📈 What if your trading flow felt as fluid as a pro gamer's combo streak, no pauses, no friction? That's the hook with Fogo Sessions – I've been testing them on mainnet, zipping through Solana-compatible dApps like BrasaFinance at 10x speed, and it's like rediscovering crypto without the constant "sign here" nagging. Picture this: just 24 hours after announcing the Uruguay Sunset event on Feb 12, community buzz is already simmering about Latin America's untapped potential, where Fogo's 40ms execution could bridge fintech institutions to on-chain trading, outpacing retrofitted rivals bogged down by legacy delays. This ties into an under-discussed twist – Fogohuntergame's PvPvE multiplayer, where real-time coordination mirrors DeFi arbitrage hunts, but with Sessions ensuring no dropped frames in the heat of battle. It's not generic speed; it's purposeful design for 2026's low-latency surge, where gaming revivals meet institutional on-ramps.

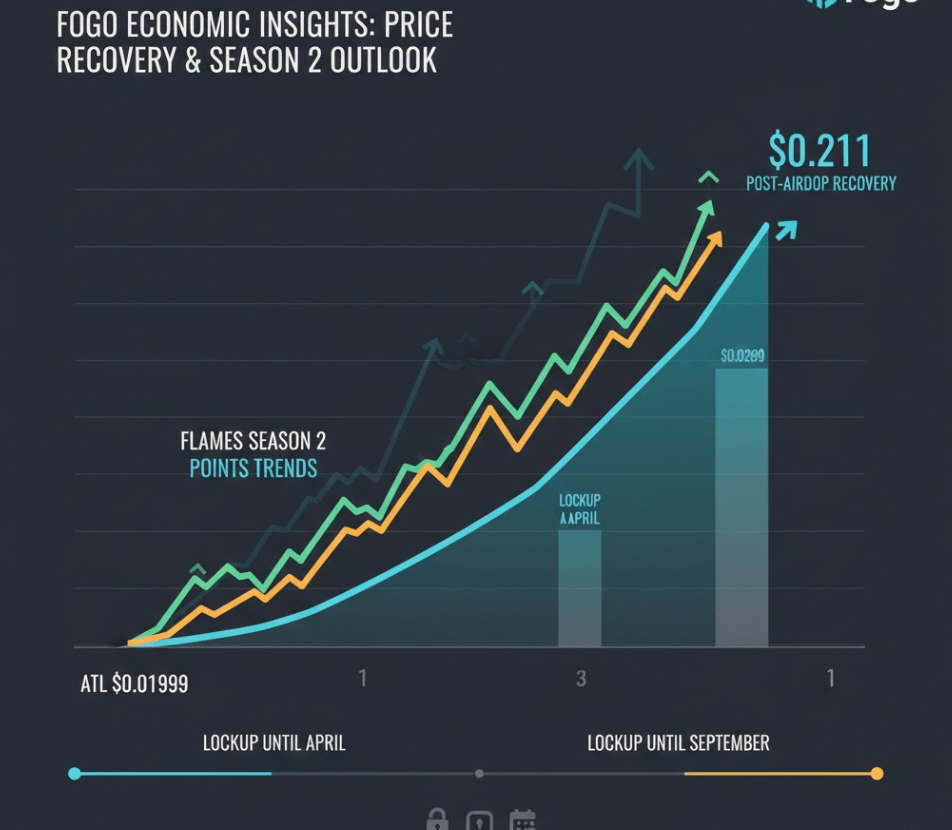

Diving deeper, consider the post-airdrop resilience unfolding now. Since the Jan 13 TGE and mainnet launch, with airdrop claims extending toward April and unlocks eyed for September, Flames Season 2 – running strong for weeks – is gamifying loyalty through lockup campaigns like Ignition's 6-month miles program. An exclusive alpha from fresh data: while price dipped to ATL $0.01999 on Feb 11 amid broader market jitters (7-day -15.2%), the +5.9% bounce to ~$0.0211 signals organic holder conviction, bolstered by ecosystem projects like Pyronfi's lending ramps and Onchainoil's deflationary burns. I've chatted with devs in ValiantTrade spaces, and the vibe is clear – these incentives are filtering committed users from flippers, contrasting with chains where airdrops fizzle without sustained activity. Philosophically, it's about mental flexibility in volatile times; Fogo's not quitting, as co-founder Robert Sagurton emphasized in that Feb 9 podcast, doubling down on crypto amid Superbowl ad flops and market dips. This positions Fogo uniquely for modular blockchain trends, where LatAm expansion via Uruguay could ignite regional grants, turning under-discussed metrics like the 40+ community guides into blueprints for scalable adoption. With TVL at $1.16M and inbound builder interest spiking, it's a grounded bet on real-time finance economies thriving in emerging markets.

Will Sessions become the standard for hybrid gaming-DeFi apps in LatAm? How might Flames lockups shape Fogo's long-term tokenomics versus quick-dump airdrops? Could the Uruguay event catalyze institutional partnerships that redefine on-chain speed?