If you’ve been around crypto long enough, you’ve seen the cycle: a new Layer 1 shows up, promises “performance,” and then real traders run into the same old bottlenecks slow confirmation, jittery latency, fees that spike at the worst possible time, and dev stacks that feel like you’re fighting the chain more than building on it. Fogo is getting attention because it’s trying to attack that entire bundle of problems at once: make the chain fast enough for serious on chain trading, keep the user experience simple, and reduce the friction developers hit when they’re shipping real DeFi products.

At its core, Fogo is a high performance Layer 1 built around the Solana Virtual Machine, usually shortened to SVM. If you’ve never touched Solana: the SVM is basically the execution environment where programs (smart contracts) run. “SVM compatible” matters because it can shrink the “learning a whole new chain” tax for developers tooling, patterns, and sometimes even code paths feel familiar compared to starting from scratch on a brand new VM design. Fogo’s docs are explicit about that: it’s based on Solana’s architecture and keeps full compatibility with the SVM.

Now for the part traders care about: speed. Fogo has been positioning itself around extremely low latency, with targets like ~40 millisecond block times and around 1.3 seconds to finality being widely cited in ecosystem explainers. Put that in human terms: the chain is trying to feel less like “submit and pray” and more like a venue where timing actually makes sense for order books, auctions, and liquidations things that get messy when the network is slow or inconsistent. And Fogo is pretty direct about those use cases: on chain order books, real-time auctions, precise liquidation timing, and reduced MEV extraction are literally the examples it leads with.

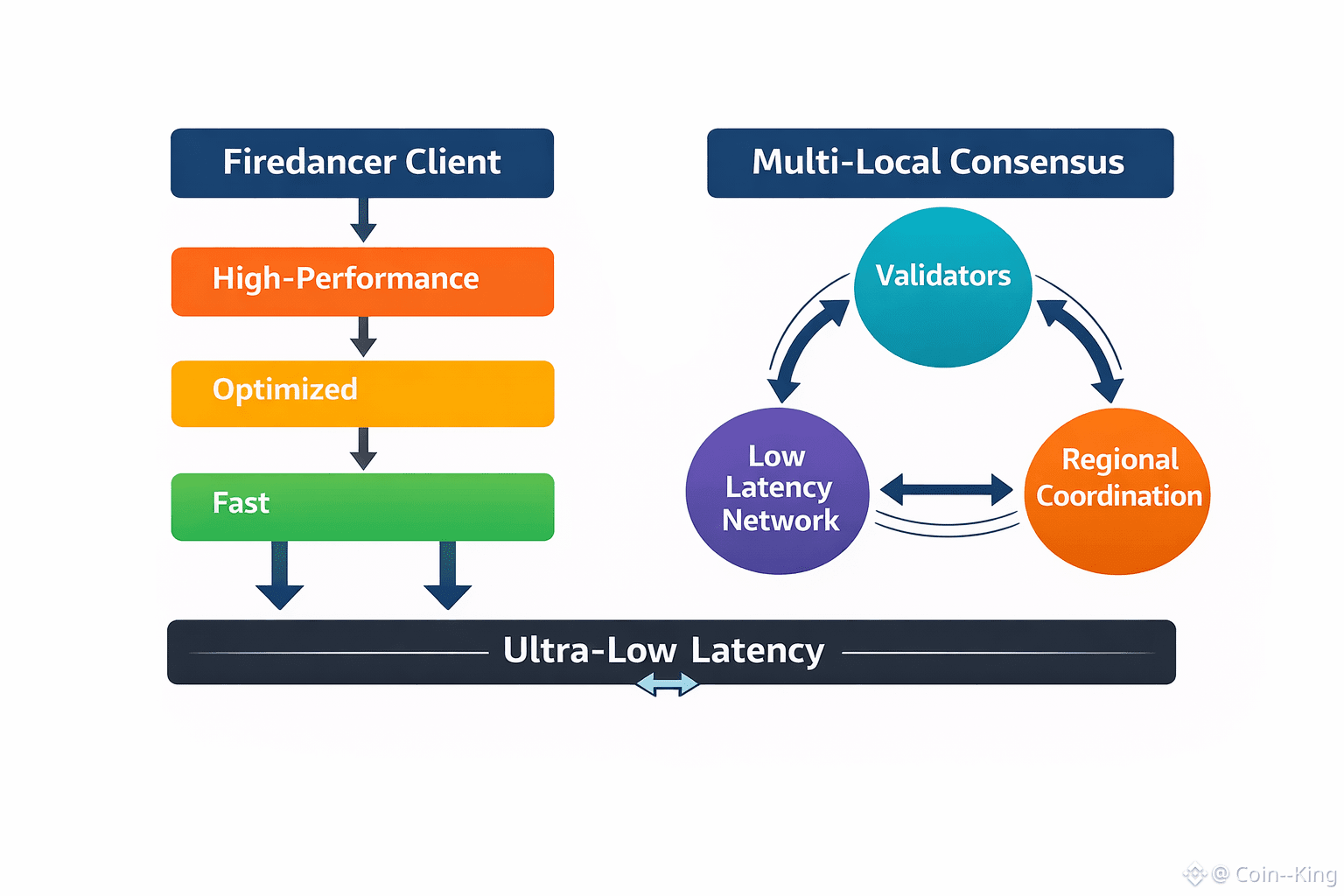

So what’s under the hood that’s supposed to make this real? Two phrases keep coming up: Firedancer and “multi local consensus.” Firedancer is a high performance Solana client implementation (think: a different engine for running the network). Fogo says its client is based on Firedancer, and that’s not a cosmetic detail client performance is where a lot of “fast chain” claims either become real or fall apart. Multi local consensus, as Fogo describes it, is about achieving minimal latency by coordinating across locations in a way that’s designed for speed, not just theoretical decentralization points. The tradeoff is worth stating plainly: when an L1 optimizes hard for latency and execution predictability, it often makes deliberate choices about validator requirements, networking, and how “wide” participation can realistically be. That doesn’t make it bad, but it does shape what kind of chain it is.

Where Fogo gets especially interesting especially if you’ve ever built or shipped DeFi is its focus on reducing day to day friction. One example that’s been highlighted is “Fogo Sessions,” an approach aimed at making dApp interaction smoother, including a more “gasless” or less interruption heavy flow for users in certain contexts. If you’re a trader, this is the difference between a venue that feels usable during volatility and one that feels like a tax on every click. If you’re a developer, it’s the difference between spending your week on product and spending your week on wallet UX edge cases and transaction babysitting.

It’s also trending because it’s not emerging in a vacuum. Multiple writeups tie Fogo’s development to Douro Labs, the team behind Pyth Network, which instantly gives it more credibility with market participants who care about trading-grade infrastructure. And unlike many “coming soon” L1s, there’s been visible progress over a real timeline. Public testnet access has been discussed since mid-2025 in ecosystem coverage, and the conversation shifted sharply in late 2025 into early 2026 around mainnet readiness and launch status. One nuance: different sources describe the “mainnet” moment differently some talk about an earlier mainnet date, while others frame January 2026 as the public mainnet push with broader availability and app activity. That’s pretty normal in practice: networks sometimes have phased launches (validators and core plumbing first, broader ecosystem later), but as a trader or builder you should always check what’s actually live versus what’s still being ramped.

From an investor/trader lens, I look at Fogo as a bet on one specific thesis: on chain trading becomes more like real markets when latency stops being a joke. If you want fully on chain order books to compete with fast venues, the base layer can’t feel like it’s running through molasses. If you want liquidations to be fairer, you need predictable timing. If you want MEV to be less of a constant bleed, you need execution that’s harder to game just because someone’s closer to the next block. Fogo is basically saying, “let’s build the chain around those realities,” rather than treating them as downstream problems.

The beginner takeaway is simple. Fogo is an SVM compatible Layer 1 aimed at ultra low latency DeFi, using a Firedancer based client and a consensus approach designed to minimize delay, while also trying to make usage and development feel less painful than the usual L1 experience. Whether it becomes a real hub or stays a niche venue will depend on the boring stuff that matters: uptime, ecosystem migration, liquidity, and whether developers actually feel that promised reduction in friction when they ship production apps. But as of early 2026, it’s on traders’ radar for a straightforward reason speed isn’t a vanity metric when timing is the product.