$XRP Infrastructure milestones in digital finance rarely arrive with dramatic fanfare, yet they often carry the greatest long-term significance. When a major global exchange expands support for a new settlement asset, the decision quietly reshapes liquidity flows, market accessibility, and institutional confidence in the underlying blockchain.

A fresh development surrounding the XRP Ledger reflects exactly this kind of structural progress and signals growing momentum for regulated stablecoin adoption within mainstream crypto markets.

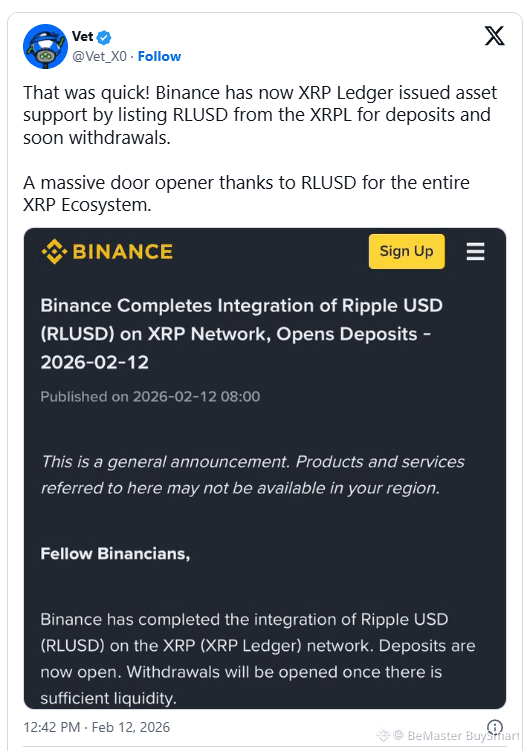

Details highlighted by Vet draw attention to a February 12, 2026, confirmation from Binance that RLUSD issued on the XRP Ledger is now integrated for deposits, with withdrawals expected once sufficient liquidity develops.

The update represents more than a routine technical addition. It expands real-world access to XRP Ledger–based dollar liquidity through one of the deepest trading venues in the global digital-asset ecosystem.

👉Expanding Liquidity and Market Access

Exchange integration determines whether blockchain assets achieve practical relevance beyond theory. By enabling RLUSD deposits, Binance connects a regulated dollar-pegged instrument to vast global trading activity. This bridge allows traders, payment providers, and institutions to move value more efficiently between traditional financial systems and on-chain settlement infrastructure.

Stablecoins serve as the main medium of exchange in crypto markets, so broader availability typically accelerates adoption of the networks that host them. RLUSD’s presence on a leading exchange, therefore, strengthens the XRP Ledger’s role not only as a payment rail but also as a liquidity environment capable of supporting continuous financial activity.

👉Strategic Momentum Behind RLUSD

The listing also reflects the broader direction of Ripple as it advances regulated digital-liquidity solutions. RLUSD aims to support enterprise-grade use cases such as cross-border settlement, treasury coordination, and tokenized asset trading, all of which depend on deep and reliable liquidity.

Exchange connectivity becomes essential in this framework because institutions require predictable execution and seamless conversion between fiat-linked assets and blockchain networks.

By achieving integration tied directly to XRP Ledger issuance, RLUSD moves closer to operating as a functional financial infrastructure rather than a purely experimental stablecoin.

👉A Broader Signal for Ecosystem Maturity

Market history shows that exchange support often marks turning points in adoption cycles. When a global platform enables deposits and prepares withdrawal functionality, it signals technical confidence, readiness for compliance, and measurable demand. These signals can encourage custodians, fintech platforms, and institutional participants to explore the same settlement rails.

Binance’s RLUSD integration, therefore, represents more than a single listing event. It reflects a gradual convergence between regulated stablecoins, exchange liquidity, and blockchain settlement efficiency. As digital finance continues to merge with traditional monetary systems, developments like this quietly define which networks stand ready for real-world scale.

🚀🚀🚀 FOLLOW BE_MASTER BUY_SMART 💰💰💰

Appreciate the work. 😍 Thank You. 👍 FOLLOW BeMaster BuySmart 🚀 TO FIND OUT MORE $$$$$ 🤩 BE MASTER BUY SMART 💰🤩

🚀🚀🚀 PLEASE CLICK FOLLOW BE MASTER BUY SMART - Thank You.