Hey,I'm Fozia(@Fozia_09 ),and I’ve been thinking a lot about how AI agents are starting to interact with the world outside of code.So much talk in AI circles focuses on better models,sharper prompts,or massive datasets.But honestly,the real leap right now isn’t just about thinking harder it’s about actually doing things.

Sure,AI can analyze,predict,optimize.It can spot trends and simulate outcomes all day. But those predictions don’t mean anything if nothing happens.For AI to really make a mark,it has to see what’s going on,make a decision,act and then settle the results.That last part,settlement,is where blockchain steps in.

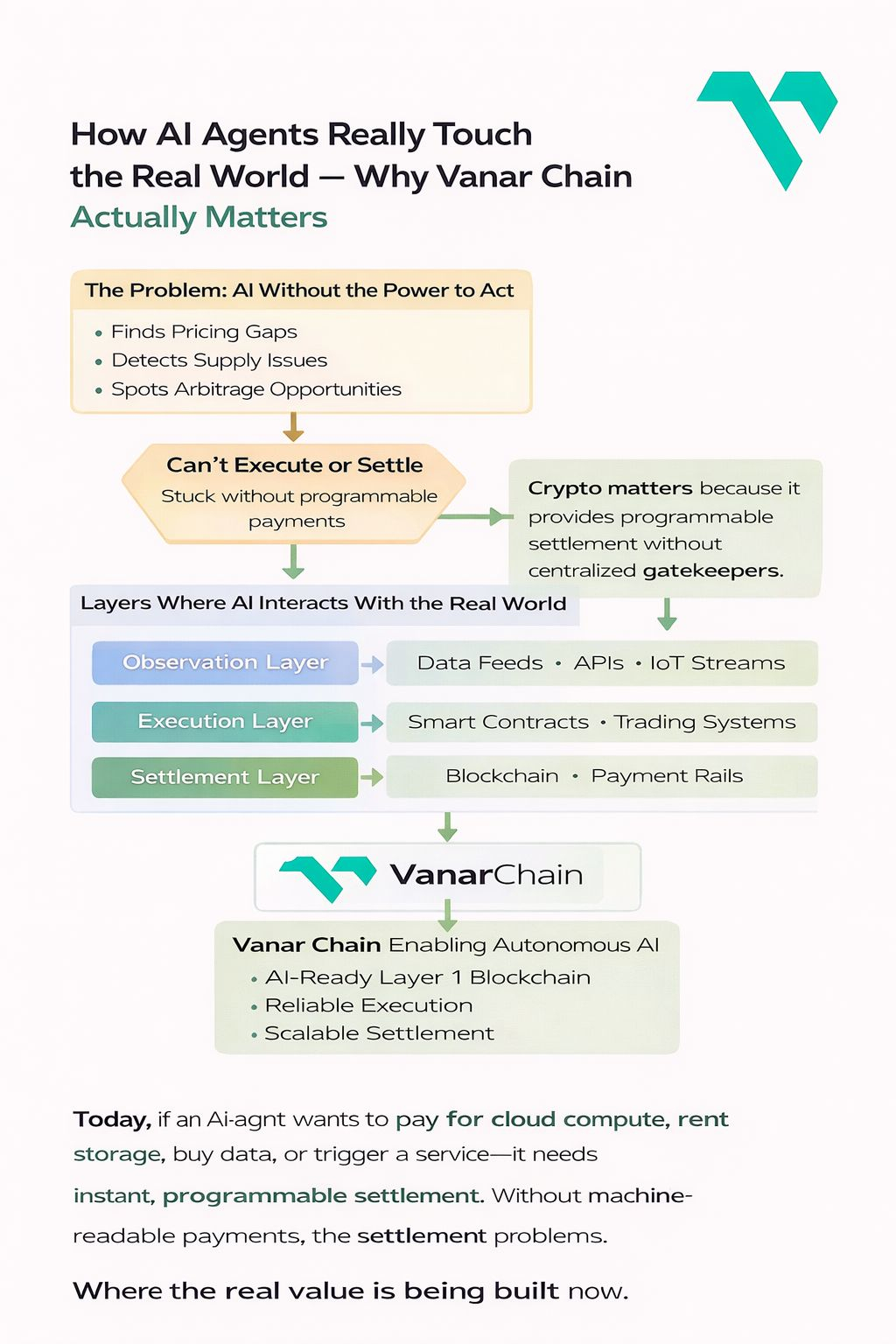

The Core Issue:AI Without the Power to Act

Let’s get real:An AI can find a pricing gap or notice a supply shortage,but if it can’t actually buy,sell,or settle a transaction,it’s just sitting on the sidelines.In the old system,you have APIs that let you do stuff and banks that move the money around but those come with human checks,centralized control,and slow processing.

Now,picture an AI agent trying to pay for cloud compute,rent storage,buy data,or trigger a service it needs instant, programmable payments.Without that,the whole loop grinds to a halt.The AI just stops at the edge,unable to cross over from thinking to doing.

How AI Agents Plug Into the Real World

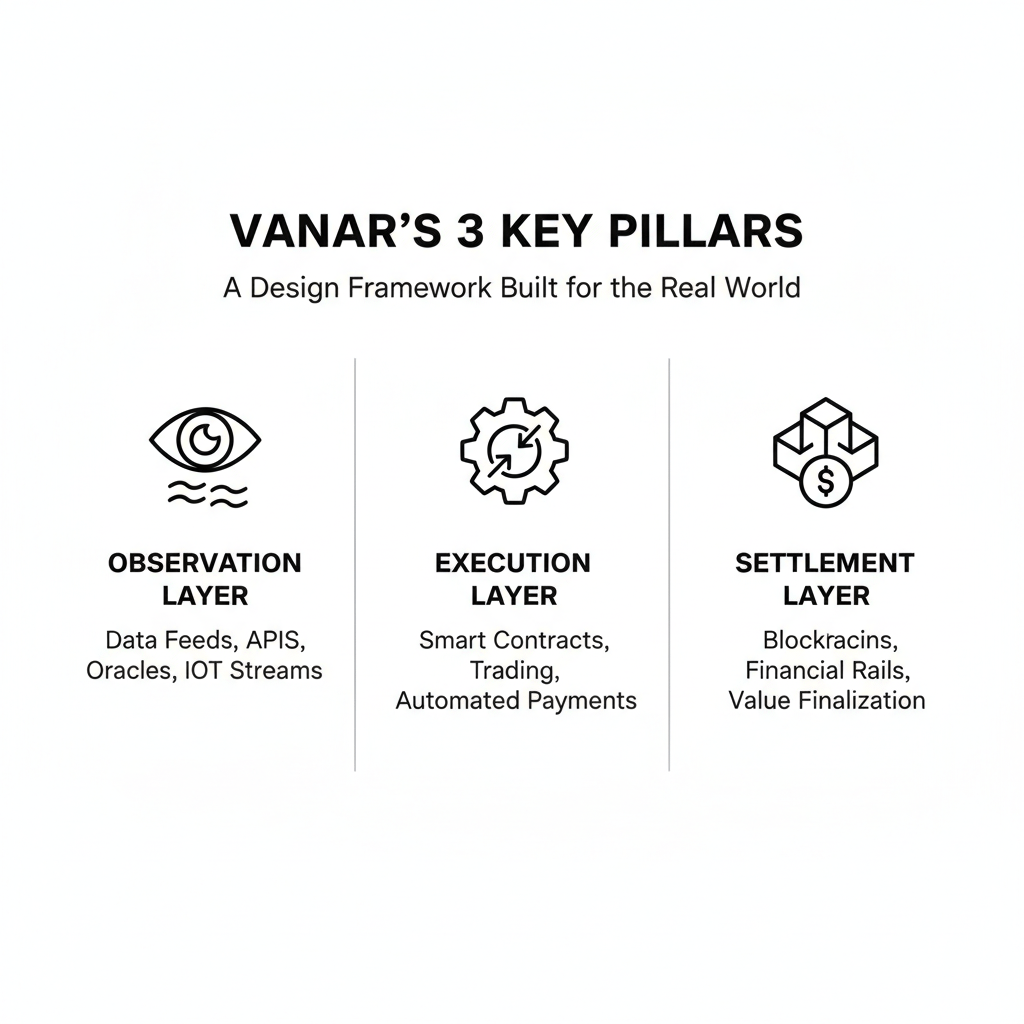

From what I’ve seen,there are three layers where AI interacts with reality.First, the observation layer:data feeds,APIs,oracles, IoT streams all the stuff that gives AI its inputs.

Second, the execution layer: smart contracts, trading platforms, automated payment systems that turn decisions into real action.Third, the settlement layer: blockchains or financial rails that actually finalize the exchange of value.Crypto matters now because it lets yousettle,programmatically,with no middleman. That’s where Vanar Chain fits in.

Why Vanar Chain Actually Works

Vanar Chain calls itself an AI ready Layer 1, and that label holds up when you look at these three layers.AI agents that run on their own need a network that’s reliable, predictable,and can settle value at scale.

If the network slows down or fees spike without warning,AI strategies fall apart. These systems need rock solid infrastructure. What I like about Vanar Chain is that they focus on getting the basics right not just selling a story.

In compute marketplaces,automated trading, and cross chain operations,the value has to move fast and securely.A blockchain that nails settlement is basically the backbone for machine to machine economies.

What’s Changing Right Now

We’re already seeing early versions of this:AI bots doing arbitrage,automated portfolio balancing,compute markets where payments unlock inference.These are just the first steps.

The real shift comes when AI can pay without waiting for a human to sign off.Imagine an AI that spots a shipping deal,books capacity with a smart contract,pays instantly,and updates the route all by itself.That’s when blockchain isn’t just helpful,it’s essential.

Risks You Don’t Want to Miss

Let’s not sugarcoat it letting AI handle payments brings real risks.Oracle manipulation,adversarial attacks,runaway feedback loops,regulatory gray zones.When an AI becomes another player in the market, you have to ask:who’s in charge here?

That’s why building safe action layers matters.AI should operate within hard boundaries.The blockchains that win will be the ones that balance scale with strong, programmable guardrails.

Where I Stand

This whole AIcrypto intersection isn’t about hype anymore.It’s about making trustless execution possible.Blockchains solve the settlement problem,but the next step is making those settlements safe for autonomous actors.

I see Vanar Chain moving in the right direction here.It’s not just about speed or slick branding it’s about getting ready for a world where AI agents run their own transactions.

If you want to see where AI and crypto really meet,don’t just chase the headlines.Watch the payment rails and execution engines. That’s where the real value is being built,and it’s happening right now.