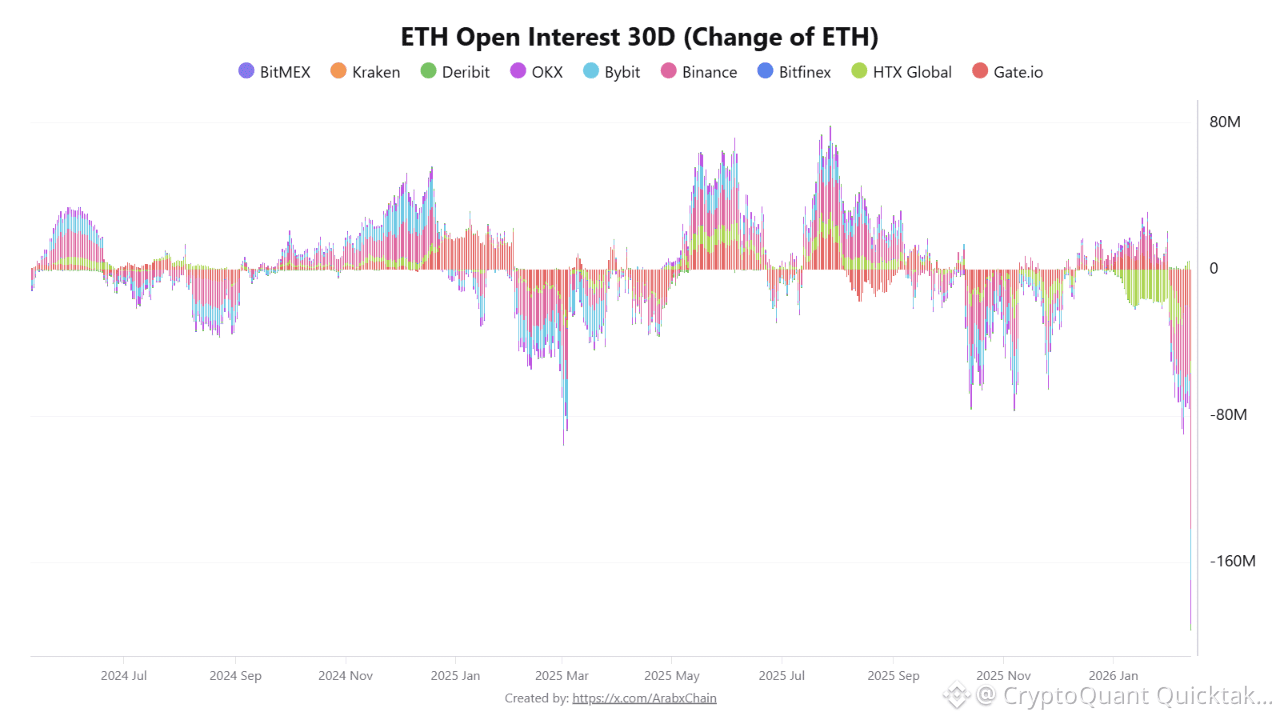

Data on net open interest (OI Change 30D) across major trading platforms indicates that the derivatives market is undergoing a clear phase of deleveraging and risk readjustment. The data shows that the downward trend is concentrated on several key platforms, most notably Binance, Gate.io, OKX, and Bybit, reflecting a widespread outflow of capital from futures positions.

Based on the displayed figures, Binance recorded a decline of approximately 40 million ETH over the last 30 days, while Gate.io’s open interest fell by more than 20 million ETH, OKX declined by about 6.8 million ETH, and Bybit by an additional 8.5 million ETH. This brings the total decline across these four platforms alone to approximately 75 million ETH.

When other platforms showing negative readings, albeit with smaller volumes, are included, the total contraction in open interest across all platforms exceeds 80 million ETH over the past 30 days, confirming that the phenomenon is widespread and not limited to a single platform.

This pattern suggests that traders, particularly those using high leverage, are reducing their exposure rather than opening new positions, whether out of caution or due to pressure from volatile price movements. Such periods typically coincide with market transitions, where short-term speculation gives way to a more conservative approach.

From a structural perspective, this significant drop in open interest can be viewed as a “clean-up” of weaker positions, thereby reducing the likelihood of sharp forced liquidations later on. This environment may pave the way for a period of relative stability or the formation of a more solid price base for Ethereum in the near future.

Written by Arab Chain