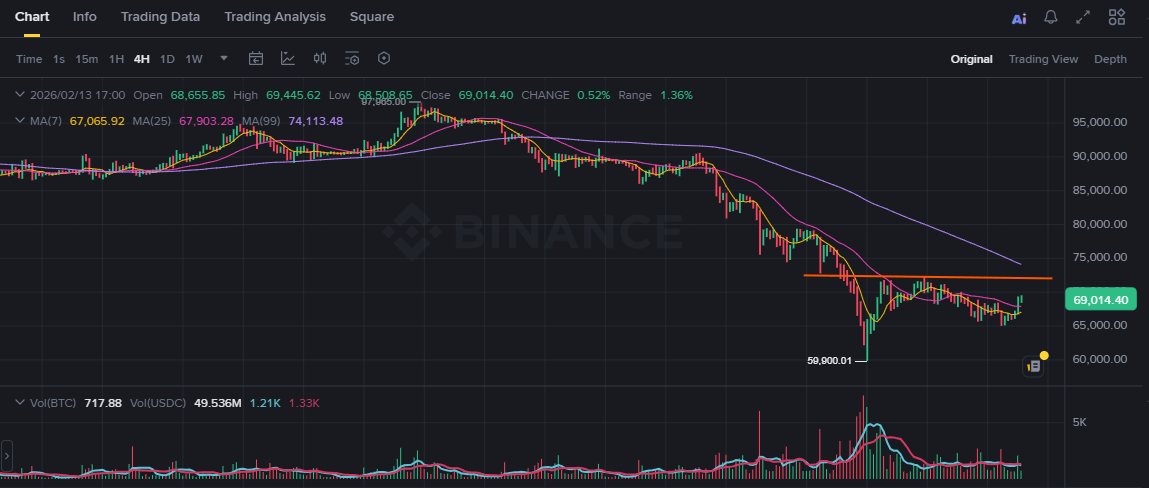

Bitcoin has moved back above $69,000, recovering from recent volatility. Holding above $68,000 is positive, but analysts say real market confidence will likely return only if BTC can post strong, sustained closes above $72,000.

Whale Activity Is Driving Uncertainty

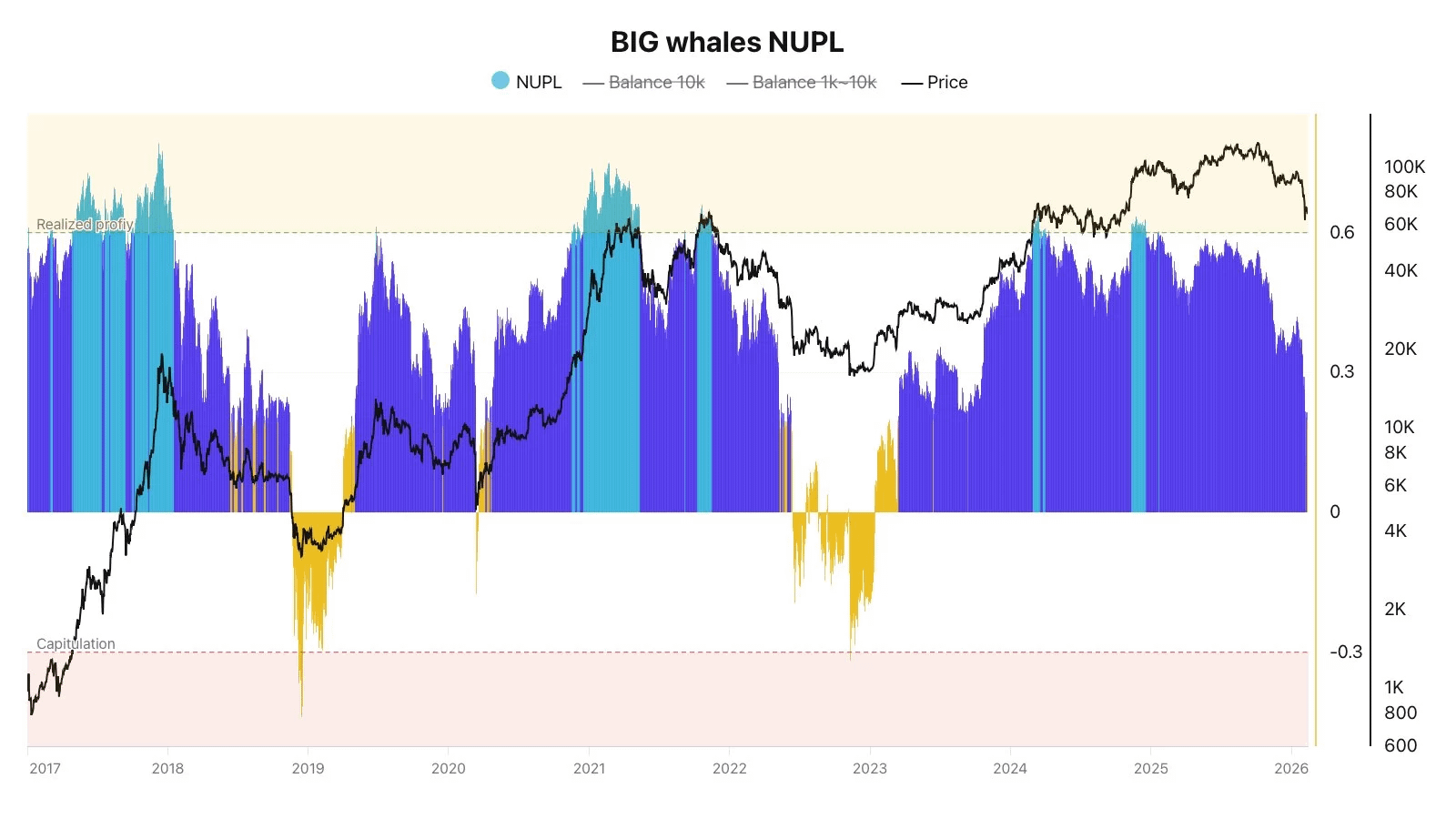

Large $BTC holders, known as whales, are becoming less predictable. On chain data shows their unrealized profits have dropped sharply, with the Net Unrealized Profit/Loss (NUPL) for major wallets falling below 0.2.

This level suggests many whales now hold little to no paper profit. Some have started selling, even at losses, which can increase short term volatility and market pressure.

Why $72,000 Matters

Technically, Bitcoin needs to break above the 4 hour EMA50 and clear resistance near $72,000 to regain strong upward momentum. Without that breakout, the rally remains fragile.

Market Outlook

Whale selling, resistance near $72K, and lower weekend trading volume are creating mixed signals. Until Bitcoin confirms strength above key resistance, traders should expect continued volatility in the near term.