There is a specific kind of anxiety only traders understand. It’s the quiet panic between clicking “confirm” and waiting for a transaction to settle. That fragile stretch of time where markets move, numbers shift, and you wonder if the system will keep its promise. It’s a feeling made of milliseconds — and yet those milliseconds can carry the weight of real money, real risk, real consequences.

Fogo was born inside that tension.

Not as a marketing slogan. Not as another logo in a sea of blockchains. But as a response to a feeling — the feeling that decentralized finance should not make you choose between sovereignty and speed.

For years, people have been told that decentralization is worth the wait. That transparency and security come with latency. That if you want instant execution, you must surrender control to centralized platforms. Many accepted this compromise. Others resented it quietly. And then came a new kind of question: what if that trade-off was never necessary?

Fogo steps into that question with fire in its lungs.

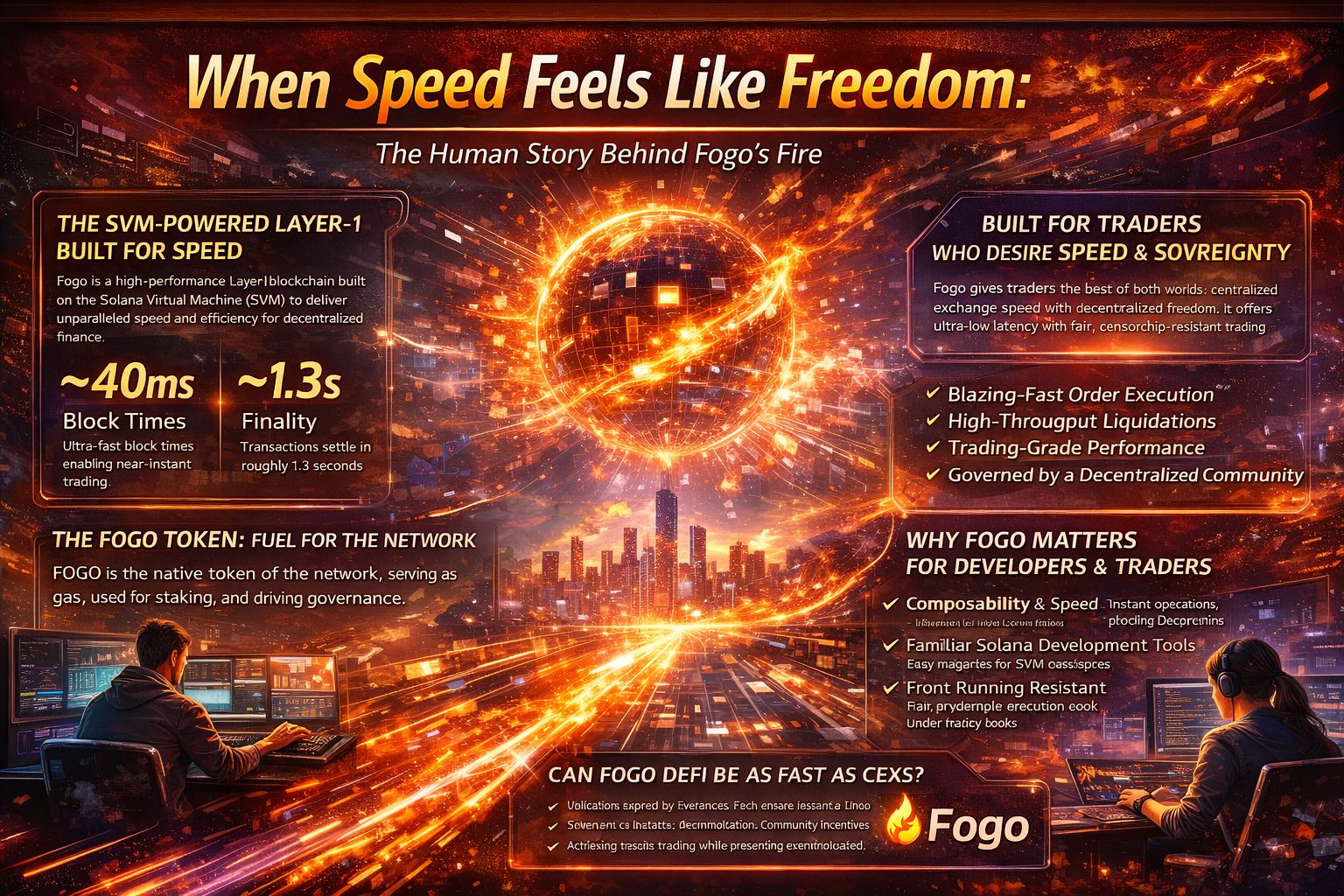

At its core, it is a high-performance Layer-1 built around the Solana Virtual Machine. That matters more than it sounds. The Solana Virtual Machine — known for its parallel execution model — allows transactions to run simultaneously instead of standing in line. Imagine a city where traffic doesn’t bottleneck into a single road but flows through many coordinated streets at once. That is the philosophy embedded in SVM. It is not just about speed; it is about flow.

And flow changes how you feel.

When blocks are produced in tens of milliseconds and finality arrives in seconds, hesitation begins to disappear. Your actions feel connected to outcomes. A trade doesn’t hang suspended in uncertainty; it lands. A liquidation executes before damage spreads. An orderbook updates in rhythm with your intention. There is relief in that rhythm — a sense that the system respects your time.

But speed alone is never enough. Speed without integrity is chaos.

Fogo’s validator infrastructure draws inspiration from high-performance engineering approaches designed to push reliability and throughput further than most chains dare to attempt. The ambition is not simply to be fast in theory but stable under pressure — when volatility spikes, when thousands of transactions collide at once, when real markets behave like storms instead of spreadsheets.

Because markets are emotional ecosystems. They are made of fear, greed, hope, and urgency. A blockchain that wants to serve traders must survive those emotions. It must not fracture when adrenaline surges.

The launch of Fogo’s mainnet felt less like a quiet deployment and more like ignition. Exchange listings followed quickly. Liquidity arrived. Speculation swirled. Early participants refreshed block explorers with the nervous excitement of watching a rocket lift off. Would the engine hold? Would the numbers match the promise?

That moment — the first days of a live network — is both exhilarating and vulnerable. There is pride, yes. But also exposure. Every block produced is a public test. Every validator online is part of a living experiment in trust.

The FOGO token is woven into this story not as decoration but as responsibility. It fuels transactions. It secures the network through staking. It gives holders a voice in governance. But tokenomics are more than allocation charts; they are moral architecture. Who holds power? Who validates? Who decides upgrades? These questions shape the soul of a chain more than throughput ever will.

Decentralization is not a switch that flips on at launch. It is cultivated. It requires transparent distribution, engaged validators, and a community willing to participate rather than spectate. If speed is the fire, governance is the container that keeps it from burning everything down.

For developers, Fogo offers something deeply comforting: familiarity. Building on the Solana Virtual Machine means many of the mental models, tools, and programming patterns are already known. That familiarity lowers fear. It allows creativity to surface. Instead of wrestling with unfamiliar infrastructure, builders can focus on designing better trading engines, safer lending protocols, smarter liquidity mechanisms.

But building for near-instant blocks changes your instincts. Assumptions expire faster. Systems must anticipate concurrency and edge cases that only appear under extreme speed. It demands discipline. It demands humility. When everything moves quickly, mistakes do too.

Still, there is beauty in that challenge. It pushes developers to think in real time. To design systems that behave gracefully under pressure. To imagine financial tools that feel less like waiting rooms and more like conversations.

Why does this matter beyond code?

Because every blockchain is ultimately a story about trust. Trust that a transaction will settle. Trust that a validator will act honestly. Trust that governance will not become a façade for central control. When blocks finalize quickly and predictably, trust compounds. Confidence becomes muscle memory.

And confidence is emotional fuel.

The name Fogo — fire — feels intentional. Fire is transformative. It brings warmth and light, but it demands care. Managed properly, it powers civilizations. Mishandled, it consumes them. The same duality lives inside high-performance networks. The faster they move, the more disciplined they must be.

Fogo is still young. Its narrative is still being written block by block. The metrics will matter: validator distribution, sustained throughput, ecosystem growth. Observers will scrutinize uptime and decentralization. They should. Scrutiny is a form of respect in this industry. It means people are watching because they care.

But beneath the analytics dashboards and staking charts lies something more intimate.

It is the quiet relief of a trader who no longer fears that their transaction will lag behind the market.

It is the spark in a developer’s mind when they realize they can build something that responds as quickly as users think.

It is the possibility that decentralization does not have to feel like compromise.

If Fogo succeeds, it will not be because it was the fastest chain in a benchmark. It will be because it made people feel safe moving at speed. Because it collapsed the distance between intention and result. Because it proved that performance and principle can coexist without apology.

In a world where financial systems often feel distant and opaque, there is something profoundly human about immediacy. About pressing a button and knowing — almost instantly — that your choice has become reality.

That is the emotional core of Fogo.

Not just fire for the sake of heat.

But fire that lights the way forward.