📢 A Paradigm Shift in US Finance? Indiana Just Lit the Fuse! 📢

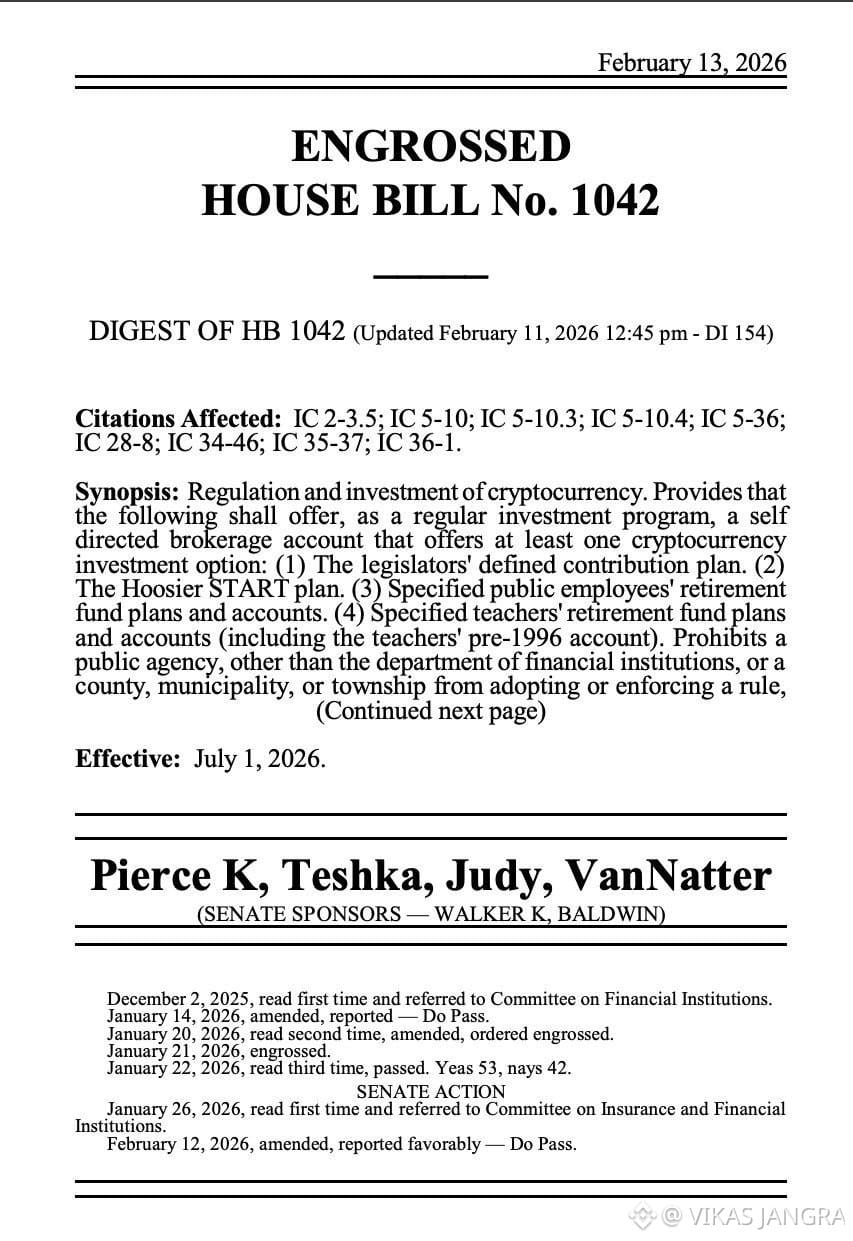

The financial world is abuzz, and rightly so. The Indiana Senate Committee has just advanced House Bill 1042 (HB 1042), a legislative masterpiece poised to profoundly reshape how Americans, particularly state employees, engage with cryptocurrency. This isn't just another crypto headline; it's a deep dive into the strategic integration of digital assets into the very fabric of state finance and individual economic freedom.

What's Under the Hood of HB 1042? A Triple Threat of Innovation

This landmark bill is far more comprehensive than a simple nod to crypto. It’s a multi-faceted approach designed to foster crypto adoption, protect users, and empower individuals.

1. The Retirement Revolution: Crypto in Your Pension?

Perhaps the most groundbreaking aspect of HB 1042 is its direct impact on retirement planning. The bill paves the way for a future where:

Legislators' Defined Contribution Plans: Those serving in Indiana's state legislature could soon have the option to include a self-directed cryptocurrency investment program in their retirement portfolios.

Public Employees' Retirement Funds: This extends to specified public employees, offering them the same opportunity to diversify their long-term savings with digital assets.

Teachers' Pre-1996 Account: Even a specific cohort of teachers' retirement accounts stands to benefit, marking a broad-based approach to crypto integration across various public service sectors.

Imagine this: A portion of your hard-earned pension, historically tied to traditional assets, now has the potential to grow with Bitcoin, Ethereum, or other leading cryptocurrencies. This move isn't just about offering an option; it's about legitimizing crypto as a viable, long-term asset class for wealth preservation and growth, directly challenging the conventional wisdom of financial planning.

2. Bolstering Crypto Rights & Protections: A Shield for Digital Asset Users

HB 1042 doesn't stop at investments. It's a robust framework designed to create a "crypto-friendly" environment by:

Protecting Mining Operations: Local governments will be prohibited from enacting ordinances that ban or significantly restrict crypto mining in areas zoned for industrial use. This provides legal certainty and encourages the growth of the vital mining infrastructure.

Legalizing Digital Asset Payments: The bill explicitly legalizes the right to use digital assets as a form of payment for goods and services, fostering their utility and mainstream acceptance in daily transactions.

Safeguarding Private Keys: Critically, it protects individuals by stating that courts cannot compel a person to produce their private keys or seed phrase unless there's no other practicable means to access the digital assets. This is a significant win for privacy and digital sovereignty.

By enshrining these protections into law, Indiana is positioning itself as a beacon for crypto innovation, attracting businesses and individuals who value digital freedom and economic opportunity.

3. The "Self-Directed" Smart Money Twist: A Lesson in Prudence

While the initial headlines might scream "institutional FOMO," a closer look reveals a strategic nuance. The bill was amended to remove direct investment by state pension funds for now. This isn't a retreat; it's a calculated move.

Institutional Caution: It suggests that while the state acknowledges crypto's potential, direct allocation from state-managed funds will wait for further market maturation and regulatory clarity. Institutions, often slow-moving giants, prefer a de-risked environment.

Individual Empowerment: By focusing on "self-directed" investment programs, Indiana is empowering individuals within the state's retirement system to make their own choices. This puts the responsibility and the potential rewards directly in the hands of the participants, allowing for personal risk assessment and portfolio customization.

This "smart money twist" teaches us a valuable lesson: Even large institutions, when entering a nascent asset class like crypto, prioritize risk management. They are creating the framework for adoption, while allowing individual conviction to drive the initial capital flow.

My Takeaway: The Road Ahead for Crypto Adoption

Indiana's HB 1042 is far more than a local legislative event; it's a powerful signal reverberating across the United States and the global financial landscape.

Validation of an Asset Class: This move unequivocally validates cryptocurrency as a legitimate and increasingly recognized asset class for long-term wealth building, moving it beyond speculative trading.

Paving the Way for Others: As Indiana takes this bold step, it sets a precedent that other states and even federal entities will undoubtedly observe and potentially emulate. The dominoes of mainstream adoption are indeed beginning to fall.

Empowerment of the Individual: By prioritizing self-directed investment and user protections, the bill champions individual financial freedom within a regulated framework.

The integration of crypto into traditional financial vehicles like retirement funds is not a matter of if, but when. Indiana has just given us a glimpse into that future. As investors, staying informed about these legislative developments is crucial. They are the undercurrents that will shape the next bull run and the long-term trajectory of the crypto market.

Are you ready to adapt your investment strategy to this evolving landscape? The future of finance is here, and it's decentralized.