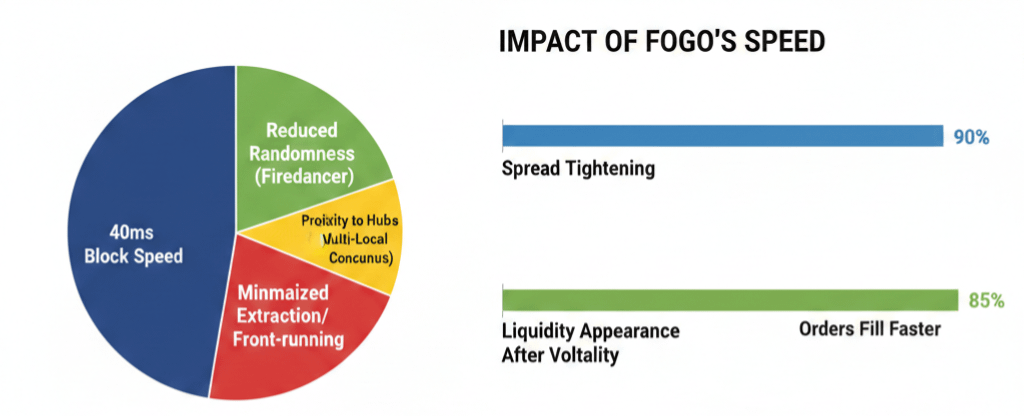

I keep watching Fogo during live volatility and asking myself if this speed is just a number or something deeper. Forty millisecond blocks sound impressive but what matters is how traders react when markets move fast. I notice spreads tighten quicker. Orders fill with less hesitation. It feels like risk is being priced differently because final settlement arrives almost instantly. When time shrinks uncertainty shrinks and that changes behavior.

The choice to standardize around Firedancer keeps pulling my attention. On paper it looks risky to rely on one dominant client but in practice it reduces randomness. Markets hate randomness more than they fear concentration. If execution becomes predictable larger players step in with confidence. I see liquidity appearing sooner after sharp moves which tells me capital feels safer rotating here.

The multi local consensus design makes me rethink geography itself. If validators are positioned close to financial hubs latency is no longer an abstract metric it becomes a strategic advantage. Capital flows toward environments where friction is lowest. Fogo seems to accept that proximity to money matters more than theoretical distribution. That realization shifts how I value the network.

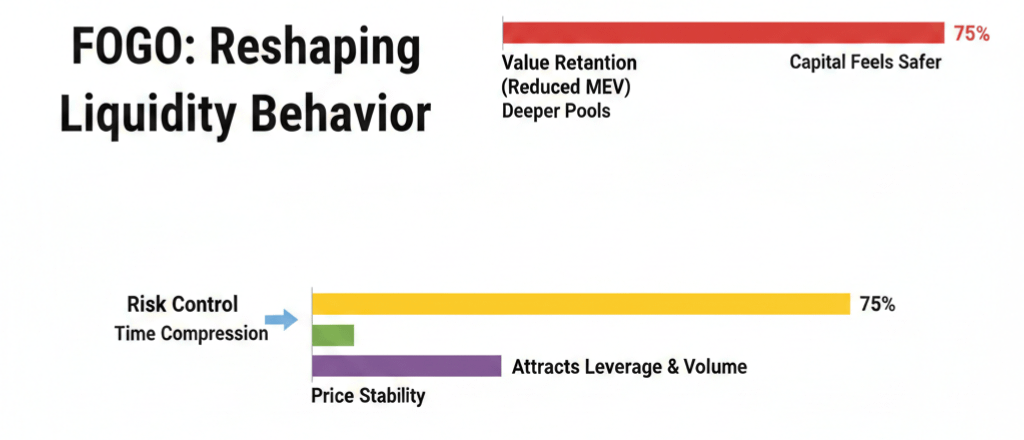

Then I consider extraction and front running. When finality happens almost immediately the window for opportunistic behavior narrows. If less value leaks out to hidden actors more remains with traders and liquidity providers. That deepens pools and steadies price swings. Stability attracts leverage and leverage attracts volume.

At first I questioned whether speed alone could justify attention. Now I see that Fogo is compressing time itself as an economic factor. In markets controlling time means controlling risk and controlling risk is what ultimately shapes price.