I was half-asleep scrolling feeds at 3 a.m. when the first red flags lit up my screen liquidation notifications, panicked threads, screenshots of cascading stop-loss triggers gone wrong. A well-known autonomous trading agent on a major on-chain exchange had executed flawlessly for weeks… until it didn’t. The model hadn’t suddenly become stupid. It had simply lost the thread of its own history. Forgotten the volatility bands it had tightened after last month’s flash crash. Forgotten the user-defined drawdown limits it once respected. Forgotten everything that made it useful beyond a single trade. In under twenty minutes millions in leveraged positions evaporated not from bad prediction, but from perfect amnesia. The agent rebooted clean, innocent, ready for round two. The capital didn’t get that luxury.

That night wasn’t an anomaly; it was a preview. Today’s on-chain AI agents are stateless nomads sharp in the moment, erased the next. Public blockchains optimize for cheap, atomic transactions, not persistent identity or evolving context. Every new session, every redeployment, every context overflow wipes the slate. Developers building with OpenClaw and similar stacks will tell you the same thing when the hype filters are off: raw intelligence is no longer the scarce resource. Memory is. Agents can solve differential equations or generate flawless code snippets in isolation, yet collapse when asked to maintain a multi-week DeFi hedging strategy or track provenance across tokenized real-world assets. One forgotten parameter and the whole position unravels. We celebrate “agent swarms” and “on-chain cognition,” but what we ship is a cognitive downgrade: dazzling short-term contractors instead of a dependable, compounding crew.

The cost compounds quietly. Redundant KYC and compliance checks burn gas. Lost personalization forces suboptimal risk settings. Forgotten audit trails turn RWAs into legal minefields. The market races toward viral demos agents that paint, rap, or meme while sidestepping the harder truth: real economic value requires agents that remember yesterday so they don’t repeat tomorrow’s mistakes. Without that continuity we stay trapped in toy territory, forever proving capability instead of delivering reliability.

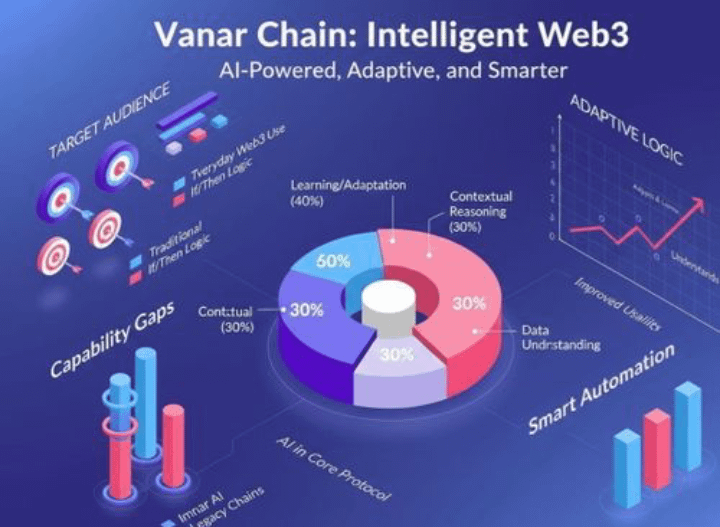

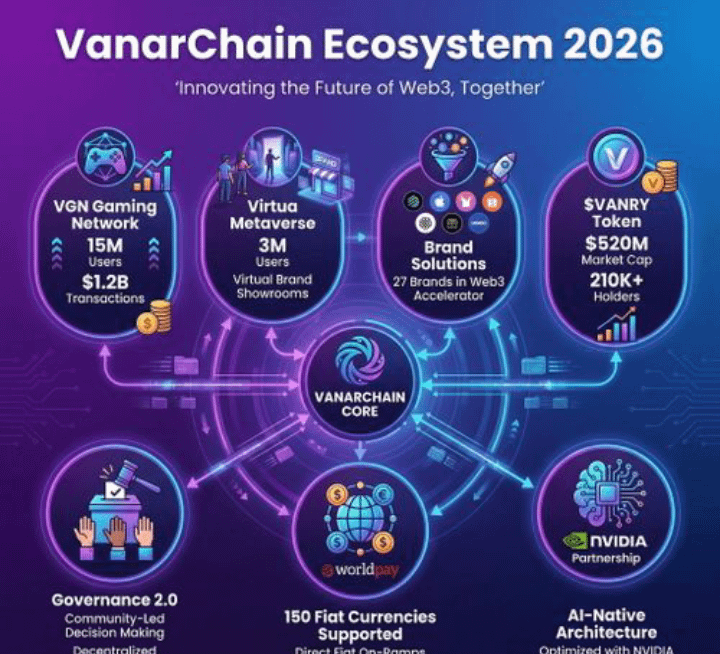

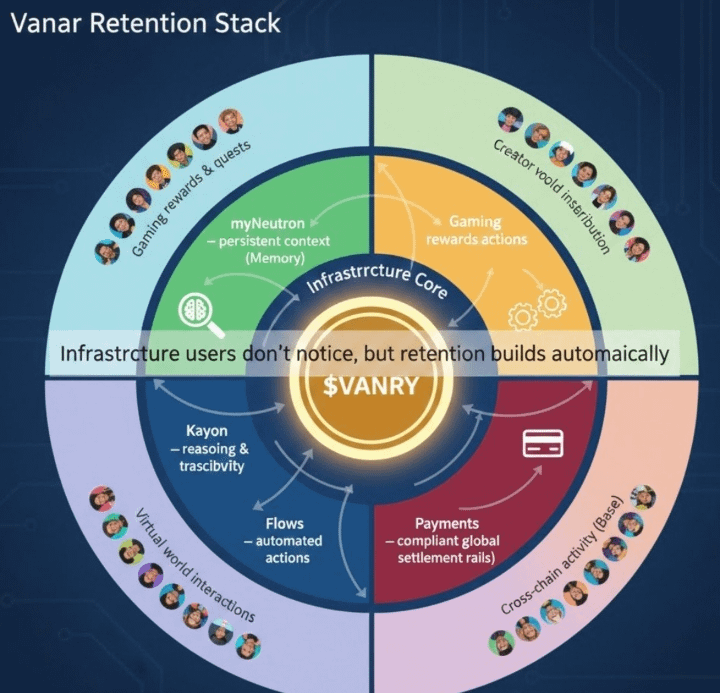

Vanar Chain ($VANRY) never pretended to be the loudest story in crypto. It didn’t need to. It built directly against the fracture exposed in that cascade: an AI-native Layer 1 where verifiable compute and durable memory are not add-ons but bedrock. Neutron, the semantic compression layer, takes sprawling datasets execution logs, compliance artifacts, strategy evolutions and compresses them into tiny, cryptographically anchored Seeds. These aren’t throwaway vectors; they’re ZK-proven, on-chain objects agents can trust and reference without centralized crutches.

Kayon brings reasoning on-chain so agents can natively interpret, validate, and act on those Seeds no off-chain black boxes, no trust leaks. The Neutron → OpenClaw integration, which dropped into production just days ago, turns theory into builder reality: grab the API key, hook the SDK, and agents suddenly inherit persistent, cross-session context that survives restarts, forks, even catastrophic failures. What used to be fragile one-shot executions become compounding machines refining DeFi arbitrage from historical slippage patterns, preserving unbroken RWA ownership chains, orchestrating PayFi flows that span months without amnesia-induced blowups. This is intelligent compound interest made concrete: every verified decision becomes capital that earns more capital.

The direction carries weight beyond tech. Human advancement has always depended on external memory we could control and carry forward merchant ledgers that survived shipwrecks, family recipe books passed down generations, personal hard drives holding decades of drafts. When those anchors disappear, progress fractures. Vanar extends the same principle to autonomous agents: honor every interaction, make it verifiable and portable, transform every scar into structural strength instead of erasure. In a space hypnotized by the next shiny demo, this insistence on persistence feels almost contrarian dignity granted to experience, endurance chosen over ephemera.

Mid-February 2026 and the charts still don’t reflect that depth. $VANRY lingers in the low $0.006 zone, daily volume a trickle, price action flatter than forgotten asphalt. No influencer megathreads, no manufactured FOMO, no narrative sugar to keep retail engaged. Sentiment drifts toward apathy; holding through the silence can feel like slow, physiological exhaustion punishment for building tools instead of theater.

Yet this is classic infra winter. Pain-point solutions don’t need constant spotlight to survive they survive through adoption. Once agents anchor memory in Neutron Seeds or reasoning in Kayon, the switching cost becomes existential: abandoning verifiable history means restarting every proof, losing every compound edge, breaking every long-running workflow. That creates path dependency stronger than any pump group. Bear markets aren’t merciful, but they’re clarifying: they incinerate narrative fluff and quietly reward the chains that enable actual throughput gas burn, subscription mechanics, ecosystem lock-in while everything else fades.

In 2026, whoever can make AI agents verifiably remember carry experience forward, execute without repeated amnesia, generate sustained economic value instead of one-shot spectacle will hold the ticket to the agent economy that endures. Vanar isn’t selling visions. It’s constructing the verifiable spine so agents can finally learn from the millions they’ve already cost us.

What agent memory failure has stung you the most so far? Are you beginning to treat continuity as the real non-negotiable?