The February 10 liquidation event is already being called "10/10" by traders which wiped out leveraged positions across the entire crypto market.

Binance Co-CEO Richard Teng just shared his thoughts on the event and his insights reveal a lot about where the market is heading

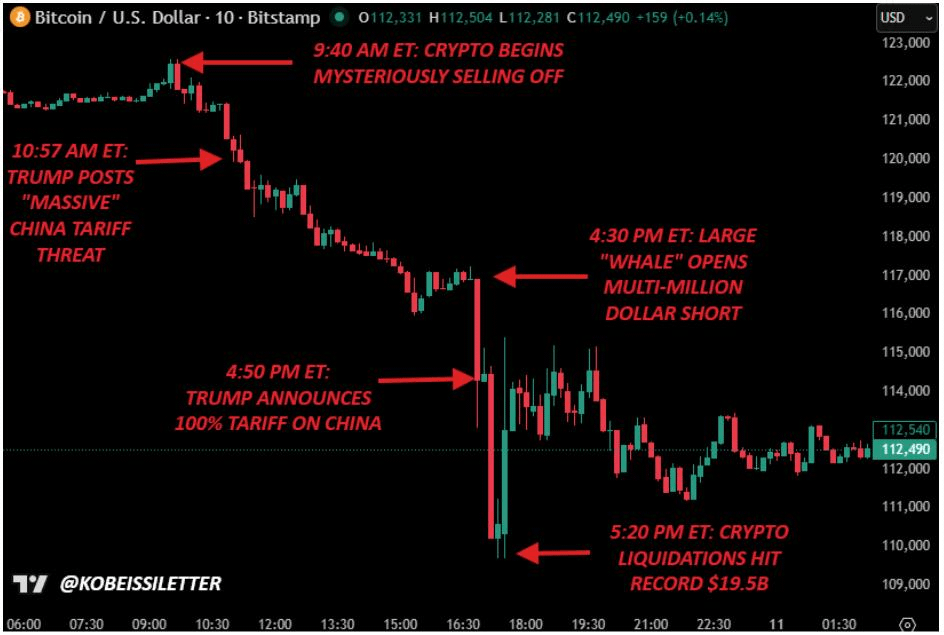

Reading the Chaos: How Macro Forces Triggered the Feb 10 Crash

That day, the US stock market evaporated $1.5 trillion in market value. The US stock market alone saw $150 billion in liquidations. The crypto market liquidation was about $19 billion.

That day, every trading platform, whether centralized or decentralized, experienced large-scale liquidations.

Approximately 75% of the liquidations occurred around 9:00 PM Eastern Time

According to Richard Teng: The '10/10' liquidation event was triggered by worldwide macroeconomic shocks, not any internal exchange issues.

He emphasized that every exchange (both centralized and decentralized) experienced massive liquidations simultaneously. Which was mostly triggered by the geopolitical tension of China's implementing of metal export controls and the US responding with 100% tariffs on Chinese goods.

The Technical Issues And How Binance Fixed It:

During the chaos, Two unrelated and isolated technical issues occurred simultaneously:

a stablecoin (USDe) briefly de-pegged to $0.65; a reflection of the market wide panic, not a platform failure

Some delays in asset transfers.

Binance's Response: Transparency, Stability, and Support

Binance remained operational throughout the turbulence and did not signal any structural disruption to its services.

While other exchanges struggled silently, Binance kept the lights on. No withdrawal freezes. No "maintenance" mode at the worst possible moment. Just continuous operation.

Also Binance has committed a staggering $600 million to user compensation

$300 million for directly to users who suffered losses specifically due to the two isolated technical issues

$300 million allocated to a goodwill compensation fund, designed to share market risk with investors who were severely impacted

Teng has also pointed out that no other centralized or decentralized exchange has provided compensation or goodwill of this nature.

Think about that. When every exchange experienced the same macro driven liquidation event, and only 1 exchange stepped up to make things right for affected users.

Conclusion:

The "10/10" crash was ugly. But it revealed something important. It showed which platforms treat users as partners versus which treat them as liquidity.

Binance had technical hiccups they admitted it. But they also:

Kept the platform running

Compensated affected users directly

Went above and beyond with goodwill payments

Published the data so you can verify it yourself

As Teng put it, the focus should be on fundamentals. And on fundamentals; transparency, stability, and user protection, Binance just set a new industry standard.