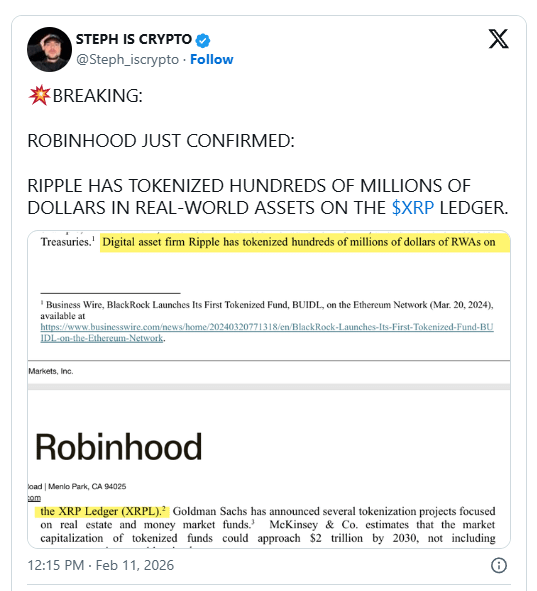

$XRP Ripple has completed a significant milestone by tokenizing hundreds of millions of dollars in real-world assets (RWAs) on the XRP Ledger (XRPL). Robinhood confirmed this development in a recent report. The move positions XRP as a key platform for large-scale digital asset operations.

Tokenization allows physical and financial assets to be represented digitally. By placing RWAs on the XRPL, Ripple enhances transparency, efficiency, and liquidity for investors.

Robinhood has previously highlighted Ripple’s success in the tokenization space. This new confirmation signals increasing adoption of XRP for serious financial operations beyond traditional cryptocurrency trading.

👉XRP Ledger Gains Institutional Recognition

The XRPL has seen growing interest from institutional players. Ripple’s efforts highlight its potential to handle large-value transactions reliably. This is consistent with broader trends in which major financial firms explore tokenization for assets, such as real estate, money market funds, and treasuries.

Steph Is Crypto (@Steph_iscrypto) emphasized the scale of Ripple’s achievement, noting that this move could open new avenues for investment and capital deployment. By integrating RWAs onto the XRPL, Ripple demonstrates the ledger’s capability to support complex financial structures without compromising speed or security.

👉Ripple’s Role in Expanding Tokenized Markets

Other firms have also entered the tokenization space. The image Steph shared revealed that Goldman Sachs has launched several projects focused on real estate and money market funds. Analysts, including McKinsey & Co., estimate that tokenized fund capitalization could reach $2 trillion by 2030, not counting other asset classes.

Ripple’s activity, however, stands out because of its operational scale and the adoption of the XRPL. The network’s ability to manage large volumes of tokenized assets makes it a strategic option for financial institutions seeking efficiency in settlement and reporting.

👉Potential for Increased Liquidity and Market Integration

By tokenizing hundreds of millions of dollars in RWAs, Ripple opens the door to broader participation from institutional and retail investors. Tokenization on the XRPL can reduce transaction costs, accelerate settlement times, and create new liquidity channels for assets traditionally limited to select investors.

This move also strengthens XRP’s position as a foundational digital asset. Its use in high-value tokenization projects demonstrates that the network can support both speculative trading and practical financial applications.

👉What’s Next for Ripple and XRP?

Robinhood’s report confirms that the XRPL is not only a medium for cryptocurrency transactions but also a viable platform for tokenized real-world assets. As Ripple grows its tokenized asset offerings, XRP’s relevance in the global financial system is expected to increase.

Investors may view the ledger as a critical tool for bridging traditional finance and digital markets, signaling a new phase of adoption and innovation for the network.

🚀🚀🚀 FOLLOW BE_MASTER BUY_SMART 💰💰💰

Appreciate the work. 😍 Thank You. 👍 FOLLOW BeMaster BuySmart 🚀 TO FIND OUT MORE $$$$$ 🤩 BE MASTER BUY SMART 💰🤩

🚀🚀🚀 PLEASE CLICK FOLLOW BE MASTER BUY SMART - Thank You.