I’ve seen a lot of “fast L1” stories come and go, and the reason most of them fade is simple: speed is easy to claim, but hard to deliver consistently when real users arrive. @Fogo Official caught my attention because it’s not trying to be everything for everyone. The vibe is clear: build a high-performance Layer 1 that’s comfortable with heavy on-chain activity, especially the kind that traders and DeFi apps generate when markets move fast.

What I like about this positioning is that it doesn’t rely on fantasy use cases. It’s built around real behavior: people want low latency, clean execution, predictable fees, and a network that doesn’t choke when volatility spikes. If a chain can handle that, it earns respect quickly.

SVM foundation: the “performance culture” behind the stack

SVM foundation: the “performance culture” behind the stack

Fogo leaning into the Solana Virtual Machine (SVM) isn’t just a technical choice — it’s a cultural one. SVM ecosystems tend to attract builders who care about responsiveness, parallel execution, and shipping products that feel “instant.” That matters because user expectations have changed. Nobody wants to wait around for confirmations when they’re swapping, trading, or interacting with apps that need real-time feedback.

If Fogo keeps execution smooth, it becomes the kind of environment where teams build serious products without constantly fighting the chain. That’s the difference between a network that gets tested… and one that becomes a habit.

The chart moment: price moved, but volume is the real headline

Looking at the FOGO/USDT snapshot, the move is obvious: price pushed up into the $0.02 zone (around 0.0225) with a strong green expansion and a clear volume spike. That’s the part most people tweet about.

But the more interesting detail is what the candles are saying: this wasn’t a slow grind. It looks like momentum kicked in after a base formed, then price accelerated quickly and printed a sharp wick near the top (around the 0.0238 area). That usually means two things can be true at once:

1. buyers stepped in aggressively, and

2. sellers also showed up to take quick profits.

So the story isn’t “up only.” The story is attention is back, and the next test is whether FOGO can hold higher levels without giving the entire move back. If volume stays healthy during pullbacks, that’s when rallies start to look more “built” than “borrowed.”

What makes $FOGO worth tracking isn’t hype — it’s the “use case gravity”

A lot of tokens pump because marketing gets loud. Infrastructure tokens hold value when usage starts pulling them forward like gravity.

Fogo’s thesis is pretty direct:

• make on-chain execution fast enough to feel natural for traders

• keep throughput high so apps don’t break under pressure

• make it easy for builders to deploy and iterate without friction

If the ecosystem actually grows — more apps, deeper liquidity, more daily transactions — then the token narrative becomes less about speculation and more about participation. That’s when an L1 stops feeling like a launch… and starts feeling like a venue.

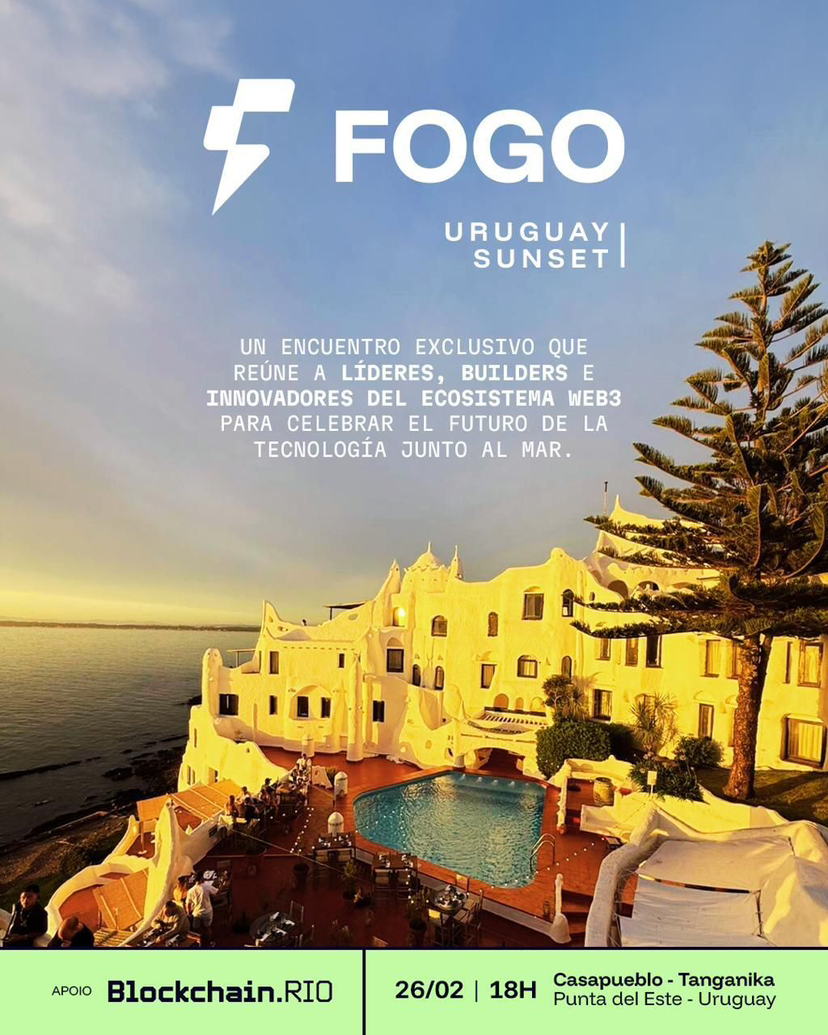

FOGO Uruguay Sunset: builders by the sea, not just online

That “FOGO Uruguay Sunset” poster is the kind of branding I pay attention to because it signals something deeper than price action: community formation in the real world.

Crypto is funny like that — projects look unstoppable online, but you only really feel the seriousness when you see builders, founders, and operators meeting face-to-face. Punta del Este + Casapueblo energy fits the theme perfectly: calm setting, high signal conversations, and the kind of networking that doesn’t happen in comment sections.

If Fogo keeps leaning into events like this, it’s a good sign. Ecosystems don’t grow from code alone. They grow from relationships, shared incentives, and builders who feel like they’re part of something that’s moving.

The FOGO logo image: simple brand, strong identity

The second visual — that clean $FOGO logo on the warm gradient — is doing exactly what good branding should do: it’s memorable, minimal, and easy to recognize across platforms.

People underestimate this, but in a crowded market, identity matters. When a project’s visuals are consistent, it becomes easier for the community to rally around it, for partners to co-brand with it, and for builders to feel like they’re building “inside” a real ecosystem, not just deploying contracts onto a random chain.

It also matches the name perfectly: FOGO = fire — momentum, ignition, heat, activity. If the chain is aiming for high-throughput, trading-heavy usage, that brand alignment is not accidental. It’s smart.

My honest takeaway

$FOGO is early, so I’m not treating it like a finished story. I’m treating it like a network that’s trying to win a specific lane: performance-first on-chain execution, especially where DeFi and trading demand speed.

The chart shows momentum and attention. The visuals show community building and a project that understands identity. Now the only thing that matters is follow-through: more builders, more apps, more daily usage — and price action that starts to reflect adoption instead of just excitement.