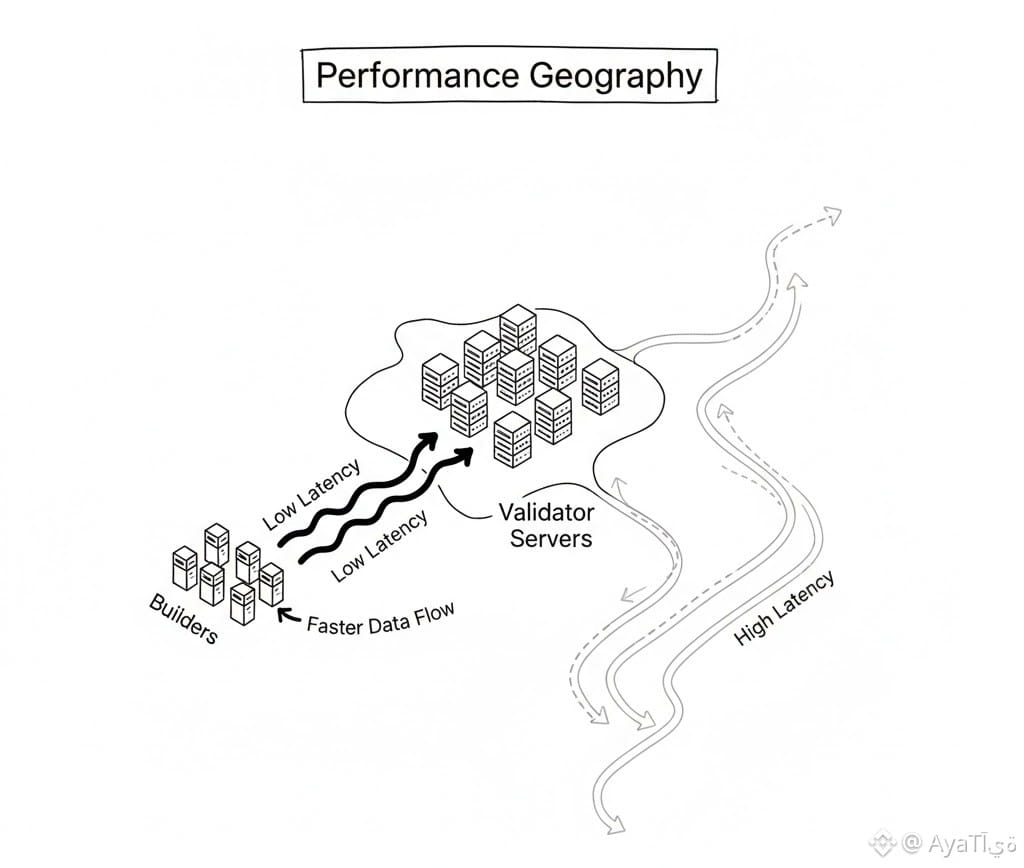

I think the most under-discussed feature of @Fogo Official is not its throughput, but its geography. When builders can co-locate near validators and operate alongside a high-performance Firedancer client, execution stops being abstract and becomes spatial. Distance turns into strategy. In my perspective, fogo is quietly introducing a performance map where proximity influences opportunity.

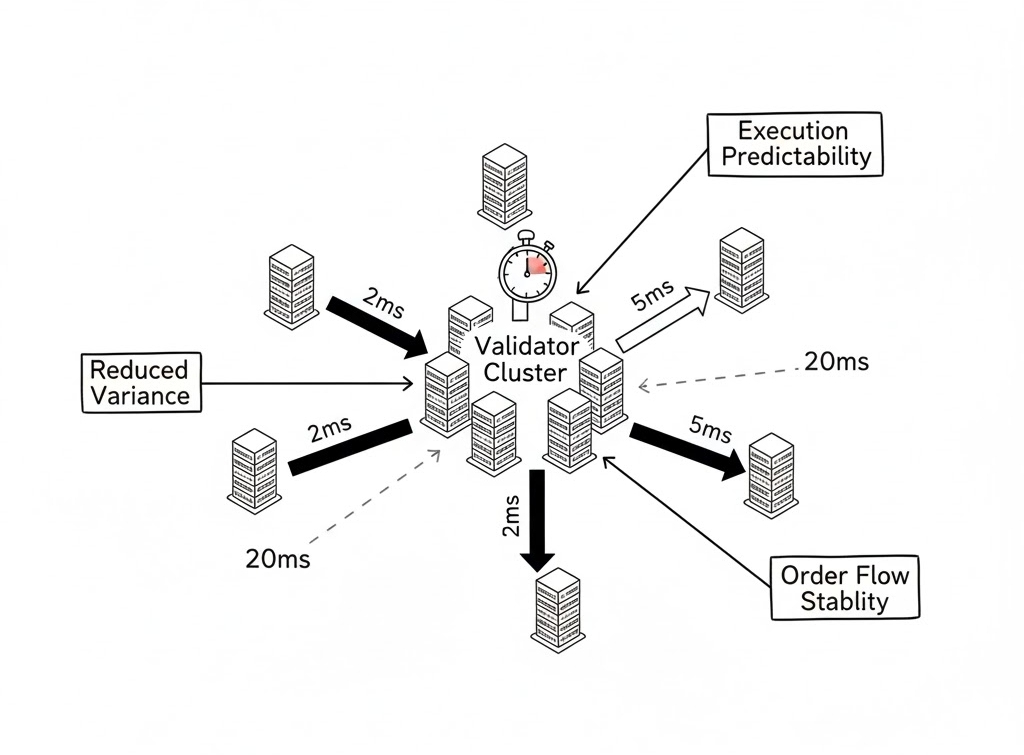

Most networks pretend distance does not matter. I acknowledge that they optimize software, but they ignore placement. #fogo does the opposite. By concentrating validators in high-performance infrastructure centers, it reduces variance. Variance is the silent tax on decentralized systems. Remove enough of it, and you reshape market behavior without changing the rules.

From my perspective, this creates something rare: execution predictability. Predictability influences how liquidity providers behave, how arbitrage stabilizes pricing, and how staking rewards are modeled. When latency dispersion shrinks, incentives align more tightly. The chain becomes less chaotic, more rhythmic.

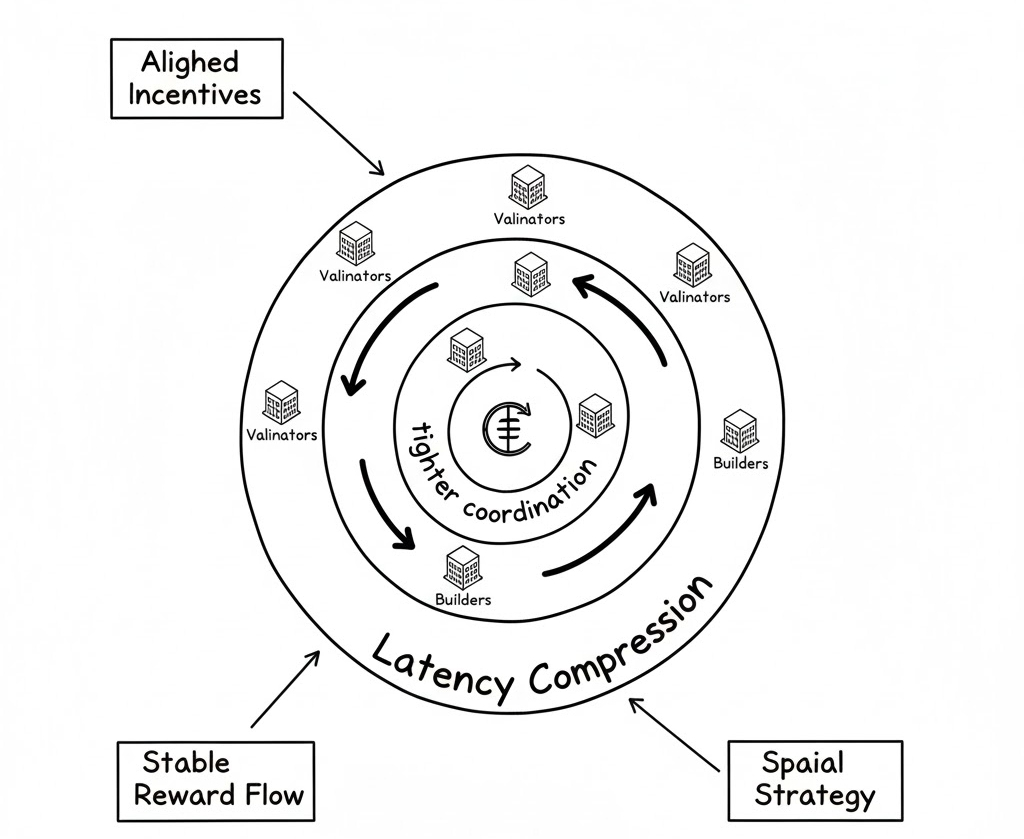

I think fogo’s architecture suggests that decentralization does not require randomness. It requires transparency in constraints. If everyone understands the physical realities of execution, strategy adapts accordingly. That is healthier than pretending all nodes are equal when they are not.

In the long run, performance geography may define market structure more than raw throughput numbers. fogo demonstrates that where infrastructure sits can matter as much as how fast it runs. I see this not as centralization, but as an acknowledgment that physics always participates in economics. And networks that design around that reality may outlast those that ignore it.