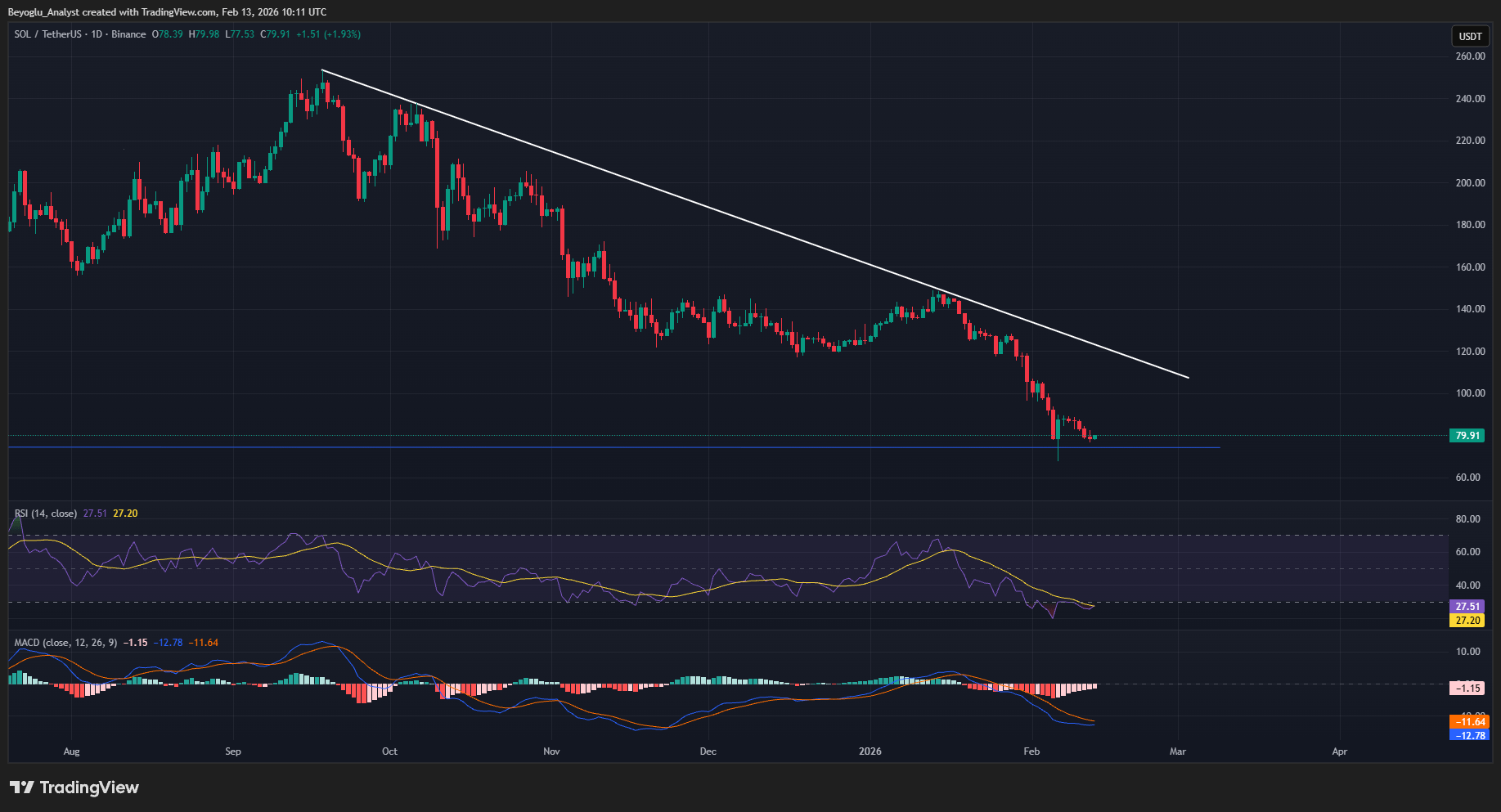

The Solana ($SOL ) was facing decline since 14 January 2026 after getting rejection from descending trend line at $140. Now the momentum in SOL is going to change from bearish to Bullish.

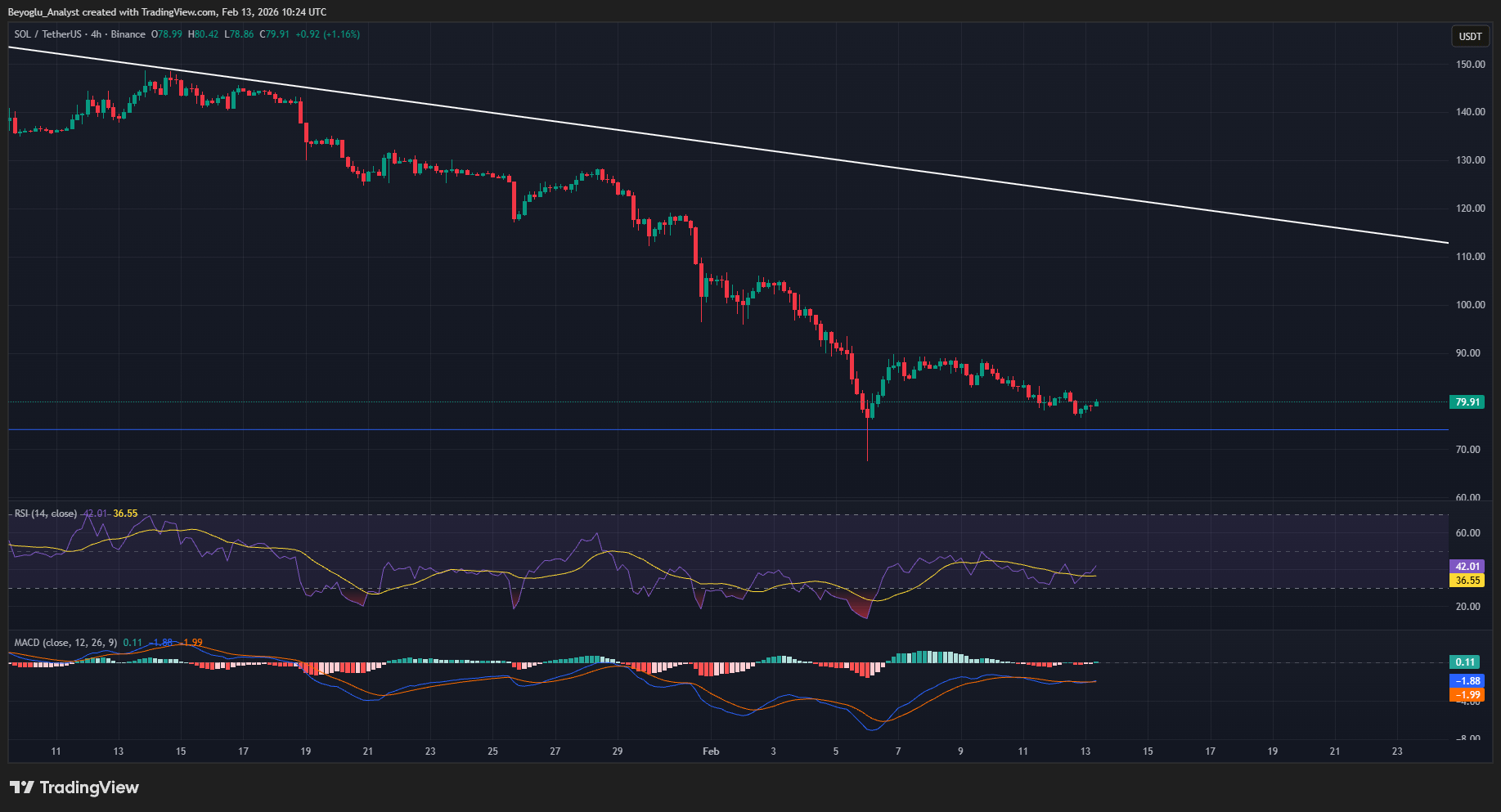

SOL is consolidating above the support price level drawn from the low of 22 February of 2022 near $74. SOL is forming a double bottom on 1 Day and 4 hour timeframe indicating that the the momentum can shift from bearish to bullish.

If SOL will start rebound from here, My Target of SOL for this month is $120. where it will again retest the descending trend line.

A Breakout above this descending trend will help SOL to extend the price recovery towards $150.

However a rejection again from $120$ can result in the fall of price again to $97.

The Relative Strength Index RSI is at 28 under the over sold territory, aiming upward indicating that the bearish momentum is getting weaker and the price could sustain an upward rally. While Moving Average Convergence Divergence MACD signaling bullish momentum, As orange line is aiming downward and the blue line is aiming upward and they are near to make bullish crossover. If this happen we can expect a strong price rally in SOL towards 150$.

On 4 Hours timeframe SOL has already showing the increase is demand and the prices has start surge. The RSI has been out from oversold region aiming upward indicating that the bearish momentum is fading away. And the Moving Average Convergence Divergence MACD has already made bullish Crossover on 4 hour Timeframe.

P.s These are my personal point of views not a finance advice before taking any decision make sure to do your own research.