Bitcoin is at $68,000.

And nobody can agree on where it's going next.

The bears say: We're heading to $40K-$50K before any recovery.

The bulls say: This is capitulation $87K to $200K+ is next.

The range: $40,000 to $200,000+.

That's a 150% spread in predictions.

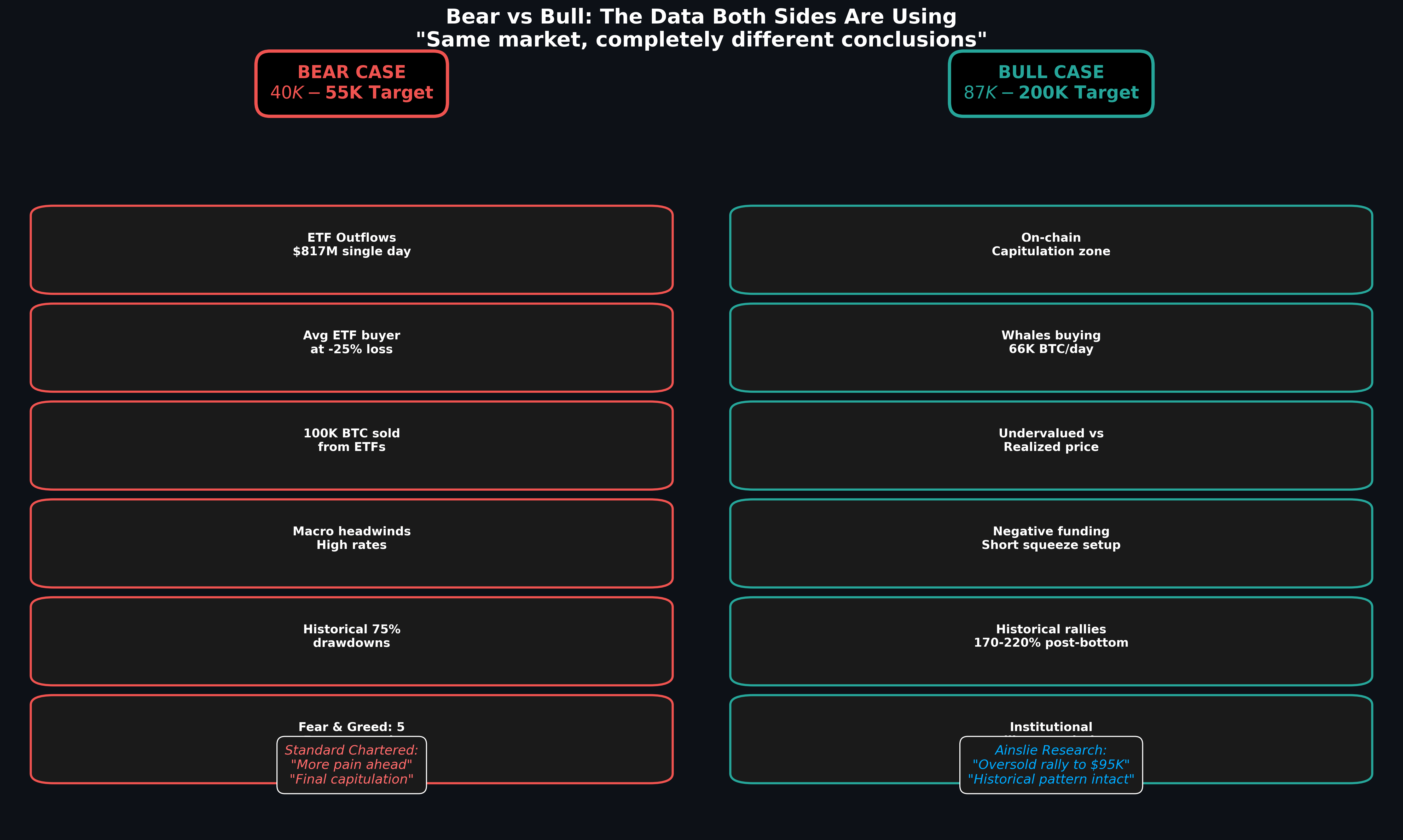

Same market. Same data. Completely different conclusions.

Let me break down what each side is seeing and why both might be partially right.

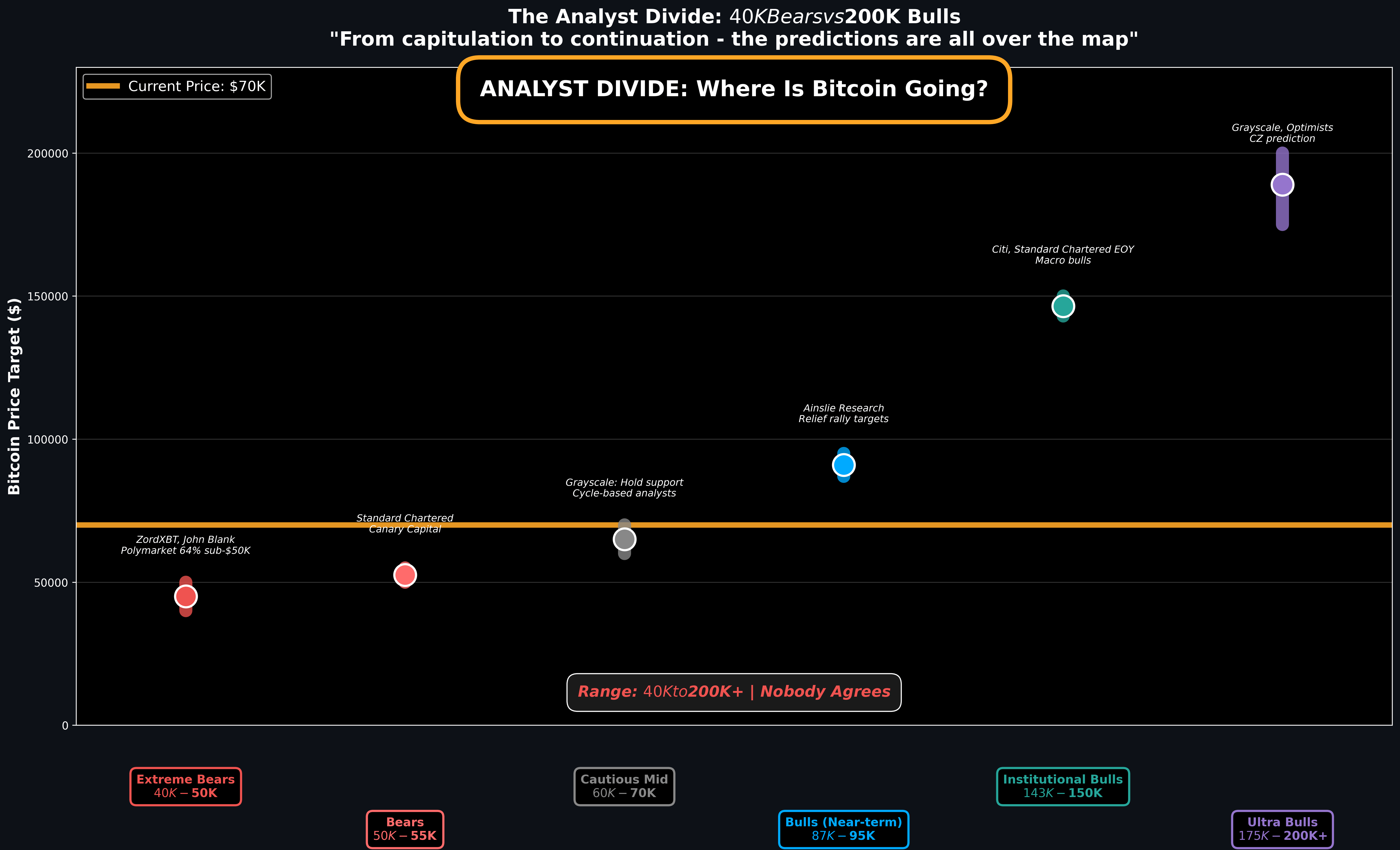

The Full Spectrum: $40K to $200K

Extreme Bears: $40K-$50K

Who: ZordXBT, John Blank (Zacks), Polymarket traders

The call: Bitcoin drops to $40K-$50K, possibly wicking to $32K

Their argument:

Historical bear markets see 75-85% drops from ATH

Current 46% drop ($126K → $70K) isn't enough

Final capitulation hasn't happened yet

Polymarket odds: 64% chance Bitcoin goes sub-$50K

Bears: $50K-$55K

Who: Standard Chartered, Canary Capital (Steven McClurg)

The call: Drop to $50K by summer, then recovery to $100K by EOY

Their argument:

ETF outflows continuing ($817M single day, $1.33B weekly)

Average ETF buyer sitting on -25% loss (bought at $90K)

Macro headwinds (high rates, sticky inflation)

Four-year cycle entering bear phase

Standard Chartered's exact words: "We are going to see more pain and a final capitulation period for digital asset prices in the next few months."

Cautious Middle: $60K-$70K Range

Who: Grayscale, cycle-based analysts

The call: Hold current support, range-bound 2026

Their argument:

BTC correlating with high-growth tech stocks

Not acting as "digital gold" yet

Might be a "breather year" in the four-year cycle

Support should hold at $60K-$70K

Bulls (Near-Term): $87K-$95K

Who: Ainslie Research (Chris Tipper), on-chain analysts

The call: Relief rally to $87K-$95K, then consolidation

Their argument:

Bitcoin oversold vs 50/100-week moving averages

Historical rallies of 170-220% after undervalued zones

On-chain showing capitulation signals

Short-term bounce likely before next leg

Institutional Bulls: $143K-$150K

Who: Citi, Standard Chartered (end-2026 target), Grayscale

The call: $143K-$150K by end of 2026

Their argument:

ETF demand will return

Institutional adoption still early

Fed rate cuts coming (eventually)

Four-year cycle might break (no traditional bear in 2026)

Citi's framework: Base case $143K, bull case $189K, bear case $78K

Ultra Bulls: $175K-$200K+

Who: Grayscale (new ATH in H1 2026), CZ, crypto-native analysts

The call: New all-time high above $150K, possibly $200K+

Their argument:

Spot ETFs changed the game (no more 80% crashes)

Institutional demand is structural, not cyclical

Supercycle thesis (2026 won't be a bear year)

Bitcoin's scarcity + growing demand = inevitable

Grayscale's specific call: "Bitcoin's price will likely reach a new all-time high in the first half of the year"

The Bear Case: Why $50K Could Happen

1. ETF Outflows Are Real

The numbers:

ETF holdings down 100,000 BTC from October peak

Total AUM dropped 41%: $165B → $96B

Average ETF buyer entry price: $90K

Current price: $70K

Loss: -22%

What bears say: Institutions aren't buying the dip. They're selling. When your average buyer is underwater, they don't add they cut losses.

2. Historical Drawdowns Go Deeper

Past bear markets:

2018: -85% ($20K → $3K)

2022: -78% ($69K → $15.5K)

Current:

2026: -46% ($126K → $70K)

What bears say: We're only halfway through a typical bear market. History says we go lower.

3. Macro Is Getting Worse

Fed not cutting rates yet

Inflation still sticky at 2.9-3.1%

Dollar strengthening (bad for $BTC )

Tech stocks correlating down

What bears say: Bitcoin trades like a risk asset. Risk-off environment = more downside.

4. Standard Chartered's Warning

October 2025: $200K for 2025, $300K for 2026

December 2025: Cut to $100K for 2025, $150K for 2026

February 2026: Cut again to $50K near-term, $100K for EOY 2026

What bears say: If a major bank keeps slashing forecasts, they're seeing real deterioration.

The Bull Case: Why $87K-$200K Could Happen

Now let me show you the data bulls are using.

1. On-Chain Says: Capitulation Zone

The signals:

SOPR (Spent Output Profit Ratio) below 1 = sellers realizing losses

Long-term holders selling at historic rates

Exchange outflows accelerating (whales accumulating)

Fear & Greed Index hit 5 (lowest ever, worse than FTX collapse)

What bulls say: Extreme fear + whale accumulation = classic bottom formation.

Example: On February 6, whales bought 66,940 BTC in a single day largest since 2022.

2. Undervalued vs Realized Price

Realized Price: $55K (average cost basis of all Bitcoin)

Current Price: $70K

What bulls say: We're trading near realized price. Historically, this is where bottoms form, not where crashes accelerate.

3. Negative Funding Rates = Short Squeeze Setup

Funding rates have been negative for multiple days.

Translation: Shorts are paying longs. Market is overleveraged to the downside.

What bulls say: When everyone's short, a bounce can trigger a massive short squeeze forcing shorts to buy back, spiking price.

4. Historical Rally Patterns

After extreme fear + capitulation:

2018: +316% rally (from $3.2K to $13K in 6 months)

2020: +1,625% rally (from $4K to $69K)

2022: +715% rally (from $15.5K to $126K)

What bulls say: If this is capitulation, the next rally could be 200-300%+. That's $140K-$210K from current levels.

Who's Right?

Honestly? Maybe both.

Here's my take on how this could play out:

Scenario 1: Bears Win Short-Term, Bulls Win Long-Term

BTC drops to $50K-$55K (capitulation)

Stays there for weeks/months

Then rallies to $87K-$100K by EOY

New ATH ($150K+) in 2027

Probability: 40%

This fits Standard Chartered's revised forecast and historical patterns.

Scenario 2: We Already Bottomed at $67K

$70K holds

Relief rally to $87K-$95K

Consolidation, then continuation to $120K-$150K

Probability: 30%

This fits the bull case if Fear & Greed 5 marked the bottom.

Scenario 3: Deeper Crash to $40K Range

Breaks $60K support

Capitulation wick to $40K-$50K

Then recovery begins

Probability: 20%

This fits the extreme bear case and Polymarket odds.

Scenario 4: Supercycle (No Traditional Bear)

Consolidates at $70K-$80K

Rallies to new ATH by mid-2026

No deep bear market

Probability: 10%

This fits Grayscale's "end of four-year cycle" thesis.

The Key Data Points to Watch

Forget predictions. Here's what to actually monitor:

1. ETF Flows

If flows turn positive: Bulls are right.

If outflows continue: Bears are right.

Current: Negative. Watch for reversal.

2. Fear & Greed Index

Currently: 15 (Extreme Fear)

If it drops below 10: Possible final capitulation.

If it starts rising: Bottom might be in.

3. $60K Support

Holds: Bulls have a case.

Breaks: Bears take control, next stop $50K.

4. Funding Rates

Stay negative: Short squeeze setup.

Flip positive: Longs getting squeezed instead.

What Should You Do?

Here's my honest advice:

If You're Waiting to Buy

Don't go all-in at one level.

Layer your entries:

20% at current ($70K)

30% at $60K

50% at $50K

This way you get exposure if bulls are right, but have dry powder if bears are right.

If You're Already Holding

Don't panic sell.

If you believe long-term (2-5 years), this chop doesn't matter.

Bitcoin at $40K, $50K, or $70K all cheap if it's going to $150K-$200K eventually.

If You're Trading

Respect the range.

We're in $60K-$80K chop. Trade the bounces, take profits, don't over-leverage.

The Bottom Line

#bitcoin is at $70,000.

Bears see: $40K-$55K before recovery.

Bulls see: $87K-$200K+ next.

The truth? Nobody knows.

But here's what we DO know:

✅ #etf outflows are real (bearish)

✅ On-chain capitulation signals are real (bullish)

✅ Macro is challenging (bearish)

✅ Fear & Greed at historic lows (bullish)

✅ Historical bear markets go deeper (bearish)

✅ Historical bottoms have this exact setup (bullish)

Both sides have valid data.

The market will decide who's right.

What's your take are we going to $50K before $100K, or is $70K the bottom? And which analyst camp are you in? Let me know below.