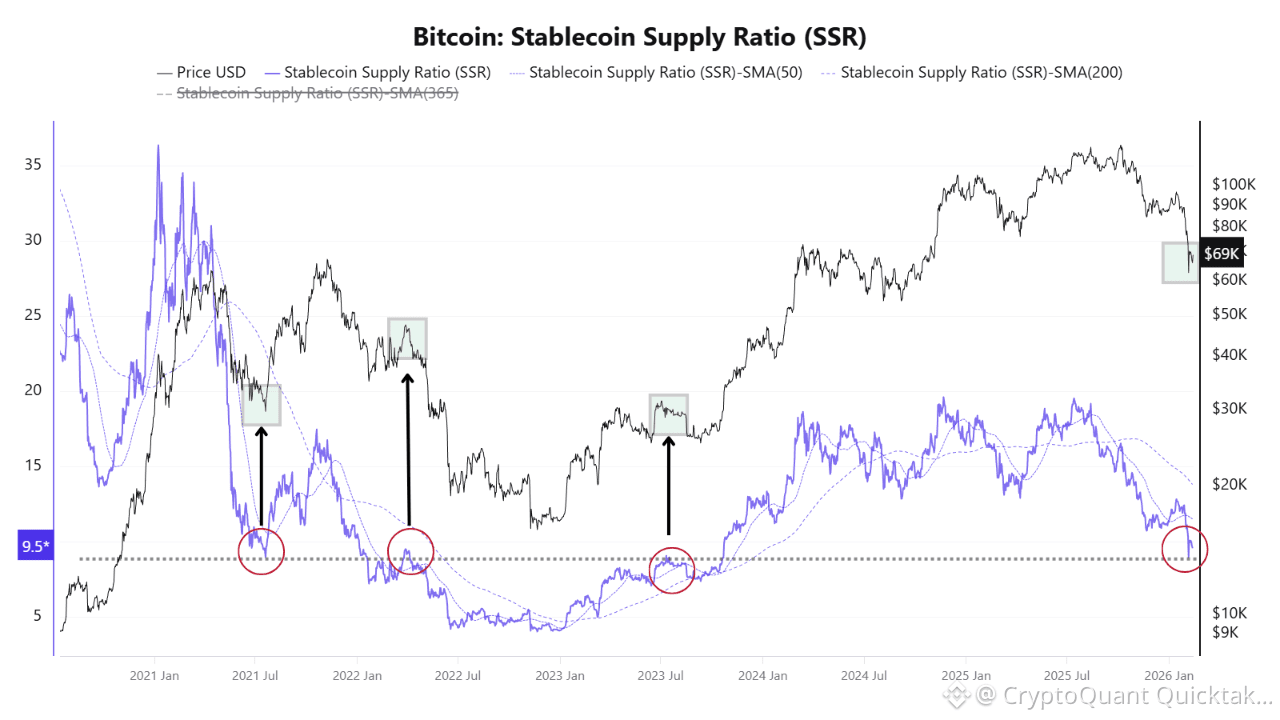

The Stablecoin Supply Ratio (SSR) is currently hovering around 9.6, a level that has repeatedly acted as a structural pivot in past cycles.

But the signal is directional.

Historically, when SSR declines from higher levels and reaches this zone, Bitcoin tends to find support. Why? Because a falling SSR means stablecoin supply is strengthening relative to BTC’s market cap. In other words, sidelined liquidity is building. As the ratio compresses toward ~9.5 from above, buying power improves, and price has repeatedly stabilized or reversed upward in this area.

However, the opposite has also been true.

When SSR approaches this level from below and fails to break sustainably above it, the zone acts as resistance. In those cases, stablecoin relative strength begins to fade, liquidity stops expanding, and Bitcoin has historically printed local tops shortly after.

So ~9.5 is not inherently bullish or bearish.

It’s a liquidity equilibrium zone.

Written by MorenoDV_