Most traders see a vertical pump and think one thing: “It’s going higher.”

But smart money asks a different question:

Is this expansion… or exhaustion?

Understanding this difference is what separates breakout winners from liquidity exit buyers.

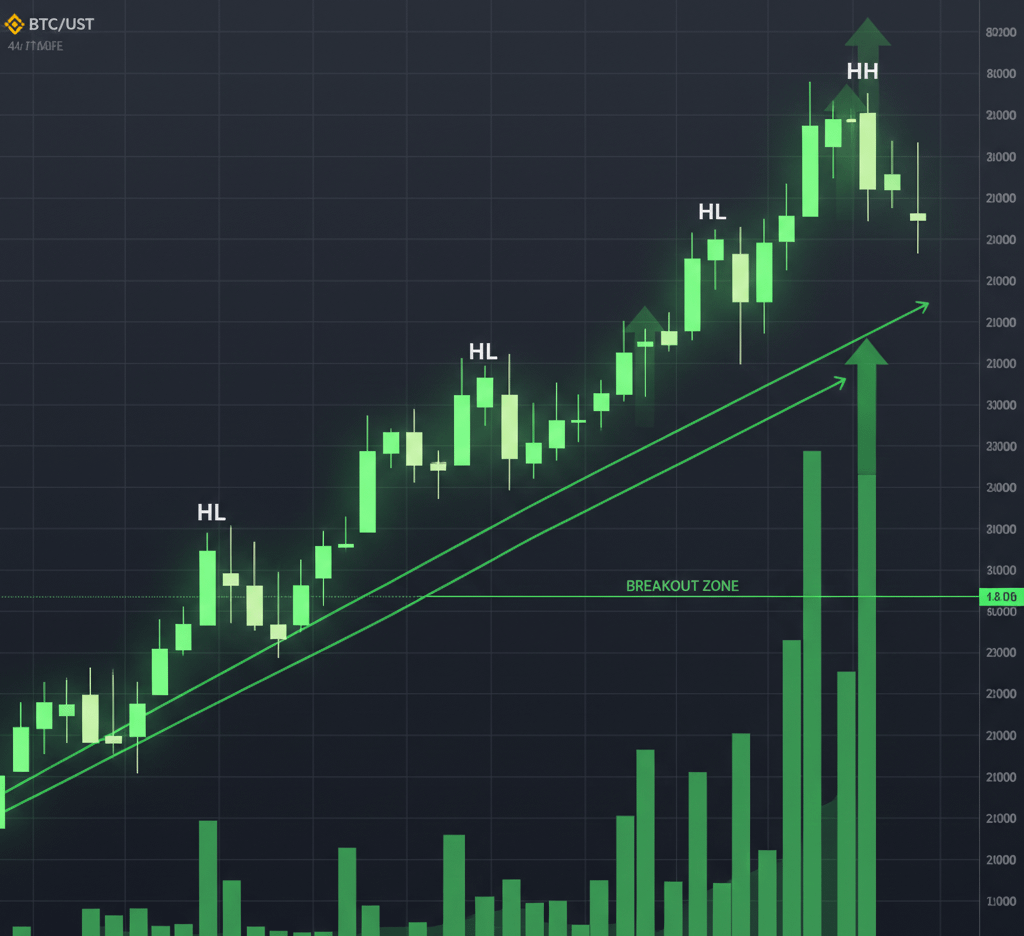

📈 What Real Expansion Looks Like

Expansion is a healthy markup phase driven by aggressive demand and acceptance at higher prices.

Key signs:

• Strong full-body candles

• Consecutive Higher Highs & Higher Lows

• Minimal upper wicks

• Volume rising with price

• Pullbacks getting absorbed quickly

This tells you buyers are in control — dips are opportunities, not reversals.

When price behaves like this, continuation probability stays high until structure breaks.

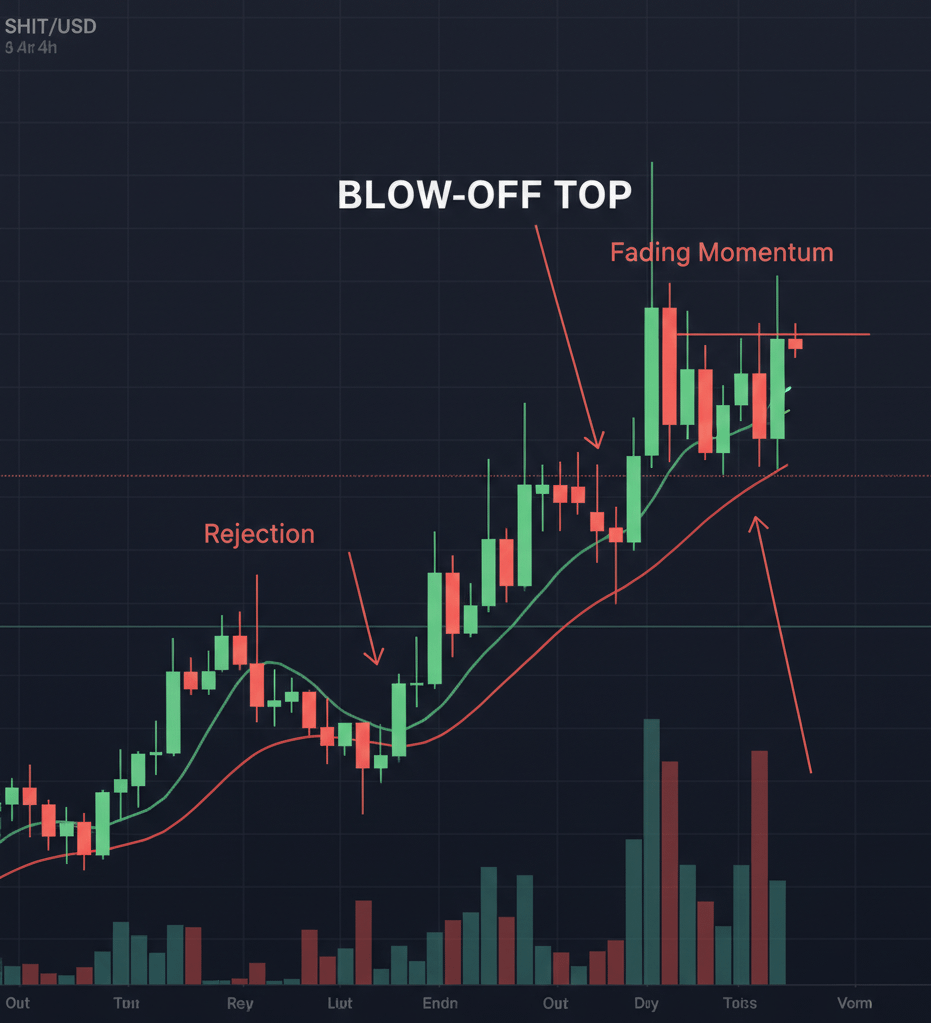

⚠️ Early Signs of Exhaustion

Exhaustion begins when momentum slows — even if price is still rising.

Watch for:

• Long upper wicks at highs

• Smaller candle bodies

• Momentum divergence

• Volume fading on pushes up

• Failure to hold breakout levels

This signals profit-taking, not fresh buying.

Smart money distributes here while retail longs late.

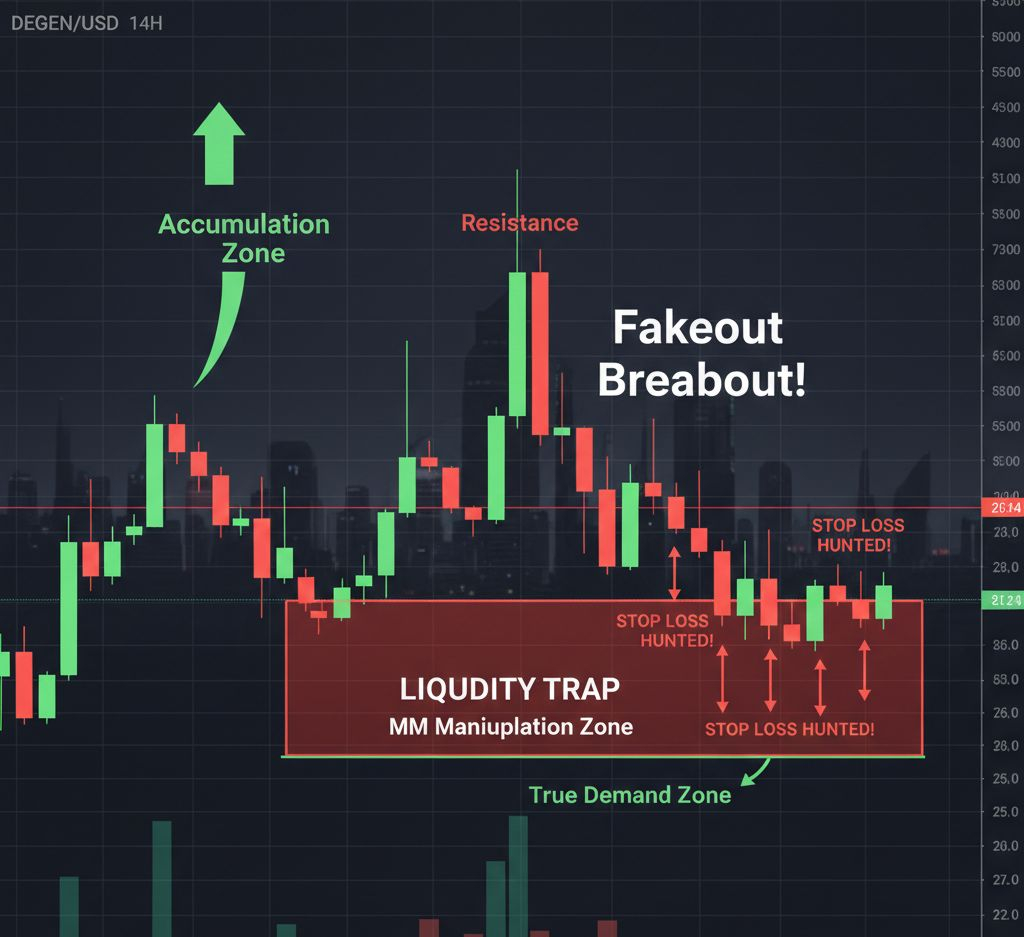

🧠 Liquidity Psychology Behind The Move

Why does exhaustion happen?

Because vertical pumps create:

• FOMO buyers

• Late breakout longs

• Clustered stop losses below

Market makers use this liquidity to exit positions, not build new ones.

Expansion = Position building

Exhaustion = Position unloading

Once buyers are fully trapped, reversal or deep correction begins.

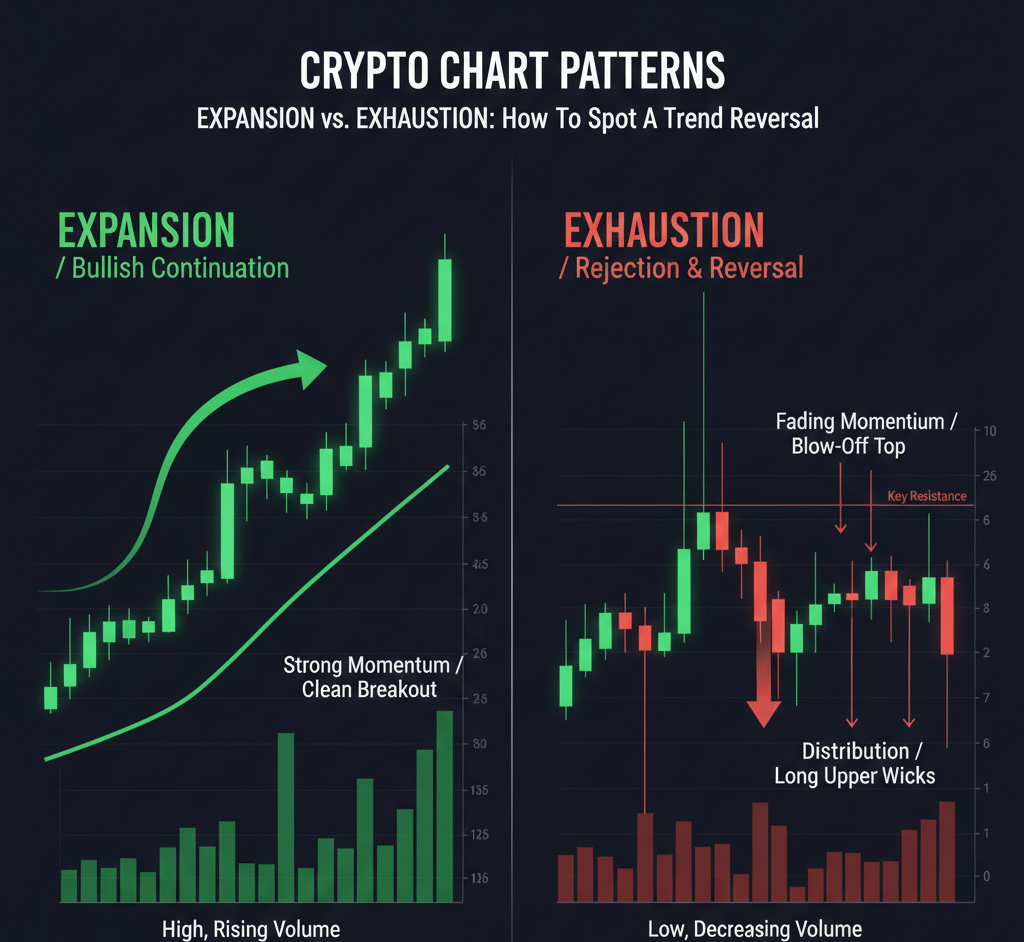

🔍 Expansion vs Exhaustion — Quick Checklist

Expansion

✔ Strong bodies

✔ Rising volume

✔ Clean structure

✔ Breakouts holding

Exhaustion

✘ Long wicks

✘ Weak closes

✘ Volume decline

✘ Breakout failures

If you see exhaustion signals at HTF supply — caution > conviction.

🏁 Final Thought

Not every pump is a long.

Some are engineered exits.

Your edge as a trader isn’t catching every move —

It’s knowing which moves are sustainable.

Trade expansion.

Respect exhaustion.

Follow for real-time structure breakdowns, continuation probabilities & liquidity mapping.

#cryptotrading #Marketstructure #tradingeducation #PriceAction #CryptoAnalysis