The short answer is No.

After looking at the data, it seems that the correction is far from finished. 😭

Currently, the market’s only aggressive buyer left is the "Bitcoin Godfather" himself.

Strategy went on a buying spree in January, scooping up 40,150 BTC. To put that in perspective, they accounted for 97.5% of all active DAT buying volume!

When you compare that to the massive red bars on the Spot CVD (Cumulative Volume Delta), it’s clear that aside from Michael Saylor, other buyers are effectively missing in action. This is a very "unhealthy" hand-off of coins and often serves as a warning sign that prices could drop further.

Triple-Data Cross-Validation:

To get the full picture, let’s look at these three key metrics:

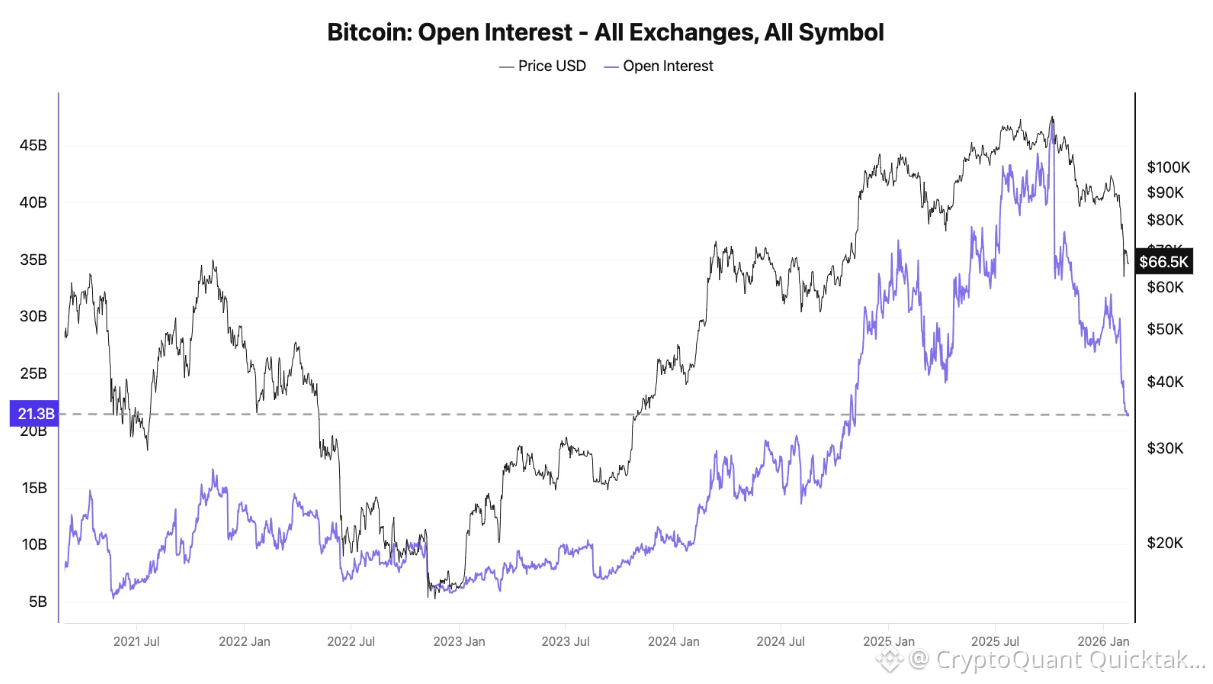

Futures Open Interest (OI): This has dropped to $21.3B, a yearly low. Leveraged speculators have fled the scene, leaving the market with zero momentum.

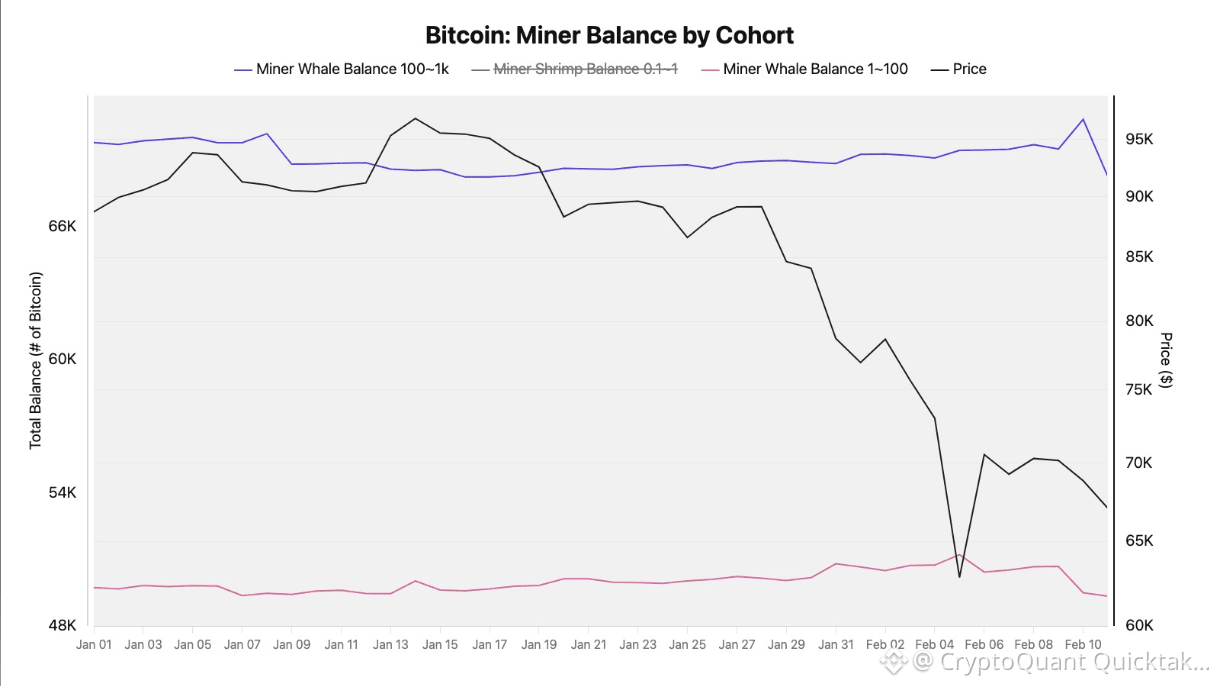

Miner Activity: Large-scale miners began reducing their positions after February 9th, increasing the circulating supply. We need to keep a close eye on how this develops.

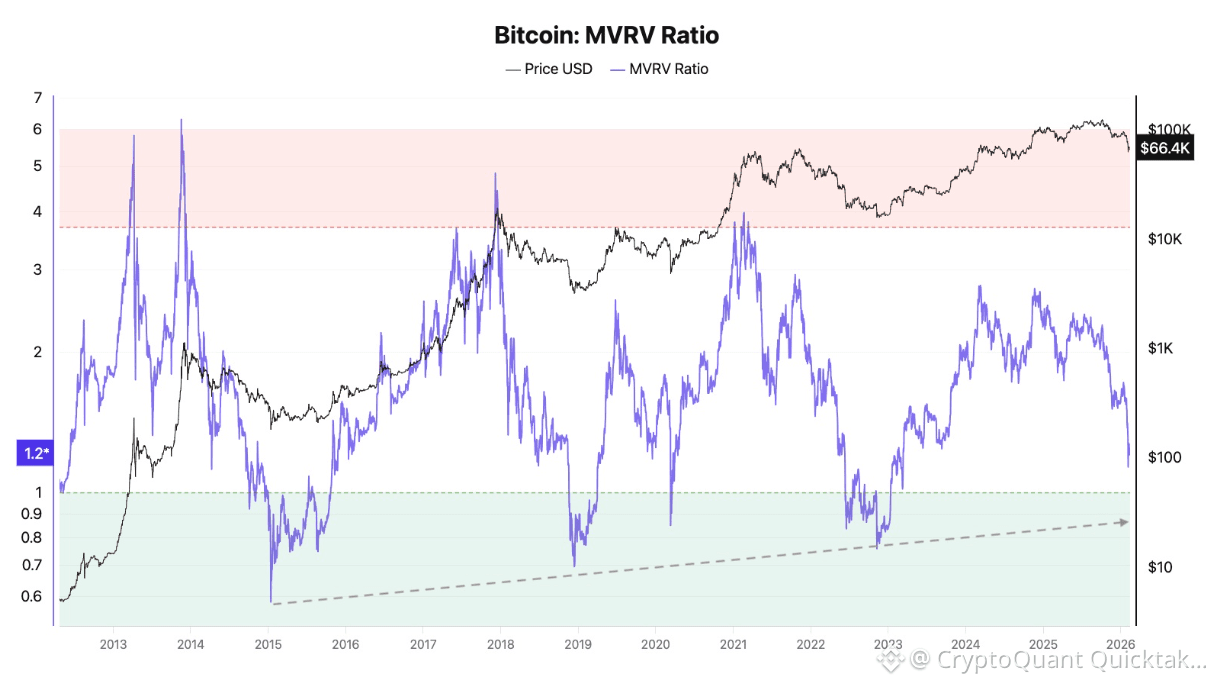

MVRV Ratio: We are currently at 1.2. Historically, a "macro bottom" usually hits between 0.7 and 0.8. If you do the math, that implies a potential 30–40% downside 🥵. (The silver lining? As the market matures, the bottom often ends up higher than previous cycles, so we might not hit those historic lows this time.)

The Verdict:

Based on the current data, the true Bitcoin bottom is not yet in. If history repeats itself, I believe the $48k – $58k range is the "fair value" bottom for this bearish phase.

So don’t rush to "buy the dip" just yet. Wait for clearer signals (ex. positive BTC spot CVD). For now, keep your powder dry. 💰💰💰 You might want to look at other bull markets (like Gold) for the time being, but whatever you do, don't use up all your silver bullets in the crypto market too early.

Written by Sunny Mom