Reports suggest Russia may pivot back toward U.S. dollar–based settlements as part of a broader economic understanding with the U.S. administration. If confirmed, this would mark a major reversal from the last 3–4 years, when Moscow actively promoted de-dollarization and alternative settlement systems.

Reports suggest Russia may pivot back toward U.S. dollar–based settlements as part of a broader economic understanding with the U.S. administration. If confirmed, this would mark a major reversal from the last 3–4 years, when Moscow actively promoted de-dollarization and alternative settlement systems.

🔄 What Changes?

Over recent years:

Several countries reduced exposure to USD assets.

Central banks trimmed Treasuries.

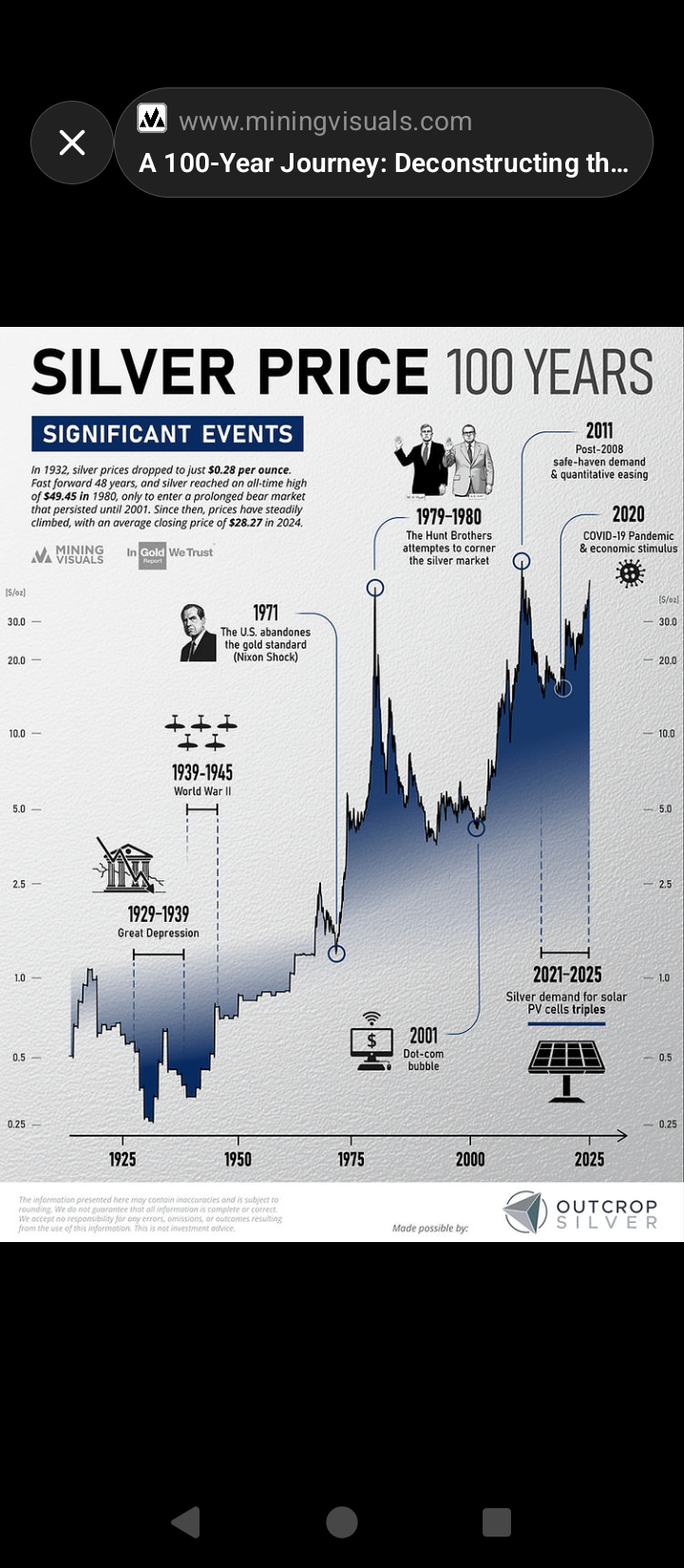

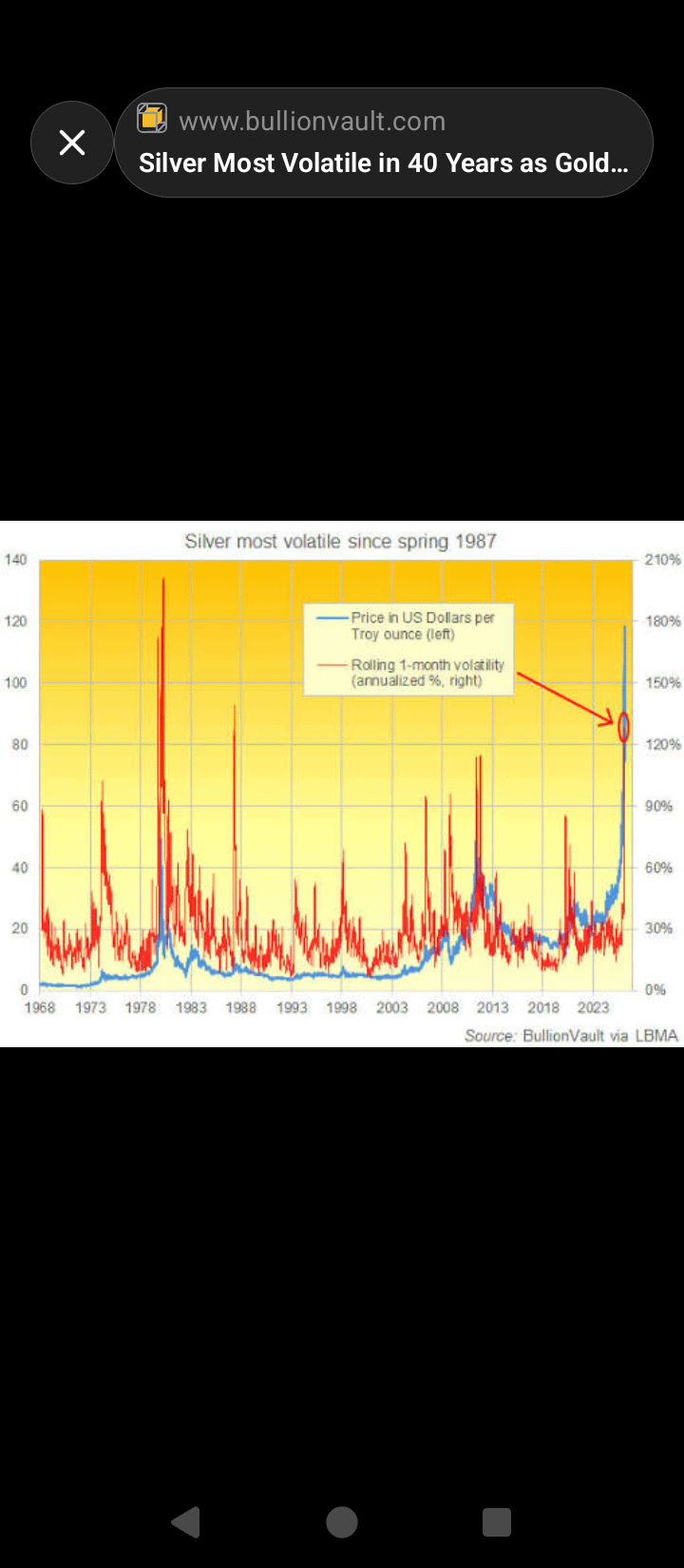

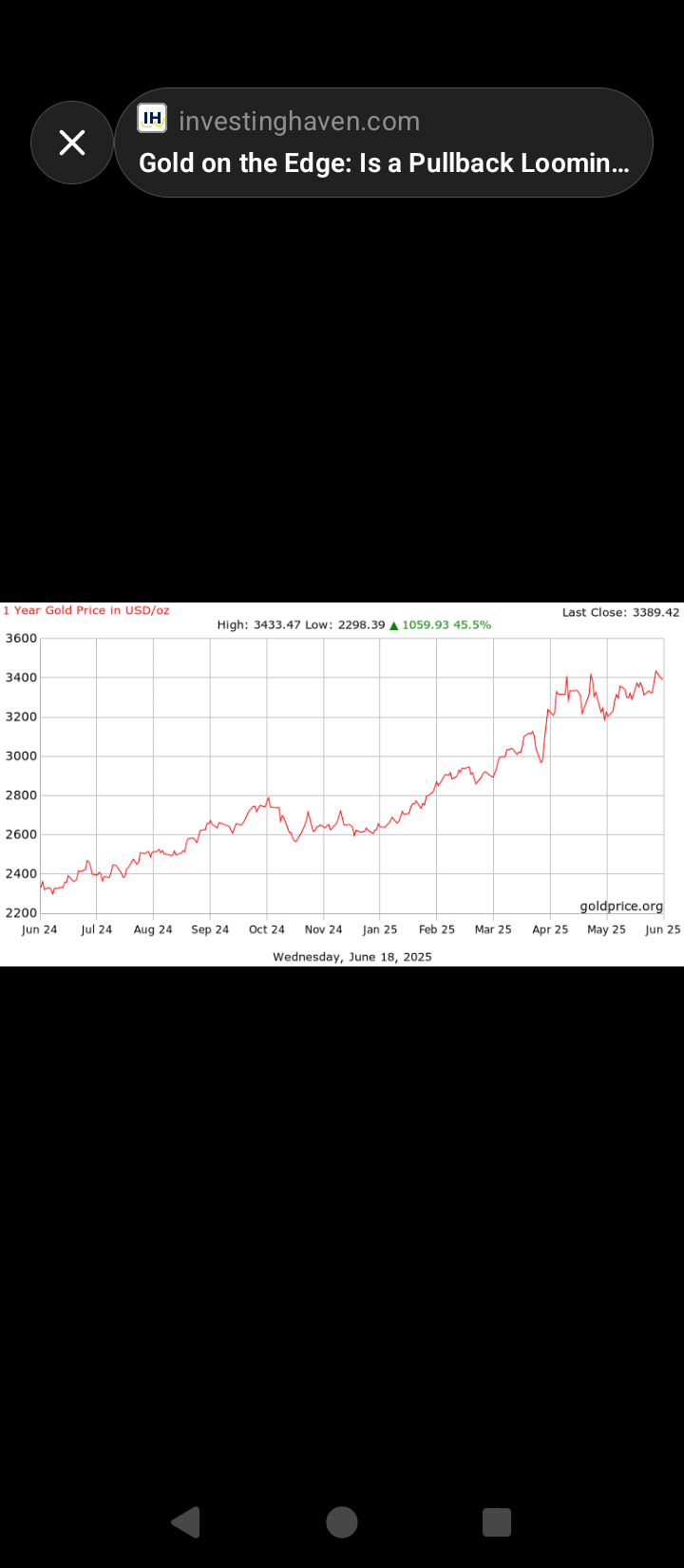

Gold and silver rallied as part of the “debasement & de-dollarization” trade.

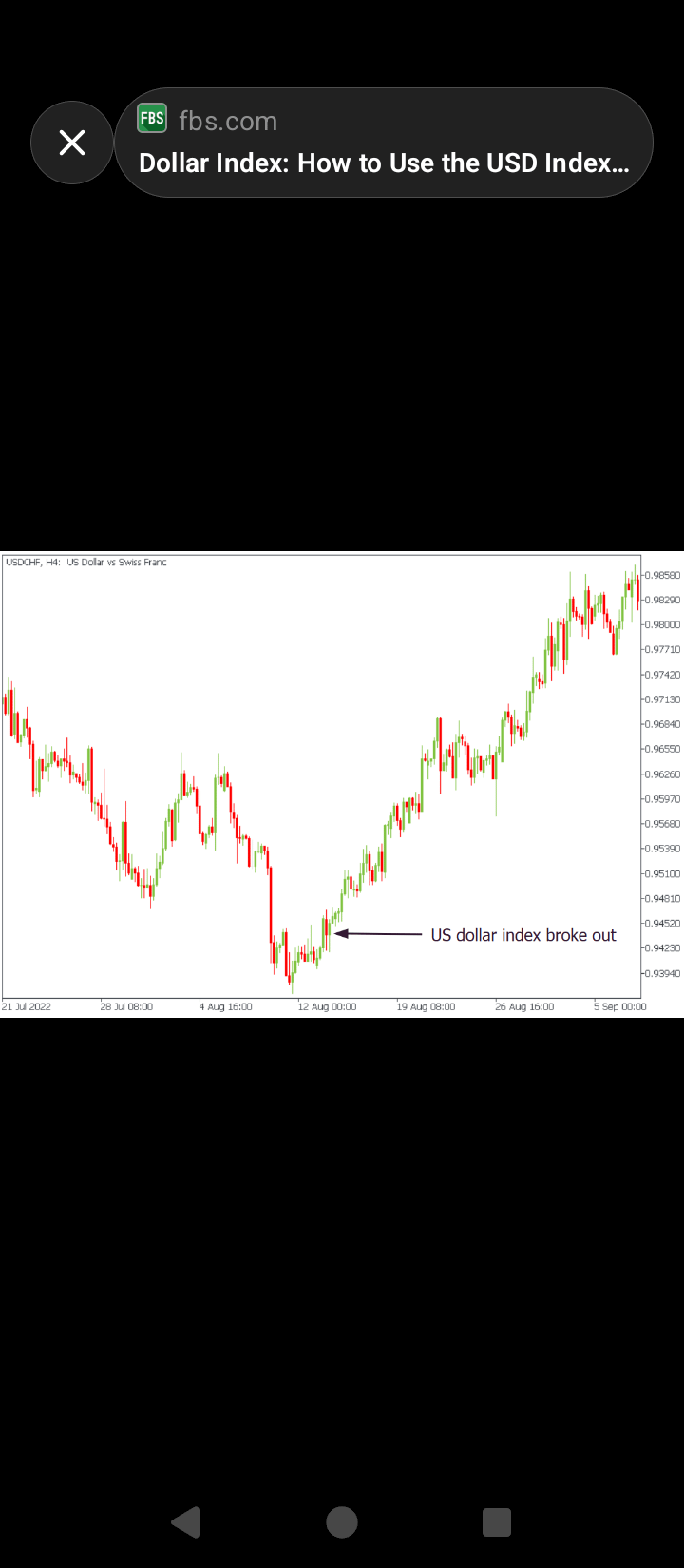

The DXY (Dollar Index) weakened amid diversification away from USD.

Now, if Russia re-enters the dollar settlement framework:

USD demand rises

DXY strengthens

The de-dollarization trade narrative cools off

📉 Immediate Market Impact

1️⃣ Metals (Gold & Silver)

Most vulnerable.

A stronger USD typically pressures precious metals since they’re priced in dollars.

The “currency debasement hedge” theme weakens if global USD demand rebounds.

2️⃣ Equities & Crypto

Short-term headwind.

Historically, a stronger dollar tightens global liquidity and weighs on risk assets.

However — this may not be a prolonged bearish phase.

⚡ Why This Could Turn Bullish Later

If a U.S.–Russia partnership increases global energy supply:

Oil pressure eases

Inflation trends lower

The Federal Reserve becomes less aggressively hawkish

Policy clarity improves

Markets dislike uncertainty more than high rates.

Remember: In 2023, Bitcoin rallied strongly despite rate hikes and quantitative tightening. Risk assets often thrive once macro direction becomes clearer.

🧠 Bigger Picture

Short-term: Dollar strength = pressure on metals, temporary risk-off mood.

Mid-to-long term: Stability + lower inflation expectations = constructive for equities and crypto.

Metals: Could face a longer consolidation or even multi-year correction if the de-dollarization trend fully reverses.

This is a major macro pivot. Watch DXY, energy markets, and Fed tone closely.

As always — stay adaptive. Markets reward flexibility. 📊$BTC $ETH $BNB

#CPIWatch #CZAMAonBinanceSquare #USNFPBlowout #USRetailSalesMissForecast #USTechFundFlows