There’s a narrative in crypto that refuses to die:

“Every dip is a buying opportunity.”

I’ve believed that story before.

Most long-time traders have.

And sometimes, in powerful bull cycles, it’s even true.

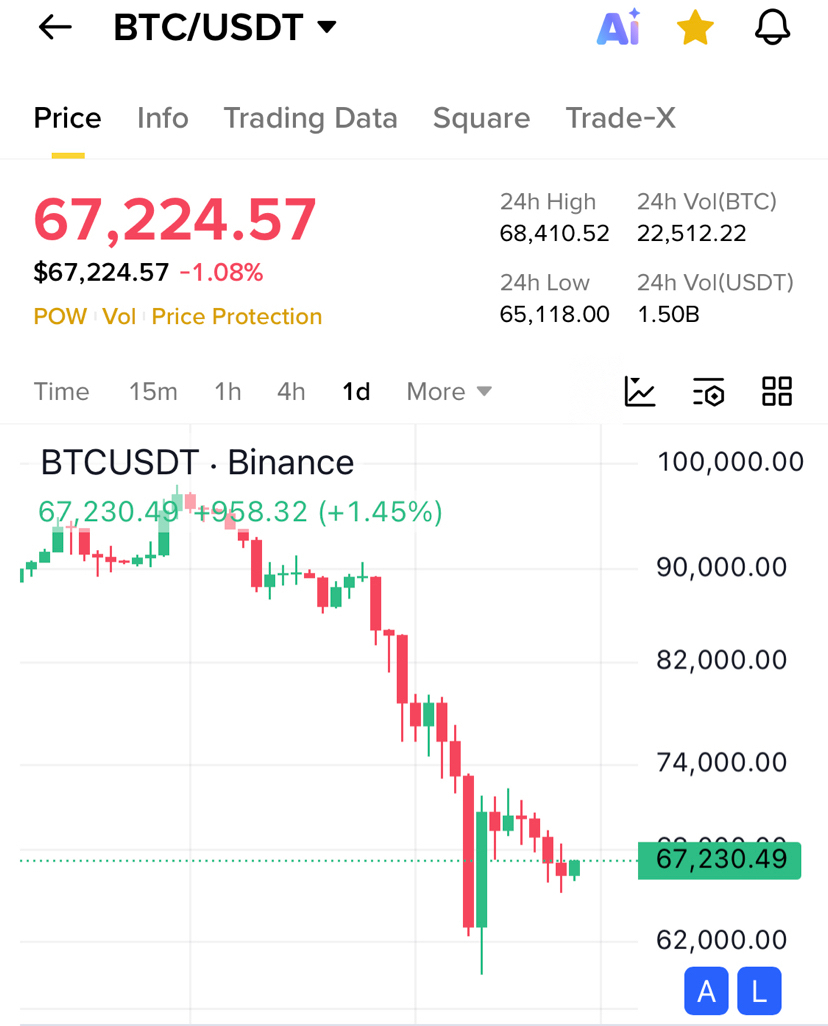

But looking at Bitcoin’s current structure around the mid-$60K range, I’m starting to think the real danger isn’t price weakness — it’s the psychological comfort of assuming recovery is guaranteed.

And that’s a controversial thing to say in a market built on conviction.

The Untouchable Myth of the Eternal Uptrend

Bitcoin has spent more than a decade proving doubters wrong.

Each crash eventually led to a higher high.

Each bear market became a memory.

That history created something powerful — but also dangerous:

A belief that time alone fixes everything.

Markets don’t reward belief.

They reward liquidity, demand, and timing.

If those disappear, history stops being a roadmap and becomes a trap.

What If This Cycle Is Structurally Different?

Here’s the uncomfortable question most people avoid:

What if the next phase isn’t another explosive bull run…

but a long, boring, sideways decade?

Not a collapse.

Not a moonshot.

Just slow capital rotation, weaker volatility, and fading public obsession.

It sounds extreme — but traditional assets often behave exactly like this after maturity.

Parabolic growth rarely repeats forever once an asset becomes mainstream.

And Bitcoin is no longer early.

It’s widely known, widely owned, and heavily financialized.

That changes the game.

Institutions Don’t Need Price Mania

Retail traders dream about vertical candles.

Institutions don’t.

Large capital prefers:

Stability over chaos

Yield over hype

Predictability over narrative

If Bitcoin gradually transforms into a slow, macro-sensitive store of value, the wild upside cycles could naturally shrink.

Ironically, success itself may reduce the explosive gains people expect.

That’s not bearish.

But it’s definitely not the dream most holders signed up for.

The Silent Risk Nobody Talks About

The loud fear in crypto is always a crash.

The quiet fear is worse:

Irrelevance.

Not death.

Not zero.

Just a world where:

Prices drift instead of surge

Attention moves to newer technologies

Holding becomes emotionally exhausting rather than exciting

Financial history is full of assets that didn’t implode —

they simply stopped mattering.

That possibility is far more controversial than any price prediction.

Why This View Makes People Angry

Because crypto isn’t just an investment.

For many, it’s identity, hope, and rebellion combined.

Questioning the endless-bull narrative feels personal.

Almost offensive.

But markets don’t care about loyalty.

They only care about flows of money and attention.

And both can change faster than communities expect.

My Honest Take

I’m not saying Bitcoin is finished.

I’m not saying a new all-time high is impossible.

I’m saying something more uncomfortable:

The future might be less dramatic than both bulls and bears imagine.

No explosion.

No collapse.

Just a slow shift into something… ordinary.

And in a market addicted to extremes,

ordinary might be the most shocking outcome of all.

So here’s the real controversial question:

Would you still hold Bitcoin

if the next 5 years were boring instead of bullish?