When you mention SVM L1, most individuals are going to immediately classify Fogo alongside any other high-throughput chain: high TPS claims, trader marketing. However, the worth of Fogo is not in the slogan, but the design decisions that seem more of a blueprint of a trading venue than a conventional crypto roadmap.

Fogo merely poses a direct question: does on-chain finance want to play with professional markets, then why do we care less about geography, network jitter and slow clients? In actual trading those things prevail. The architecture of Fogo appreciates that and develops around it.

The new narrative isn’t “speed.” It’s coordination: synchronizing time, place, client performance, and validator behavior in such a way that on-chain markets behave like real markets, rather than the noisy experiments they are commonly thought to be.

The thesis: latency is a system issue in order to implement real-time finance.

Latency is frequently a want at Crypto. It is a structural constraint Fogo considers it the same way exchanges do.

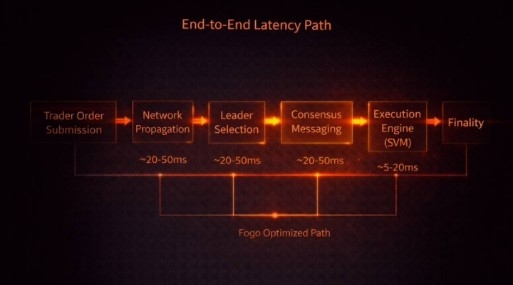

When you require on-chain order book, real time auctions, accurate liquidation time and reduced MEV-mining, you cannot just optimize the execution engine. You have to make the pipeline as optimum as possible: the clocks, propagation, consensus messaging and who is allowed to make blocks. This is the clear positioning of Fogo on the high throughput and low latency application including order books, and liquidations with precision.

That is the change of mindset: Fogo does not build a chain and hopes markets will behave, he makes a chain market-behaving in form at the first stage.

Solana foundation, but with an interpretation of performance-first.

Fogo is placed on the architecture of Solana rather than re inventing everything. It carries with it some fundamental functionality: Proof of History to synchronous time, Tower BFT to fast finality, Turbine to block propagation, SVM to execution and deterministic rotation of the leader.

That is significant since the problem the fast chains tend to have is mundane: clocks drift, propagation is a nightmare, a leader hand-over is not stable. Fogo is betting on it by beginning with an architecture that is proven it can afford to concentrate on the real thing: optimizing the system to be low-latency marketable.

The point isn’t “we’re Solana.” It means that we retain what has already served, and re-optimise that which prevents real-time finance the sense of cleanliness.

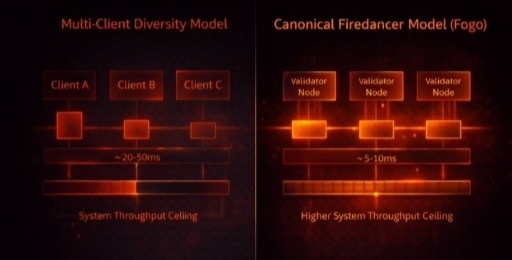

The most radical choice: a single client as opposed to a quilt of clients

This is the choice that most chains will not publicize: Fogo will choose one canonical validator client as based on Firedancer, as opposed to many equally valid clients.

Theoretically speaking, client diversity limits some of the risks. Practically, it makes performance a bargain with slowest implementation. The ceiling of the chain reduces in case one half of the network is using a slow client. Fogo refers to this as a bottleneck in the diversity of the client and believes that performance is constrained by the slowest client.

The action of So Fogo is straightforward, get the operations standardised on the quickest route and turn a slow client into a financial burden since lost blocks are lost revenue.

This style is reflective of exchanges. Trades do not have five matching matching engines since diversity is a nice idea. They operate the most successful one since milliseconds make the difference.

Even Fogo gives a detailed plan of a gradual implementation: begin with Frankendancer, a combination strategy, and switch to pure Firedancer as the development progresses. That depicts a realistic migration route, rather than an idealistic theory system.

Multi-local consensus: accepting geography, and purposefully employing it.

Multi-local consensus is the most peculiar concept of architecture found in Fogo. It is a zone model in which the validators are located in a close physical proximity to drive latency to the hardware limits.

That’s not a small detail. Validators are synchronised instead of being haphazardly distributed. Inter-machine latency may be very small in one data centre. That allows making consensus messaging quicker, so block time can be reduced. The reduction in block times minimizes the gaming window in the markets.

But Fogo doesn’t stop there. It introduces dynamic zone rotation, whereby the zone is able to rotate between epochs, and which is accomplished through on-chain voting, with a majority in advance reaching an agreement on upcoming locations.

This more detailed story reveals how Fogo attempts to reap the advantages of co-location without actually being bound to a single jurisdiction or territory. The docs expressly put zone rotation in the perspective of the need to maintain the advantages of decentralisation such as the benefits of jurisdictional diversity and regional robustness.

In other words: co-locate to win milliseconds, rotate to evade capture.

That’s not a normal L1 story. It is a story of how do we operate global market infrastructure.

Cultured curators: performance as a membership characteristic, not aspiration.

The other non-generic action is the curated validator set. Although it can be inferred that a minor percentage of under-provisioned or under-performing validators can hold a network to physical performance constraints, Fogo claims to counter this by relying on curation to keep performance constant.

This is a controversial event in crypto culture since permissionless is being seen as a religion. However, when you want to be market-grade in your performance, you must face an ugly truth: when anybody can join with incompetent hardware and wartsied operations, the entire system inherits those incompetencies.

The docs of Fogo explain that the system has two conditions, namely stake thresholds to guarantee economic security and validator approval to guarantee operational capability. That is simply to say: it is true that decentralization is important, but not to the extent of making the chain a slow moving social experiment.

Of particular interest is that this explicitly refers to social layer enforcement of the behavior which is difficult to directly encode in protocol rules such as the expelling of grossly underperforming nodes and even the kicking out of malicious practice of MEV.

That is an adult confession: not all the most difficult issues in market infrastructure are technical, but behavioral. And even the governance that can be acts as the means of protecting the system.

Why this is important to the traders and not engineers alone.

As a trader, you are concerned with three things above buzzwords: consistency, predictability and fairness.

Consistency signifies the same behavior of chain under load.

Predictability This is the behavior of an order not affecting its character because the network has become noisy.

Fairness implies that you do not always pay some unknown tax to bots and privileged flow.

The literal definition of the same is presented by the Fogo site: the friction tax, the bot tax, the speed tax, and the calls out the toxic flow that kills profits. That is marketing talk, alright, but it makes sense with the architectural decisions: co-locating to reduce the size of the latency window, a prototypical high-performance client to eliminate slow-client drag, and carefully tested validators to minimize operational degradation.

That is, the tech story is equivalent to the trading story. That coherence is rare.

The macro concept: Fogo is not merely creating a chain but rather an infrastructure of the market.

When you remove the branding, Fogo is selling a particular vision of the world:

A blockchain that is meant to accommodate real-time markets should not be an attempt to create a public bulletin board and more of a coordinated mechanism.

It requires that it has a powerful worldwatch, velocity of spread and predictable conduct of leaders.

It requires customers who already are performance-oriented, instead of being divided into a lowest common denominator collection.

It must have a credible attitude to geography, as information flows in the world with physical restrictions.

It must have validator standards that will safeguard the user experience, not the ideology.

It is possible to disagree with the elements of that worldview. But you can’t call it generic. It is a unified thesis, and it has one victim, to make on-chain trading to be less about crypto trading and more about trading.

Should Fogo win, it will not be a story on TPS winning. The victory will be that designers cease to design around chain weakness. They will construct order books, auctions, liquidation engines and market primitives which feel too weak on most chains. And users will experience the difference in the single way that counts in markets, execution that is clean.