While most people are glued to red candles and panic posts, Binance is quietly doing something that matters.

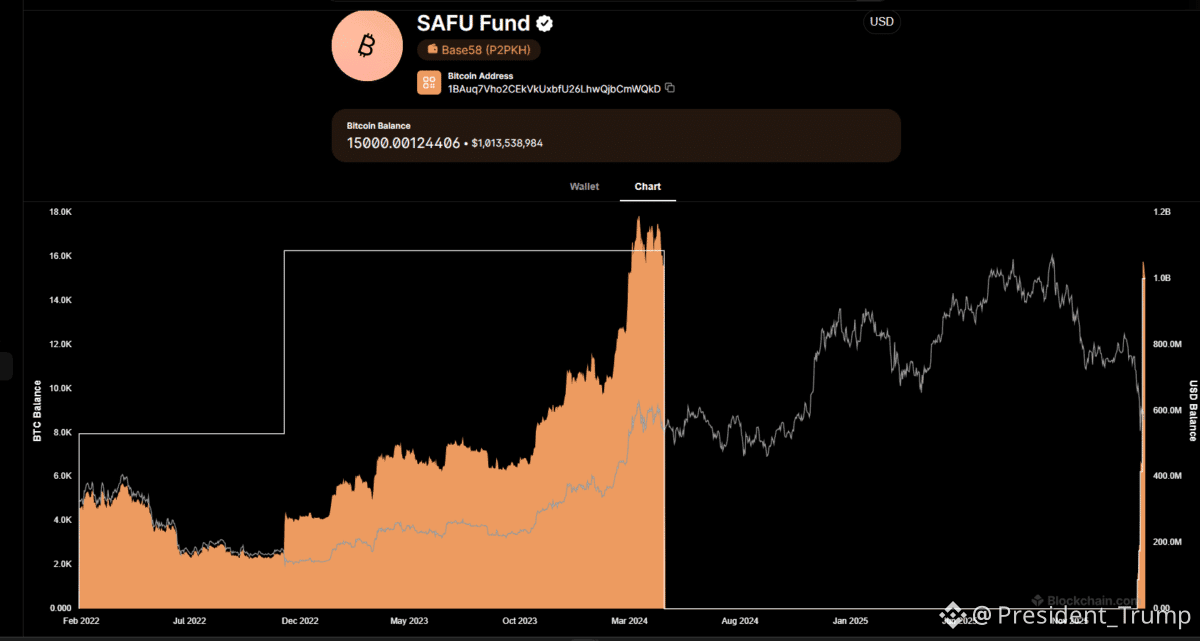

On February 9th, Binance added 4,225 BTC (almost $300 million) to its SAFU fund.

Then on February 12th — another move.

Binance SAFU Fund bought 4,545 BTC worth $304 million.

That brings total SAFU holdings to 15,000 BTC.

That’s roughly $1 BILLION in Bitcoin sitting there as user protection.

Let that sink in.

What Is SAFU (And Why This Matters)

SAFU stands for Secure Asset Fund for Users.

Binance created it back in 2018 as an emergency reserve — protection in case of hacks or unexpected events.

For years, most of that reserve sat in stablecoins like USDC and BUSD.

But in January 2026, Binance made a bold shift:

They decided to convert the entire $1 billion SAFU fund into Bitcoin.

Not in one reckless buy.

Not to pump price.

But slowly and strategically.

And now? The transition is complete.

This Isn’t Emotional Buying

There’s something important here.

Binance also committed that if the SAFU fund drops below $800 million, they will top it back up to $1 billion.

That’s not short-term speculation.

That’s structured conviction.

They’re not trading.

They’re positioning.

Déjà Vu?

Back in 2023, during heavy market stress, Binance shifted nearly $1 billion into BTC, ETH, and BNB.

Soon after, the market stabilized.

Now in 2026, they’re going even stronger — focusing mainly on Bitcoin.

That sends a clear message:

When it comes to long-term reserve strength, Binance trusts Bitcoin the most.

While the Market Pulls Back…

Bitcoin is hovering around the high $60Ks.

Fear is louder than optimism.

Retail sentiment is cautious.

But the largest exchange in the world just locked in 15,000 BTC for long-term protection.

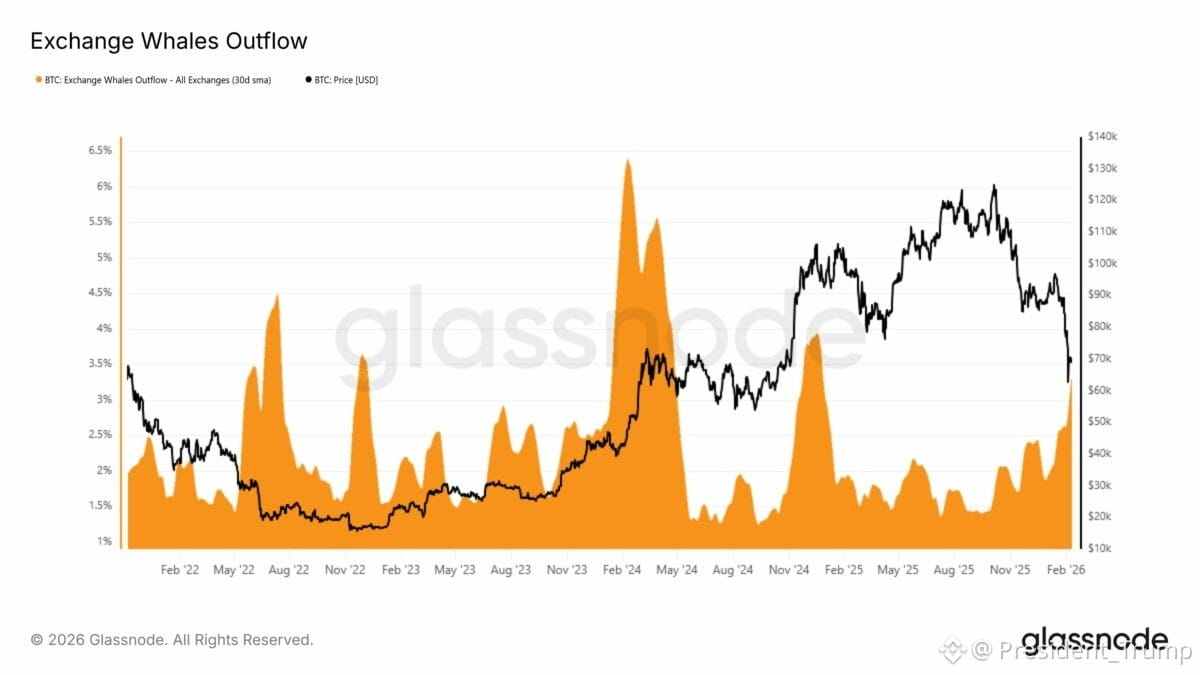

The biggest players don’t wait for green candles.

They build during weakness.

So ask yourself honestly:

Are you reacting to price?

Or are you paying attention to what the strongest hands are doing behind the scenes? 👀