The cryptocurrency market is currently experiencing significant volatility, with overall momentum waning as traders shift toward caution and reassess risk. Bitcoin, the primary liquidity barometer for the digital asset ecosystem, is moving within volatile ranges, reflecting a consolidation phase after periods of sharp fluctuations. This has prompted some liquidity to seek alternative opportunities in specific sectors, most notably lending and borrowing.

Over the past few days, data has shown a notable increase in spot trading volumes for major lending-protocol tokens, potentially indicating a gradual return of interest in this sector. These tokens give holders governance rights and platform benefits such as better borrowing rates, higher yields, or fee discounts, tying their demand to activity within the ecosystem. Such rotation toward utility-driven assets often emerges during periods of market stagnation. When directional conviction weakens, investors often shift from outright exposure toward balance-sheet management strategies, seeking liquidity, capital efficiency, or yield without fully exiting core positions.

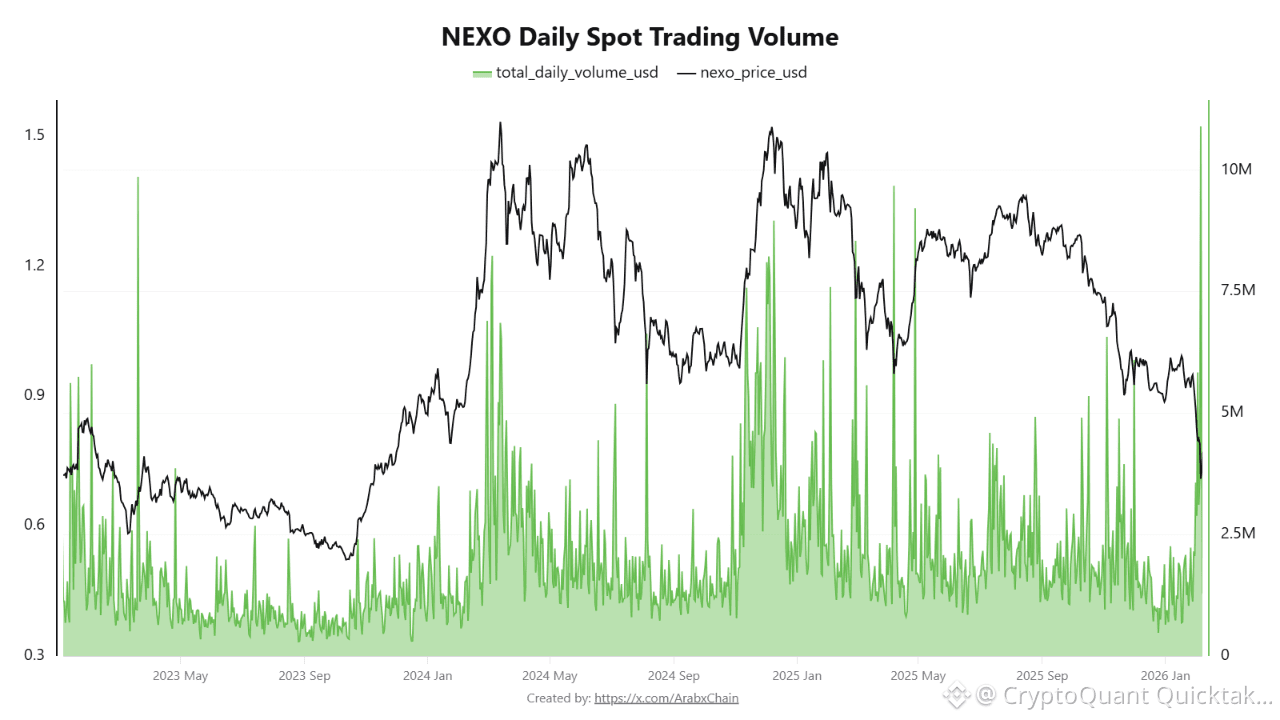

NEXO, the native token of digital assets wealth platform Nexo, recorded approximately $10.9 million in daily trading volume in recent days, the highest level observed in the token’s history, according to available data. This surge may be linked to increased use of the token as collateral or as a liquidity-management tool within the project’s lending ecosystem.

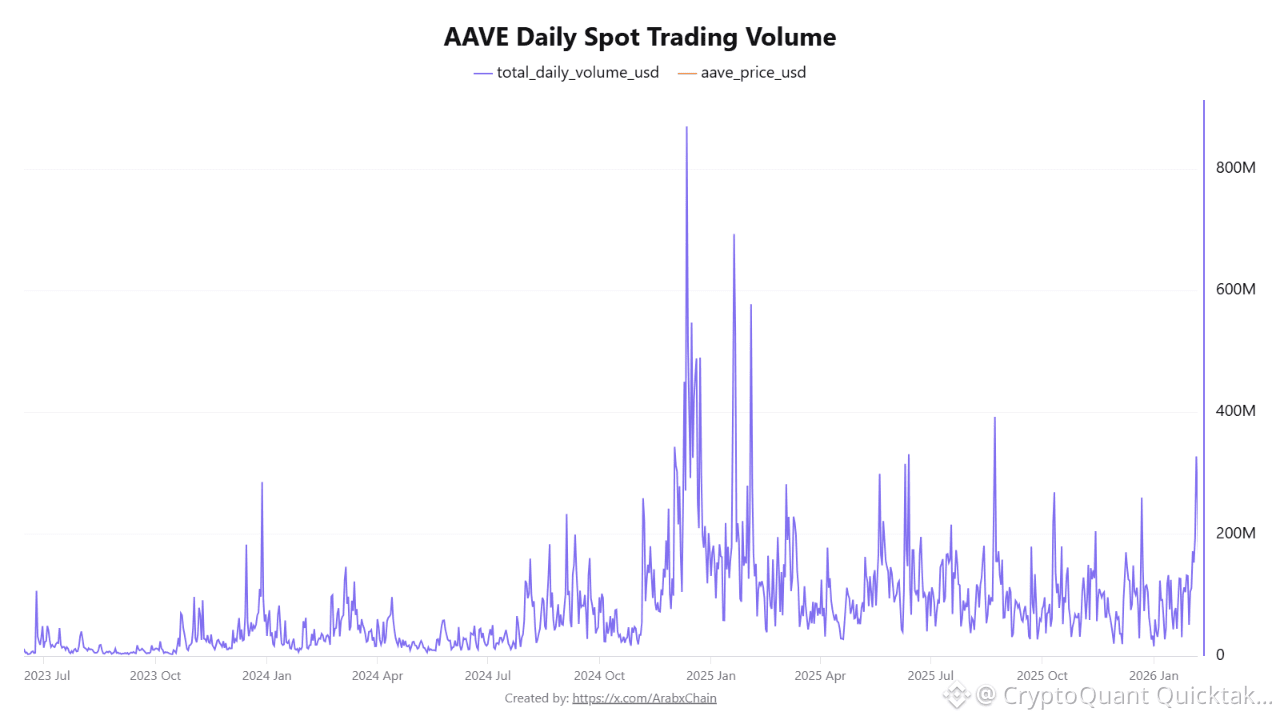

Meanwhile, AAVE saw a significant jump in daily trading volume, reaching approximately $327.8 million in recent days—a notably high level compared with the much lower averages of previous months.

Overall, Bitcoin’s volatility coinciding with rising trading volumes in lending tokens suggests a partial shift in liquidity from major assets toward sub-sectors with a more operational or yield-oriented focus.

Written by Arab Chain