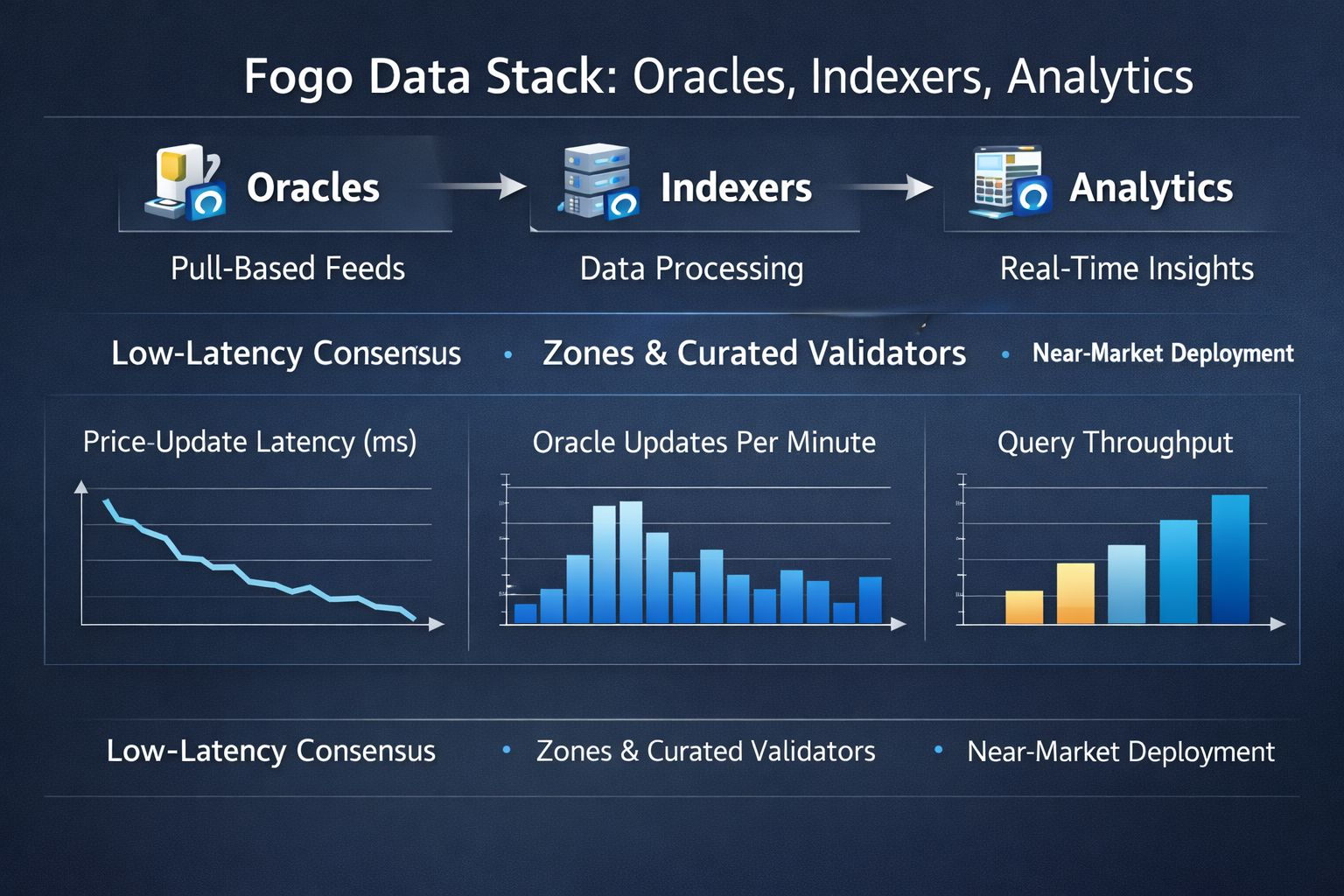

I’ve been trying to make sense of what “real-time markets” could mean onchain, and I keep bumping into the same awkward fact: speed isn’t useful if you can’t trust what you’re seeing. My first instinct was that blockchains would always feel like delayed settlement. These days I’m more persuaded that the interesting part is the surrounding data stack—how quickly a system can move from “a thing happened” to “everyone agrees what happened,” with enough detail to act. Fogo is a clear case study because it optimizes around that constraint. In its architecture docs, validators coordinate ahead of time around selected “zones,” and the network uses a curated validator set to avoid performance being dragged down by under-provisioned operators. On its site, it also describes operating consensus close to a major market center to lower latency and keep validation near the action. You can debate those tradeoffs, but once you aim for that responsiveness, the rest of the stack becomes non-negotiable. Oracles are the first pressure point. Smart contracts can’t naturally look up prices, yet lending health, liquidations, funding rates, and routing decisions all depend on a shared reference for value. What’s changing lately is the preference for price updates that arrive when an application needs them, not on a fixed cadence. Pyth describes this as a low-latency pull design, where users can “pull” price updates on-chain when needed. That sounds like a minor detail until you picture a fast venue trying to liquidate or settle a derivatives position with an update that’s a few seconds old. Indexers are the next piece, and they’re easy to overlook until you try to build a product. A fast chain is still a ledger, not a reporting database. Traders and risk systems ask questions the base chain isn’t optimized for, like “what just traded” or “what’s the current state across thousands of accounts.” Indexers turn raw event streams into queryable datasets and APIs, while absorbing realities like reorganizations and historical backfills. Fogo’s ecosystem page treats indexing as a first-class category and names Goldsky there. Analytics is where this becomes usable by humans. Explorers and monitoring help you tell the difference between a real market move and an infrastructure hiccup, and they make performance visible when the chain is stressed. Fogo’s ecosystem list highlights an explorer and analytics tooling alongside infrastructure, which feels like an honest acknowledgment that speed without visibility is a liability. This is getting attention now because onchain trading is large enough that latency and data quality start to feel like market structure. A recent Solana analytics piece put 2025 DEX volume around $1.5 trillion and suggested activity is still growing into 2026. And outside crypto, regulators are talking about consolidating fragmented trading data into more complete real-time feeds to see liquidity properly. I don’t think the “right” architecture is settled, but I do think the direction is clear: if you want markets that react in the moment, the data has to do the same.

@Fogo Official #Fogo #fogo $FOGO