I’ve stared at a payments screen that stopped moving while customers kept pressing “send.” Chats lit up. Finance wanted answers. All because a basic transfer got stuck in a queue. I get the same knot in my stomach when stablecoin traffic on-chain starts acting strangely. When dollars don’t move cleanly, confidence fades fast. Payments teams don’t want magic. They want things to behave the same way every time.

Here’s the core idea I care about: Plasma is built so stablecoin movement stays predictable when usage is heavy, messy, and constant. Stablecoin settlement isn’t a feature on the side. It’s the main reason the chain exists. That decision shapes everything from how transactions are handled to what “final” really means in practice.

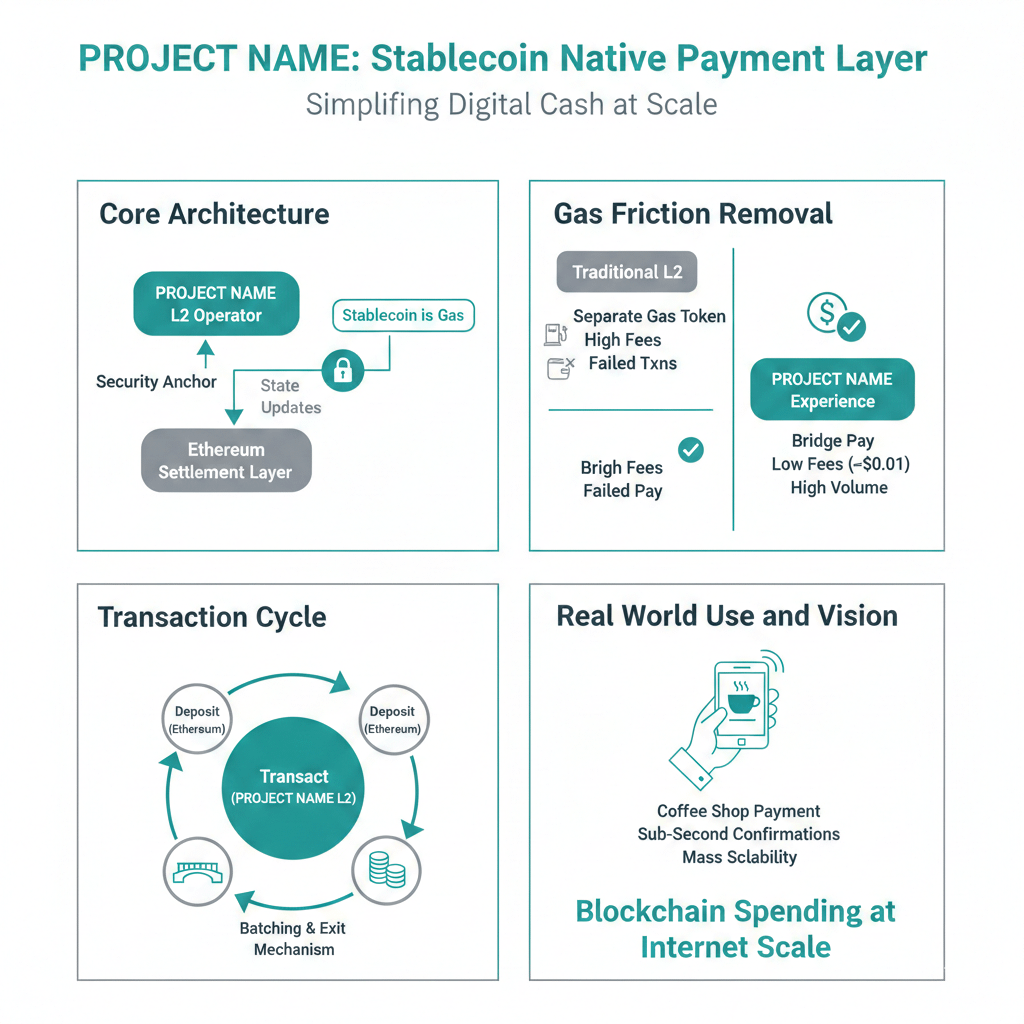

I see the same user mistakes again and again. No gas token. Too many retries. Confusion about what step comes next. Gasless stablecoin transfers remove the most common failure point right away. Then fee abstraction — a paymaster-style approach — lets fees be paid in approved tokens, so users don’t have to think about a separate gas asset at all. That means fewer failed sends, fewer duplicate attempts, and fewer late-night support messages asking where the money went. I build with timeouts and retry limits because I’ve learned that small edge cases become big trust issues.

For builders, familiarity matters. Plasma keeps Solidity and the usual EVM tools, but the environment is tuned for payment traffic instead of experimental contracts. Transfers are treated as first-class activity in how the mempool and gas model behave. Settlement behavior is the priority. PlasmaBFT is there so when a transfer is marked “done,” it actually means something for operations — tight timing, low reorg risk, and clarity for reconciliation.

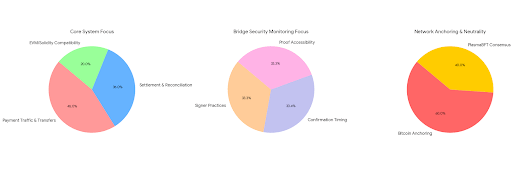

Neutrality is not a slogan when money is involved. Plasma leans toward Bitcoin for anchoring, adding an external credibility layer and making censorship harder. The native Bitcoin bridge is designed with caution: deposits are observed, verifiers confirm events, and withdrawals rely on threshold signing. Bridge risk is real, so I pay attention to signer practices, confirmation timing, and whether proofs are easy to check. I treat it like monitoring a live system, not trusting a black box.

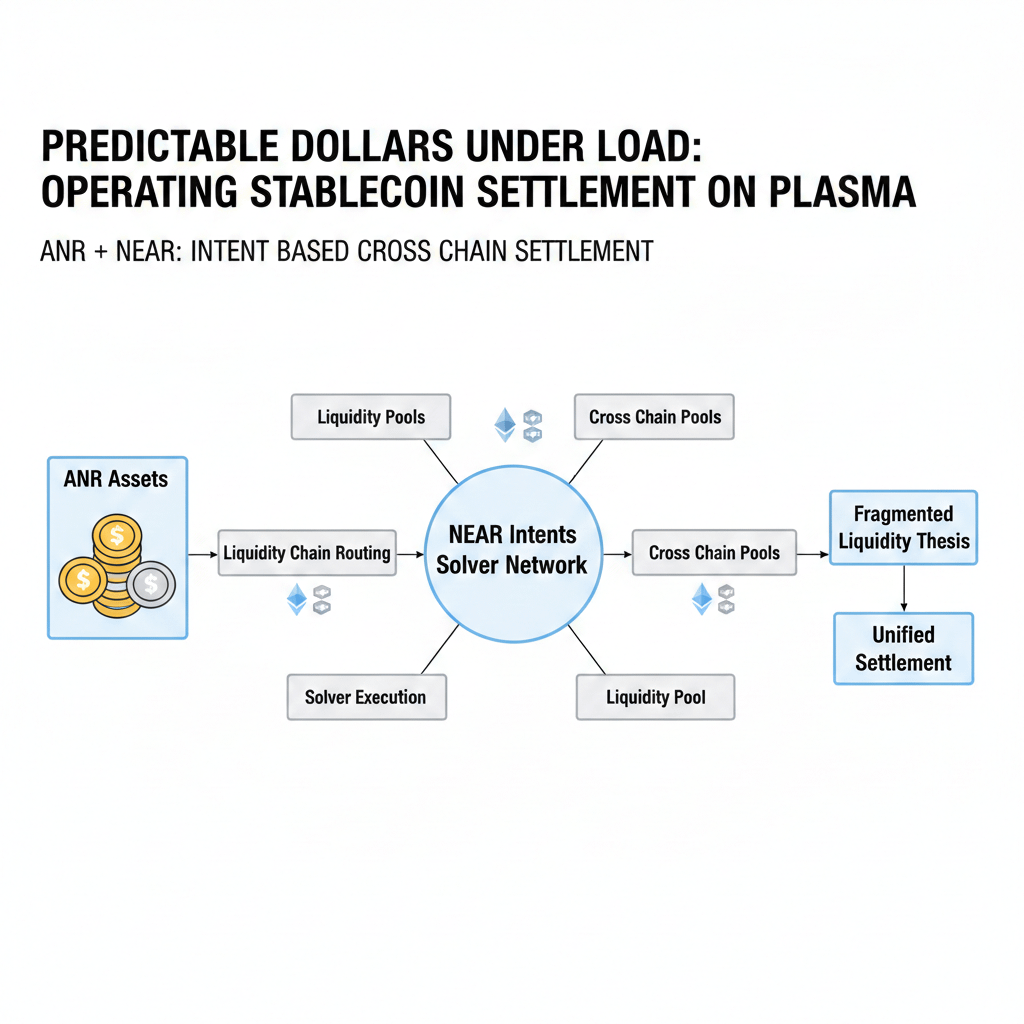

We’re not launching into a vacuum. The rollout focuses on real connections: wallets, liquidity partners, on-ramps, and apps that can move value from day one. Supporting USDt0 helps standardize how liquidity moves across chains so it doesn’t get scattered. Before calling anything live, I expect reconciliation tests, compliance checks, and clear settlement windows. Liquidity is not just a metric — it’s working relationships.

My first 90 days are judged by simple signals: stable block timing, high success rate for gasless transfers, low need for manual fixes, healthy payment corridors, and real wallet/app integrations. A recent 24-hour snapshot showed encouraging signs — tens of thousands of transactions, a couple thousand new addresses, and several contracts deployed and verified. Useful signals, not proof. What I want next is repetition and fewer support questions per thousand transfers.

If those patterns hold, Plasma becomes the kind of system payments teams can rely on. Quiet, steady, dependable.