The market does not collapse with a single violent move, it chooses a slower and far more effective method, it erodes conviction over time. Over the past 12 months, Bitcoin has declined from the 96,000 to 100,000 USD area to around 69,000 USD, a drawdown of roughly 28 percent. This is not a shock event, it is a prolonged process where each weak rebound becomes another test of patience for those who remain invested.

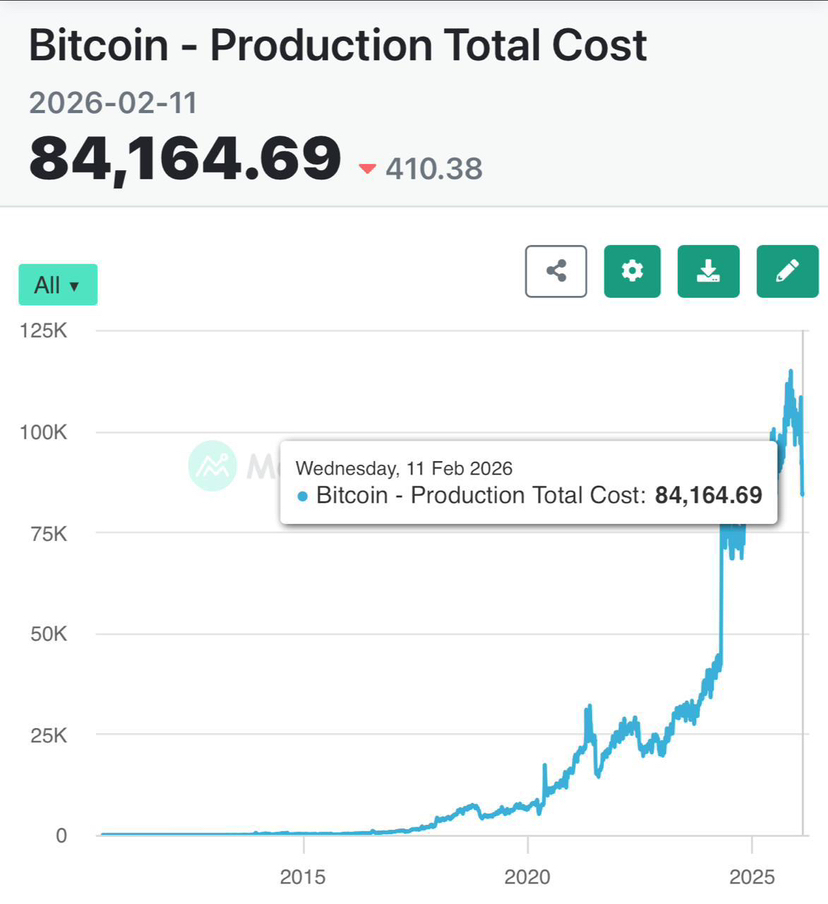

When the current price is compared with production cost, the test shifts from emotion to structure. Data shows that the average cost to mine one Bitcoin has risen to approximately 84,164 USD, more than 20 percent above the market price. This means a significant portion of miners are operating below breakeven. Historically, periods when price trades near or below production cost are not moments of network weakness, they are moments of forced efficiency, where weaker participants are removed and the system is pushed to rebalance for long term survival.

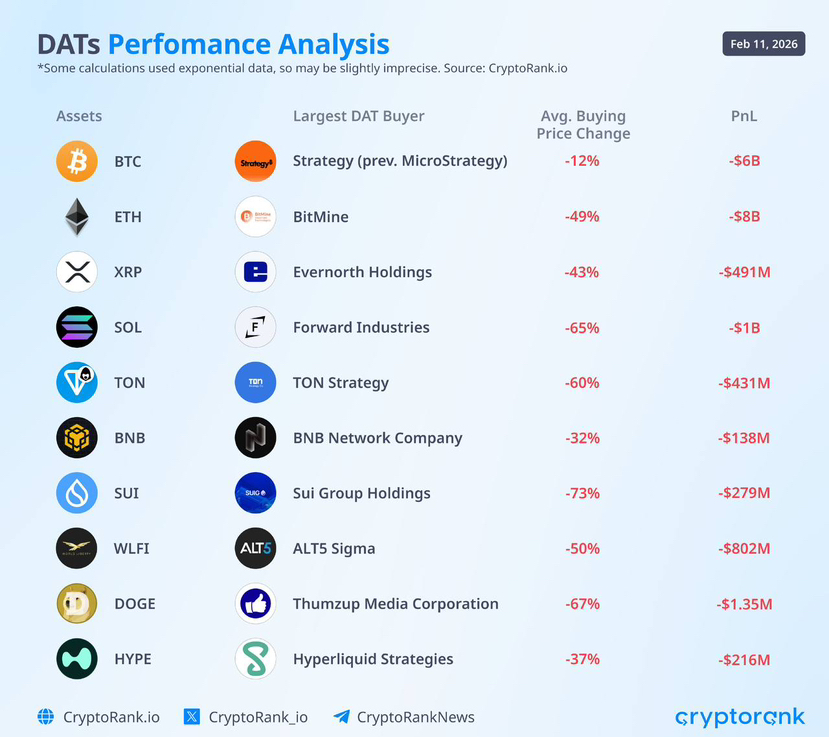

The next layer of the test belongs to large capital. Data on deep accumulation entities shows unrealized losses at scale. The largest Bitcoin accumulator is facing roughly 6 billion USD in losses with price sitting about 12 percent below its average cost. Ethereum shows an even deeper gap, with prices nearly 49 percent below institutional cost basis, translating to roughly 8 billion USD in unrealized losses. Other major assets such as SOL, SUI, and TON record drawdowns in the 60 to 73 percent range. This confirms that the pressure is not isolated to retail, institutions are being tested on conviction and time as well.

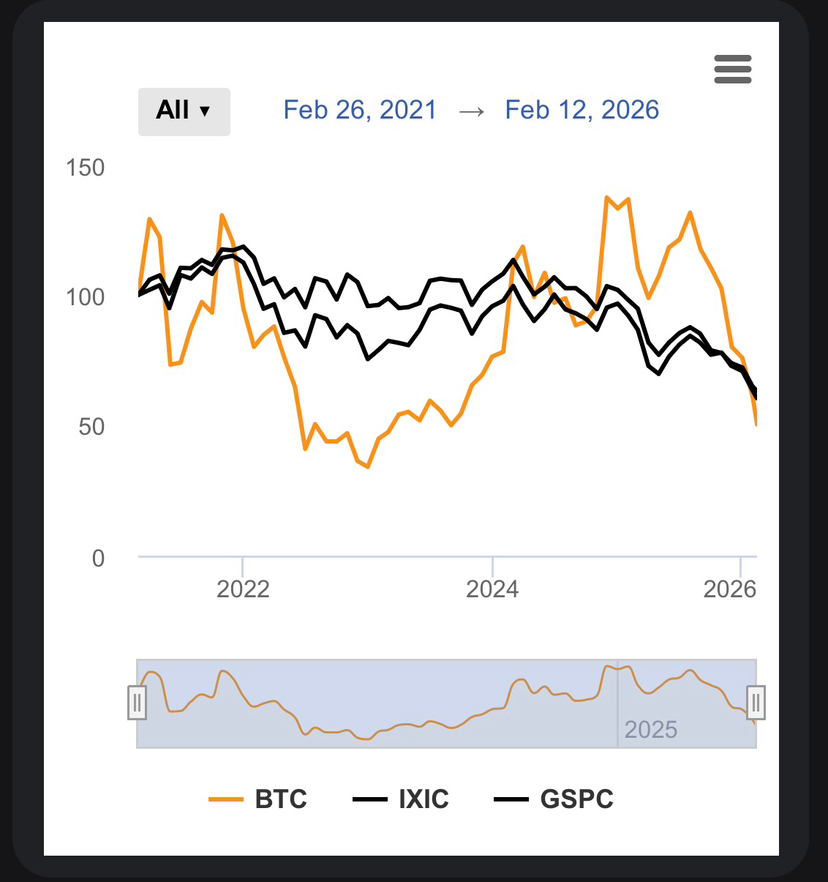

From a macro perspective, Bitcoin no longer moves in isolation. Normalized comparisons show that between 2021 and 2026, Bitcoin weakened alongside Nasdaq and the S and P 500, particularly during phases of liquidity tightening. This places Bitcoin into the same cyclical test as traditional risk assets, not about avoiding drawdowns, but about proving recovery after them.

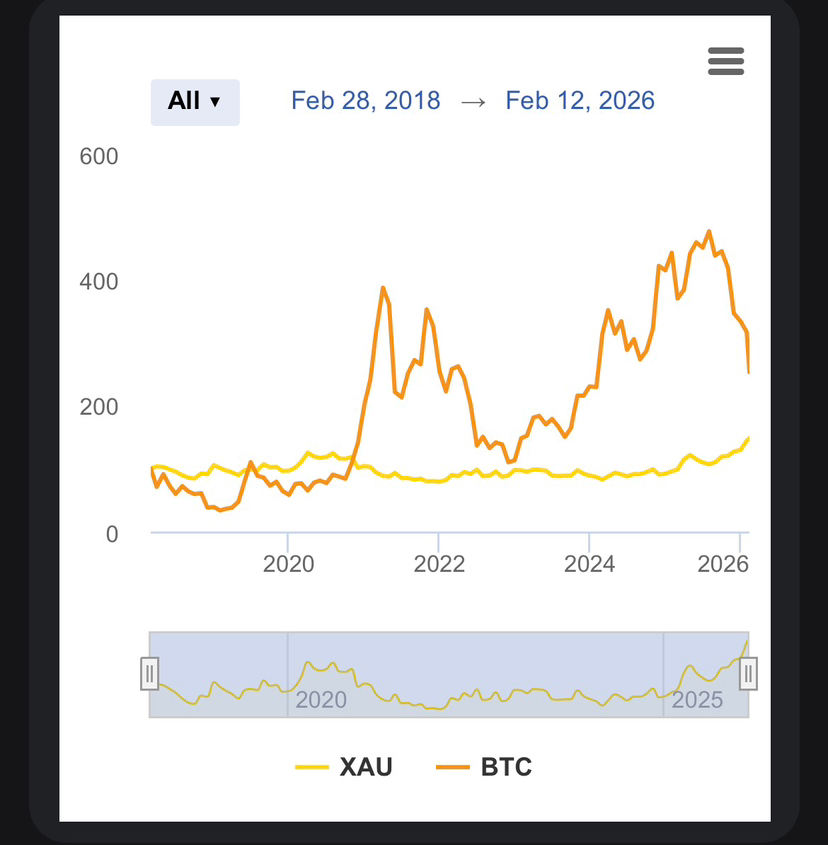

A comparison with gold further clarifies the nature of the test. From 2018 to 2026, gold shows relatively stable growth, while Bitcoin experiences sharp expansions followed by deep contractions, with volatility multiples far exceeding gold. The challenge here is not choosing the correct asset, it is accepting the nature of the one being held. Bitcoin does not test investors with low returns, it tests them with extreme swings and long waiting periods.

Looking at the market as a whole, total crypto market capitalization stands near 2.34 trillion USD, up by more than 1.36 trillion USD over the past five years, a gain of roughly 140 percent. Capital has not disappeared, expectations have been reset. Periods like this are not market endings, they are filtration phases that remove participants who no longer have the resilience to stay.

The market does not exist to give answers, it exists to test behavior when answers stop working. Miners are tested by costs exceeding price, institutions are tested by multi billion dollar unrealized losses, investors are tested by a nearly 30 percent annual drawdown, and the market itself is tested by time. Not everyone who stays will win, but everyone who wins has stayed through a phase exactly like this.