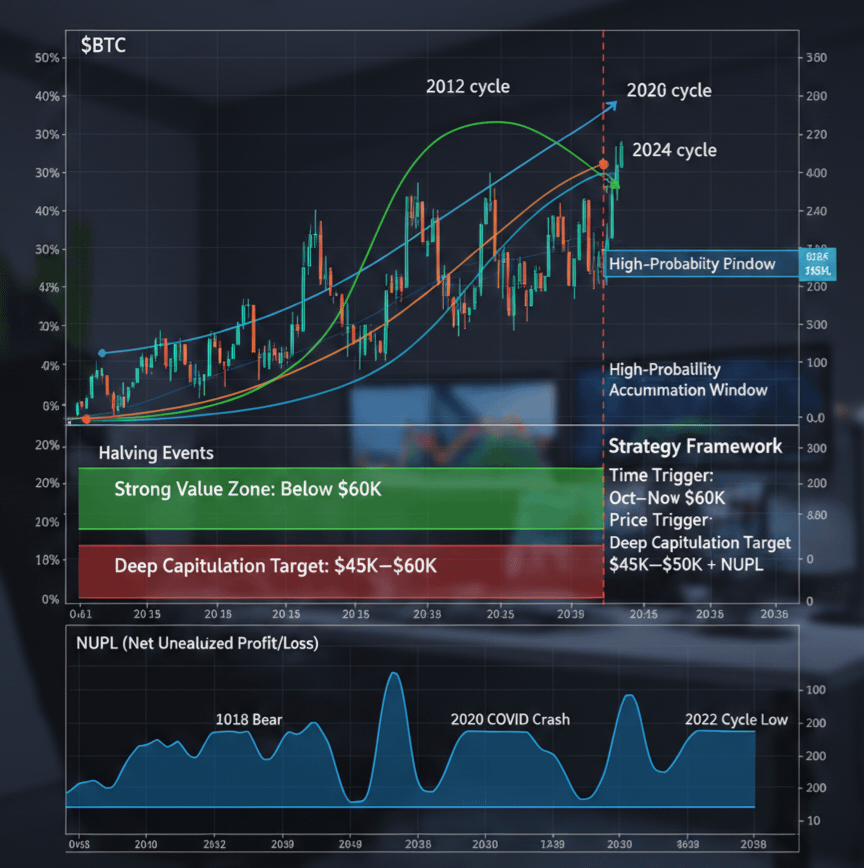

Right now, $BTC is moving in a structure that closely resembles previous post-halving cycles. That doesn’t mean history will repeat perfectly. But it does rhyme.

Let’s break it down.

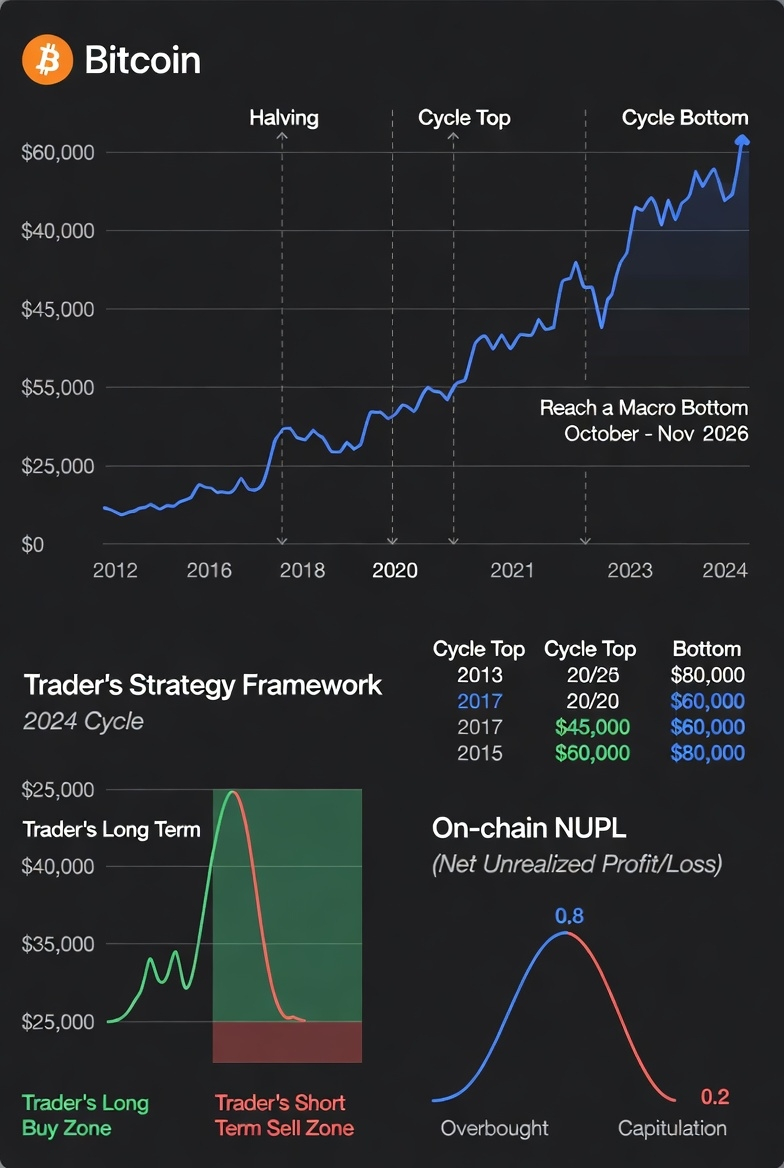

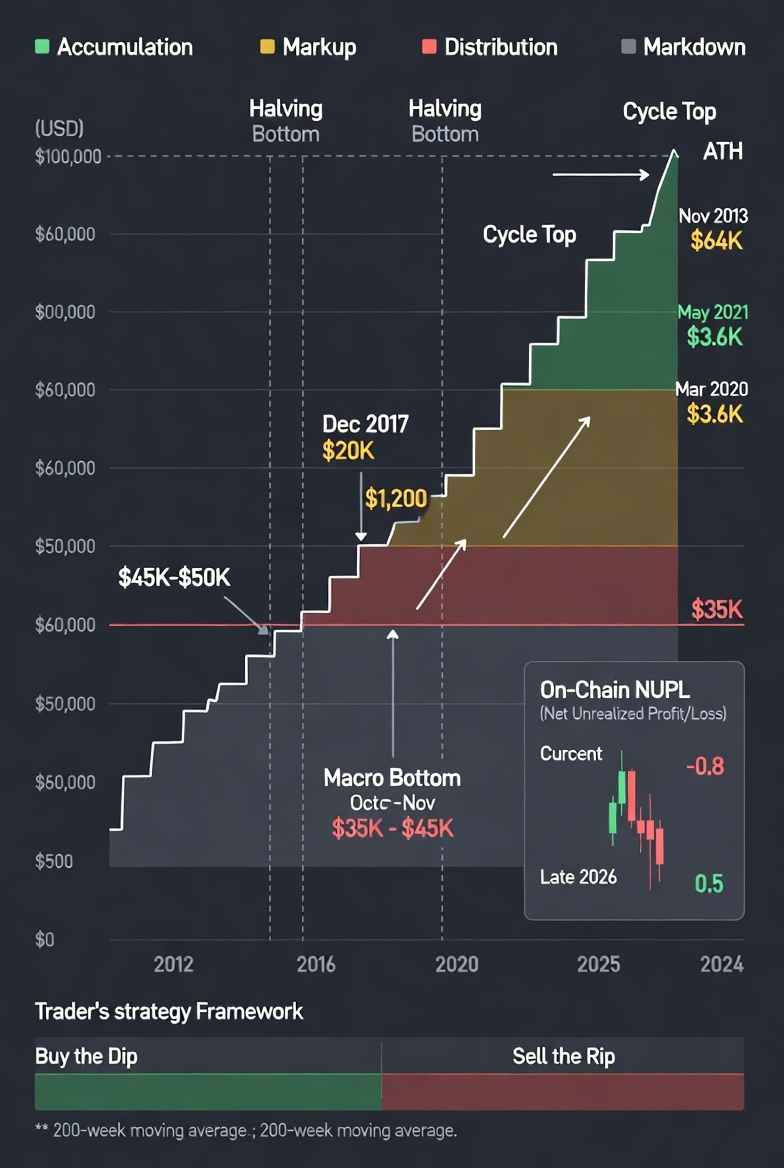

1️⃣ The Time Axis – Where Are We in the Cycle?

After each halving, Bitcoin typically forms a major cycle top, followed by a prolonged correction before establishing the true cycle bottom.

Days from ATH to cycle low in past halvings:

2012 cycle: 406 days

2016 cycle: 363 days

2020 cycle: 376 days

2024 cycle: Ongoing

The numbers are surprisingly consistent.

If this rhythm continues, the highest probability window for a meaningful macro bottom falls around October–November 2026.

That’s my primary time target.

When that window arrives, I accumulate aggressively regardless of what price looks like. Because when time aligns, it often prevents you from being front-run by the market.

2️⃣ The Price Axis – Identifying Value Zones

While waiting for the time window, I don’t sit idle.

I began accumulating once BTC entered the $60,000 zone. Why?

Because waiting for the “perfect price” is how many investors miss the entire move.

Retail mindset:

“I’ll only buy at X.”

Reality:

The market doesn’t owe anyone a perfect entry.

My framework is simple:

If price enters a value area → I scale in.

If historical timing aligns → I buy regardless of price.

This removes emotion and replaces it with structure.

3️⃣ On-Chain Confirmation – NUPL

One of the key on-chain indicators I monitor is NUPL (Net Unrealized Profit/Loss).

Historically, deep bear market bottoms were marked when NUPL entered extreme capitulation zones:

2018 bear market

2020 COVID crash

2022 cycle low

At the moment, we are not yet in that deep blue capitulation zone.

That’s why I wouldn’t rule out a deeper retracement into the $45K–$50K range, especially if macro pressure builds into 2026.

⚠️ Could $35K Happen?

In crypto, extreme moves are always possible. Panic phases can overshoot fair value.

But based on time symmetry + on-chain structure, the more probable macro bottom window still appears to be late 2026.

📌 My Strategy Framework

Time Trigger:

October–November 2026 = High-probability accumulation window.

Price Trigger:

Below $60K = Strong value zone.

Deep Capitulation Target:

$45K–$50K with NUPL confirmation = High conviction area.

The market feels messy right now. That’s normal in mid-cycle transitions.

Cycles don’t reward emotion. They reward structure, patience, and positioning before headlines confirm the move.

Study time. Study price. Manage risk.

And always do your own research.

#CPIWatch #CZAMAonBinanceSquare #USNFPBlowout #TrumpCanadaTariffsOverturned #USRetailSalesMissForecast