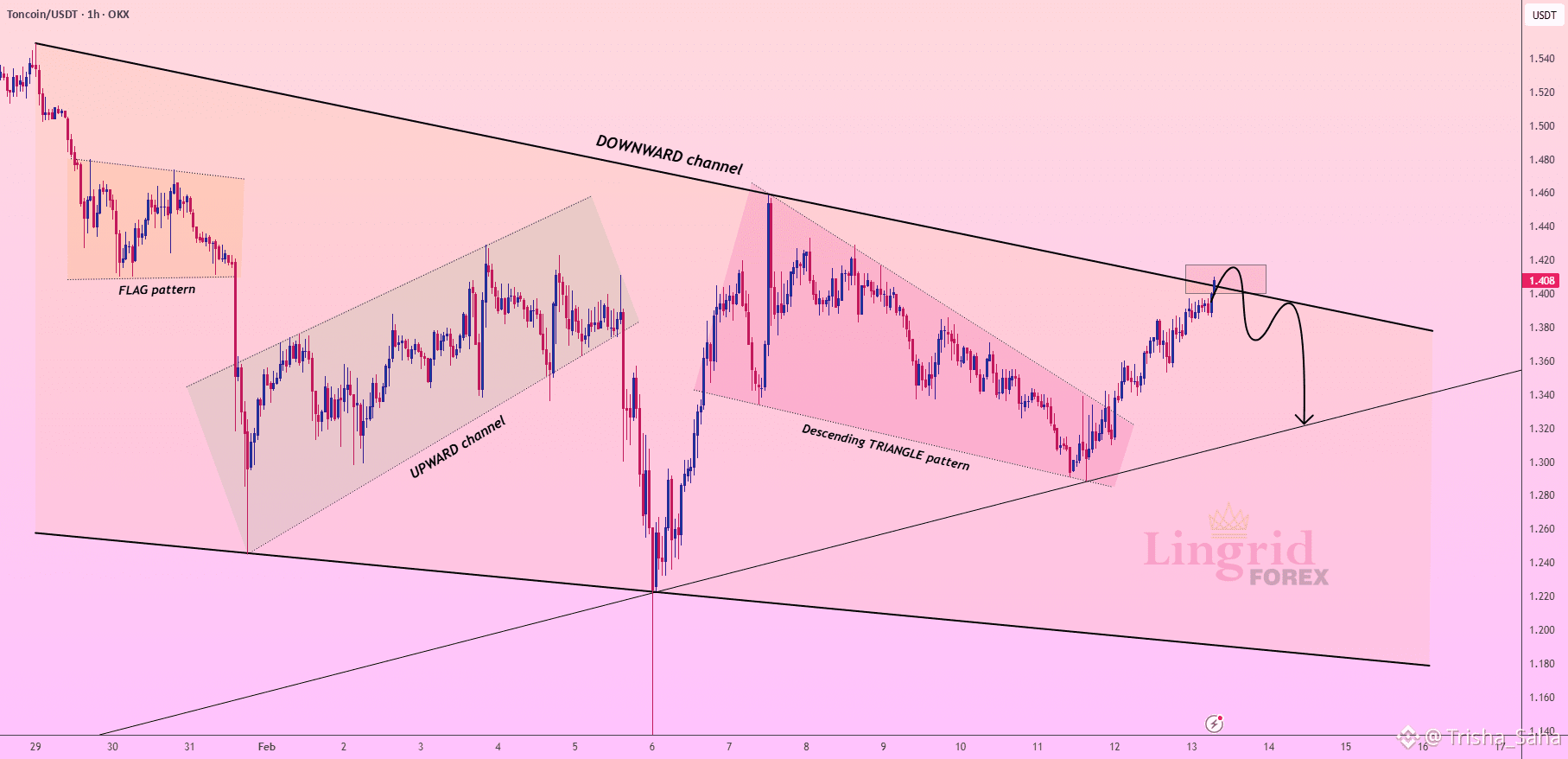

TONUSDT perfectly played out my previous trading idea. Price is testing upper boundary of a well-defined descending channel, where multiple prior reactions have emerged. The recent advance appears corrective rather, climbing into a confluence of dynamic resistance and horizontal supply near 1.40–1.42. Structure still reflects a sequence of lower highs on the broader slope, suggesting that upside attempts may be vulnerable if sellers defend this region.

If price fails to secure acceptance above the channel lid, it could rotate lower toward 1.33 first, with a deeper slide potentially extending toward lower levels. That diagonal base may act as the next liquidity pocket should bearish pressure accelerate.

➡️ Primary scenario: rejection from 1.40–1.42 → continuation toward 1.33.

⚠️ Risk scenario: sustained breakout above 1.42 could invalidate the short bias and shift momentum toward 1.48.

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts