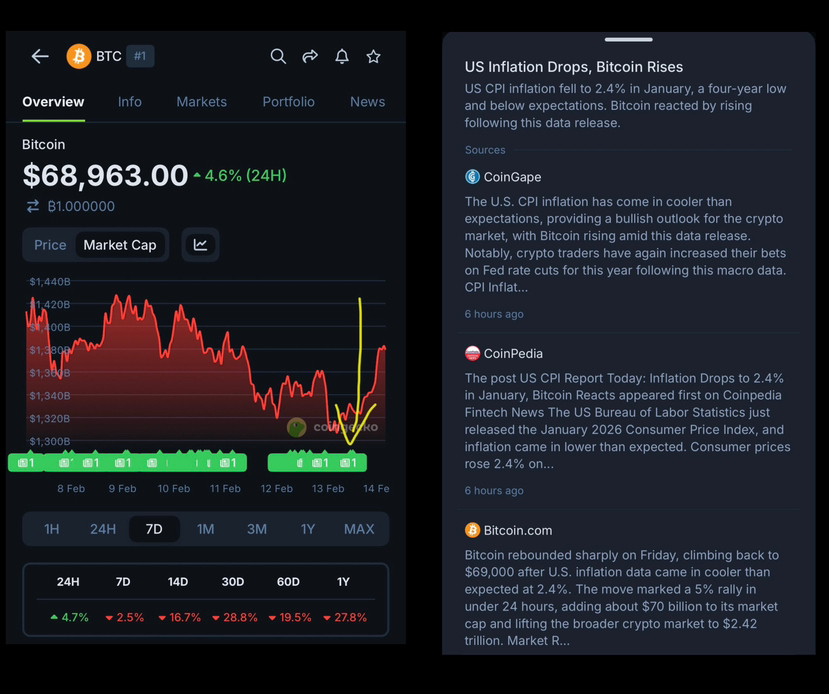

📊 US CPI: 2.4% | Expected: 2.5% | Previous: 2.7%

📊 US Core CPI: 2.5% | Expected: 2.5% | Previous: 2.6%

Inflation is clearly cooling, and the data confirms that progress. However, the market shows little sign of relief. CPI at this stage no longer functions as a catalyst - it acts as confirmation. Confirmation that inflation is not re-accelerating, but also that it is not falling fast enough to change the macro narrative.

The persistence of core inflation is the key issue. While the direction has improved, the speed has not. Markets have already priced in “gradual improvement,” which is why better-than-expected CPI fails to generate momentum.

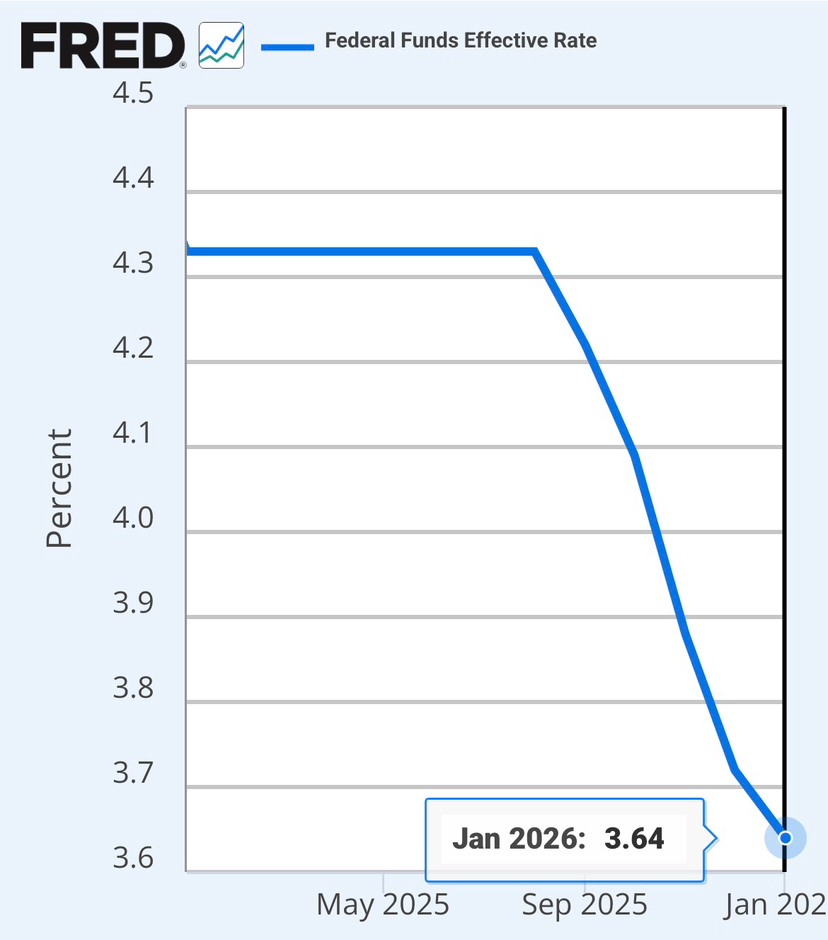

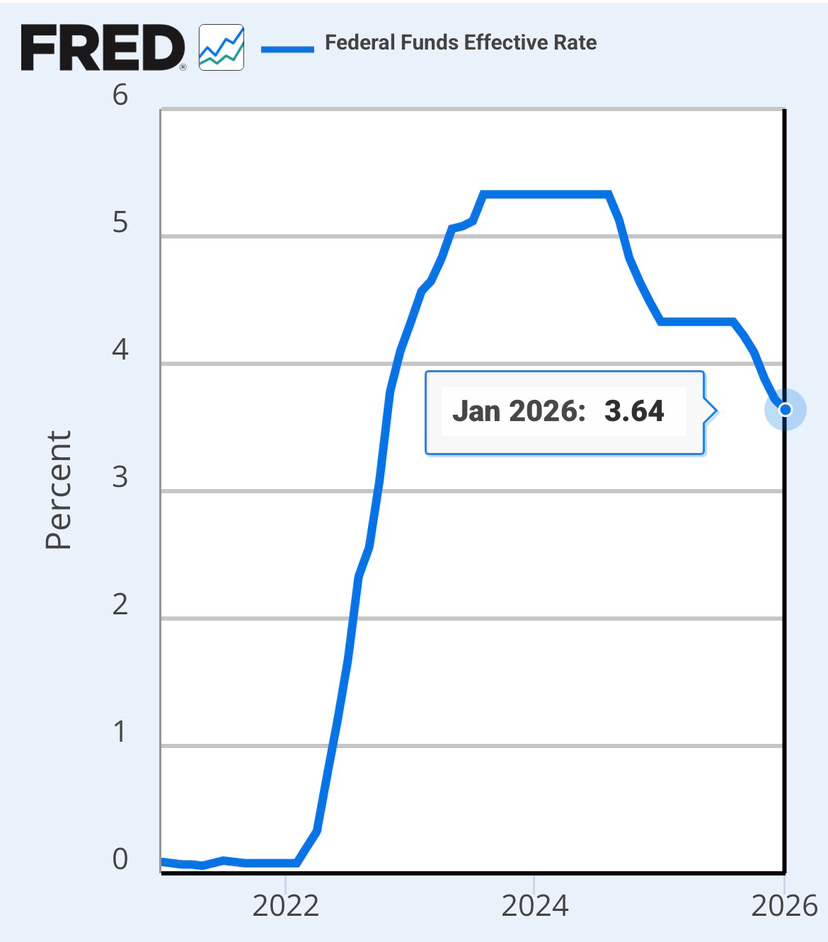

The real focus has shifted away from inflation prints and toward policy direction. As long as interest rates remain restrictive, risk assets remain capped. The Federal Reserve has no incentive to pivot prematurely, especially with core inflation still above comfort levels. A single CPI release, even a positive one, does not alter that calculus.

Market pricing reflects this reality. Rate-cut expectations remain cautious, and probability distributions continue to favor a prolonged period of tight monetary conditions. Without a change in policy expectations, CPI improvements lose their market impact.

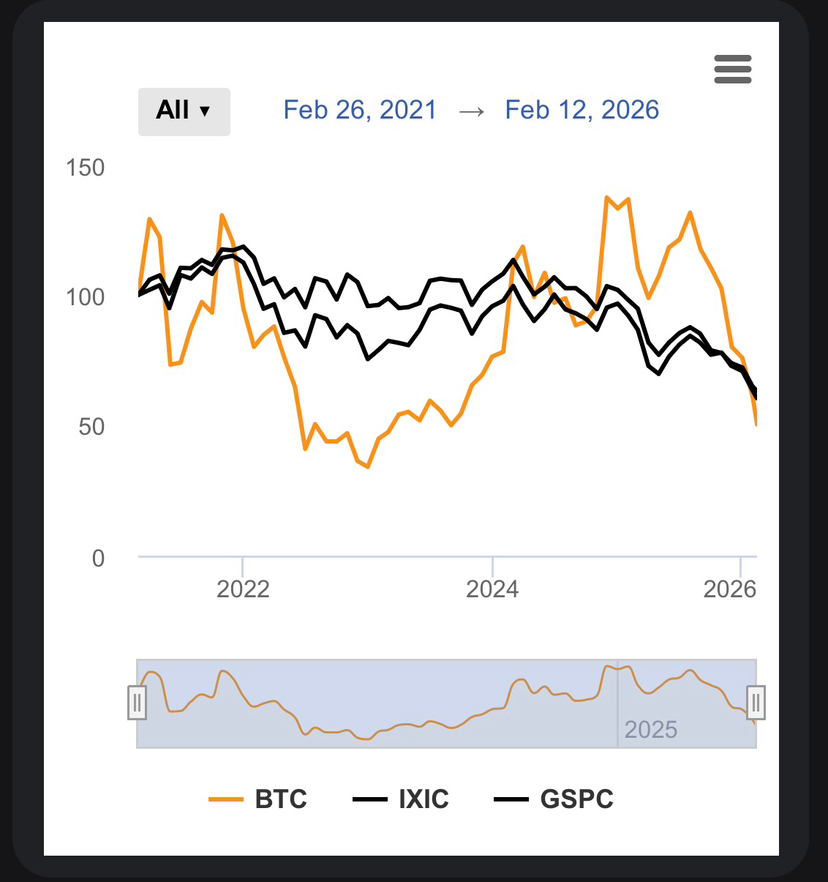

This environment does not produce panic - it produces erosion. Markets are not collapsing in violent moves; they are weakening through time. Each rebound becomes smaller, each recovery attempt fades faster. Capital does not exit in fear; it steps aside in exhaustion, waiting for clarity rather than chasing hope.

This behavior confirms a macro-driven phase, not an asset-specific failure. Risk assets move together, constrained by the same policy ceiling. CPI falling is necessary, but without a clear policy shift, it remains insufficient.